|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nachrichtenartikel zu Kryptowährungen

Bitcoin (BTC) Drops Below $90K as Risk-Off Sentiment Prevails; Saylor Hints at Another Purchase

Jan 13, 2025 at 07:55 pm

Risk assets are seen trading lower on Monday as the dollar index and U.S. Treasury yields benefit from Friday's stellar nonfarm payrolls report, while the Palisades Fires pose a risk to the insurance sector and some P&C companies.

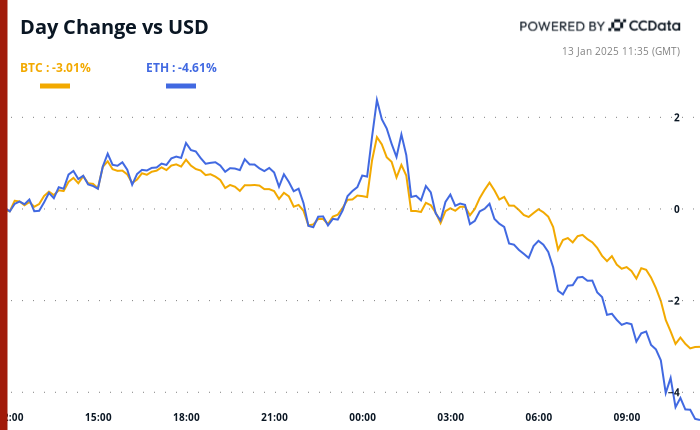

BTC is seen down 2%, changing hands in the key support zone of $90,000 and $93,000. Alternative cryptocurrencies are posting bigger losses, as is usually the case. ETH has dropped to the lowest level since Dec. 21 and the risk-off mood is clouding XRP's bullish technical outlook (see TA section). Whales did appear to be accumulating XRP on South Korea-based Upbit over the weekend, as far as we can tell.

AI coins are the worst performing sub-sector of the past 24 hours. In traditional markets, futures tied to the S&P 500 are indicating a negative open, along with continued downside volatility in the British pound and emerging market currencies.

The risk-off sentiment, however, did not stop Michael Saylor from indicating a potential appetite for another bitcoin purchase as he shared an update on MicroStrategy's bitcoin purchase tracker. Whether that would put a dent in the negative market sentiment, is another story. "The firm's purchase last Monday amounted to approximately $100 million, which had limited market impact, but underscores the firm's ongoing demand," said Valentin Fournier, an analyst at BRN.

Other things being equal, the risk of BTC losing the support zone appears high as some investment banks believe the Fed rate-cutting cycle is over, with Bank of America suggesting a potential for a rate hike. Per some observers, the consensus is that prices will deflate to $70K, followed by a renewed rally.

Meanwhile, the 30-day moving average of the Coinbase-Binance BTC price differential, which has a knack of marking major price tops, slipped to the lowest since at least 2019, a sign of weaker stateside demand. Over the near term, the crypto market is likely to focus on President-elect Donald Trump's inauguration on Jan. 20 and the ongoing FTX claim distributions, according to Coinbase Institutional.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

Haftungsausschluss:info@kdj.com

Die bereitgestellten Informationen stellen keine Handelsberatung dar. kdj.com übernimmt keine Verantwortung für Investitionen, die auf der Grundlage der in diesem Artikel bereitgestellten Informationen getätigt werden. Kryptowährungen sind sehr volatil und es wird dringend empfohlen, nach gründlicher Recherche mit Vorsicht zu investieren!

Wenn Sie glauben, dass der auf dieser Website verwendete Inhalt Ihr Urheberrecht verletzt, kontaktieren Sie uns bitte umgehend (info@kdj.com) und wir werden ihn umgehend löschen.

-

- Dogecoin (DOGE) Preisbewegung signalisiert ein erhöhtes Risiko, lange Positionen im Wert von über 216 Mio. USD, die Liquidation ausgesetzt sind

- Apr 07, 2025 at 10:05 pm

- Dieser Schritt hat zu Bedenken hinsichtlich Derivatemärkte ausgelöst, auf denen Händler genau auf weitere Anzeichen einer Volatilität nachsehen.

-

- Der Kryptomarkt zeigt einen stetigen Aufwärtstrend, wobei Ton, Sui und Pi beeindruckende Gewinne veröffentlichen

- Apr 07, 2025 at 10:05 pm

- Der Kryptomarkt befindet sich stetig nach oben, wobei mehrere Altcoins beeindruckende Gewinne erzielen. Unter den Top -Performen in den letzten 24 Stunden (27. März) sind Tonne, Sui und PI

-

-

-

-

-

-

-