|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Articles d’actualité sur les crypto-monnaies

Bitcoin (BTC) Drops Below $90K as Risk-Off Sentiment Prevails; Saylor Hints at Another Purchase

Jan 13, 2025 at 07:55 pm

Risk assets are seen trading lower on Monday as the dollar index and U.S. Treasury yields benefit from Friday's stellar nonfarm payrolls report, while the Palisades Fires pose a risk to the insurance sector and some P&C companies.

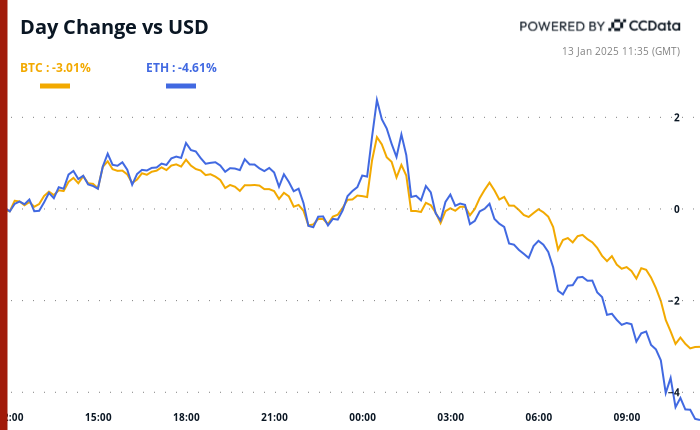

BTC is seen down 2%, changing hands in the key support zone of $90,000 and $93,000. Alternative cryptocurrencies are posting bigger losses, as is usually the case. ETH has dropped to the lowest level since Dec. 21 and the risk-off mood is clouding XRP's bullish technical outlook (see TA section). Whales did appear to be accumulating XRP on South Korea-based Upbit over the weekend, as far as we can tell.

AI coins are the worst performing sub-sector of the past 24 hours. In traditional markets, futures tied to the S&P 500 are indicating a negative open, along with continued downside volatility in the British pound and emerging market currencies.

The risk-off sentiment, however, did not stop Michael Saylor from indicating a potential appetite for another bitcoin purchase as he shared an update on MicroStrategy's bitcoin purchase tracker. Whether that would put a dent in the negative market sentiment, is another story. "The firm's purchase last Monday amounted to approximately $100 million, which had limited market impact, but underscores the firm's ongoing demand," said Valentin Fournier, an analyst at BRN.

Other things being equal, the risk of BTC losing the support zone appears high as some investment banks believe the Fed rate-cutting cycle is over, with Bank of America suggesting a potential for a rate hike. Per some observers, the consensus is that prices will deflate to $70K, followed by a renewed rally.

Meanwhile, the 30-day moving average of the Coinbase-Binance BTC price differential, which has a knack of marking major price tops, slipped to the lowest since at least 2019, a sign of weaker stateside demand. Over the near term, the crypto market is likely to focus on President-elect Donald Trump's inauguration on Jan. 20 and the ongoing FTX claim distributions, according to Coinbase Institutional.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

Clause de non-responsabilité:info@kdj.com

Les informations fournies ne constituent pas des conseils commerciaux. kdj.com n’assume aucune responsabilité pour les investissements effectués sur la base des informations fournies dans cet article. Les crypto-monnaies sont très volatiles et il est fortement recommandé d’investir avec prudence après une recherche approfondie!

Si vous pensez que le contenu utilisé sur ce site Web porte atteinte à vos droits d’auteur, veuillez nous contacter immédiatement (info@kdj.com) et nous le supprimerons dans les plus brefs délais.

-

- Les données de Coinglass révèlent que les commerçants de Dogecoin (DOGE) ont commis plus de 1,96 milliard de dollars aux marchés dérivés de la crypto-monnaie

- Apr 07, 2025 at 10:15 pm

- Malgré ce chiffre de 1,96 milliard de dollars enregistré au cours des dernières 24 heures, cela représente une baisse de 4,47% par rapport à la veille et est bien en dessous de la moyenne de novembre / décembre 2024 de plus de 3 milliards de dollars.

-

- Les données de Coinglass révèlent que les commerçants de Dogecoin (DOGE) ont commis plus de 1,96 milliard de dollars aux marchés dérivés de la crypto-monnaie

- Apr 07, 2025 at 10:15 pm

- Malgré ce chiffre de 1,96 milliard de dollars enregistré au cours des dernières 24 heures, cela représente une baisse de 4,47% par rapport à la veille et est bien en dessous de la moyenne de novembre / décembre 2024 de plus de 3 milliards de dollars.

-

-

-

- Dogecoin (DOGE) Signaux de mouvement des prix Risque élevé, des positions longues d'une valeur de plus de 216 millions de dollars exposées à la liquidation

- Apr 07, 2025 at 10:05 pm

- Cette décision a déclenché des préoccupations sur les marchés des dérivés, où les commerçants veillent de près pour de nouveaux signes de volatilité.

-

- Le marché de la crypto montre une tendance à la hausse régulière, avec Ton, Sui et Pi publiant des gains impressionnants

- Apr 07, 2025 at 10:05 pm

- Le marché de la cryptographie est sur une tendance à la hausse régulière, avec plusieurs altcoins affichant des gains impressionnants. Parmi les meilleurs interprètes des dernières 24 heures (27 mars) figurent Ton, Sui et Pi

-

-

-