|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

ZA Bank, Hong Kong's Virtual Banking Pioneer, Embraces Digital Finance Revolution

Apr 06, 2024 at 02:06 am

Hong Kong's virtual lender ZA Bank ventures into digital finance by engaging with prospective stablecoin issuers to establish fiat reserve accounts. This move aims to integrate digital assets into traditional banking and aligns with Hong Kong's efforts to explore digital asset ETFs and position itself as a digital asset hub. ZA Bank's initiative to explore stablecoin use cases, backed by cash and bond reserves, signals a convergence between digital and traditional finance in the region.

Hong Kong's Virtual Banking Pioneer Embraces Digital Finance Revolution

Hong Kong's virtual banking frontrunner, ZA Bank, is making bold strides in the ever-evolving landscape of digital finance. In a strategic move that signals the increasing convergence of traditional banking and the burgeoning world of digital assets, ZA Bank is actively engaging with prospective stablecoin issuers to establish fiat reserve accounts.

This pioneering initiative marks a significant milestone in Hong Kong's journey to establish itself as a vibrant digital asset hub. The city's progressive stance towards crypto regulation, including the licensing of crypto trading platforms and the exploration of digital-asset-exchange-traded funds (ETFs), is paving the way for the seamless integration of digital assets into mainstream financial infrastructure.

Exploring the Tangible Potential of Stablecoins

"Stablecoins have captured our attention due to their multifaceted applications in both wholesale and retail markets," said Devon Sin, Alternate Chief Executive of ZA Bank. These digital assets, designed to maintain a stable value typically pegged to fiat currencies like the US dollar, present numerous opportunities for innovation and efficiency in financial transactions.

In collaboration with potential stablecoin issuers, ZA Bank aims to explore tangible use cases that leverage the unique capabilities of stablecoins. From seamless tokenization of assets to frictionless exchange trading settlements and secure cross-border remittances, the potential applications are vast.

Regulatory Sandbox: A Testbed for Innovation

Hong Kong's Monetary Authority (HKMA) has established a regulatory sandbox, providing a controlled environment for financial institutions to experiment with innovative financial products and services. ZA Bank's engagement with stablecoin issuers will fall under the ambit of this sandbox, allowing for the testing and development of robust and compliant solutions.

Regulatory Framework for Stablecoins

The HKMA is diligently working on developing a comprehensive regulatory framework specifically tailored for stablecoins. This framework will provide clear guidelines on the issuance, operation, and oversight of these digital assets, ensuring stability and security within the digital asset ecosystem.

Hong Kong's Commitment to Digital Asset Regulation

Last year, Hong Kong made a bold move by adopting regulations for stablecoin issuers, demonstrating its commitment to creating a robust and transparent digital asset market. The proposed rules, outlined in a consultation paper by the Financial Services and the Treasury Bureau and the HKMA, aim to strike a balance between fostering innovation while safeguarding investors' interests.

According to the consultation paper, stablecoins are defined as digital assets pegged to one or more fiat currencies, aiming to maintain a stable value. Stablecoin issuers actively marketing their fiat-referenced stablecoins to the Hong Kong public must obtain a local license.

Algorithmic stablecoins, which have gained notoriety following the collapse of TerraUSD, are not permitted in Hong Kong. To obtain a license, stablecoin issuers must adhere to stringent requirements, including maintaining a full reserve of assets backing the stablecoins, ensuring it is at least equal to the par value. These reserves must be segregated and securely stored, and they must be regularly reported to regulators. Additionally, stablecoin issuers must establish a local presence by appointing key personnel, including a Chief Executive Officer and senior management team.

Conclusion

ZA Bank's engagement with potential stablecoin issuers is a testament to the growing recognition of the transformative potential of digital assets in the banking and financial sectors. With Hong Kong's progressive regulatory approach and the HKMA's commitment to fostering innovation within a sound regulatory framework, the city is well-positioned to become a global leader in the digital asset revolution.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

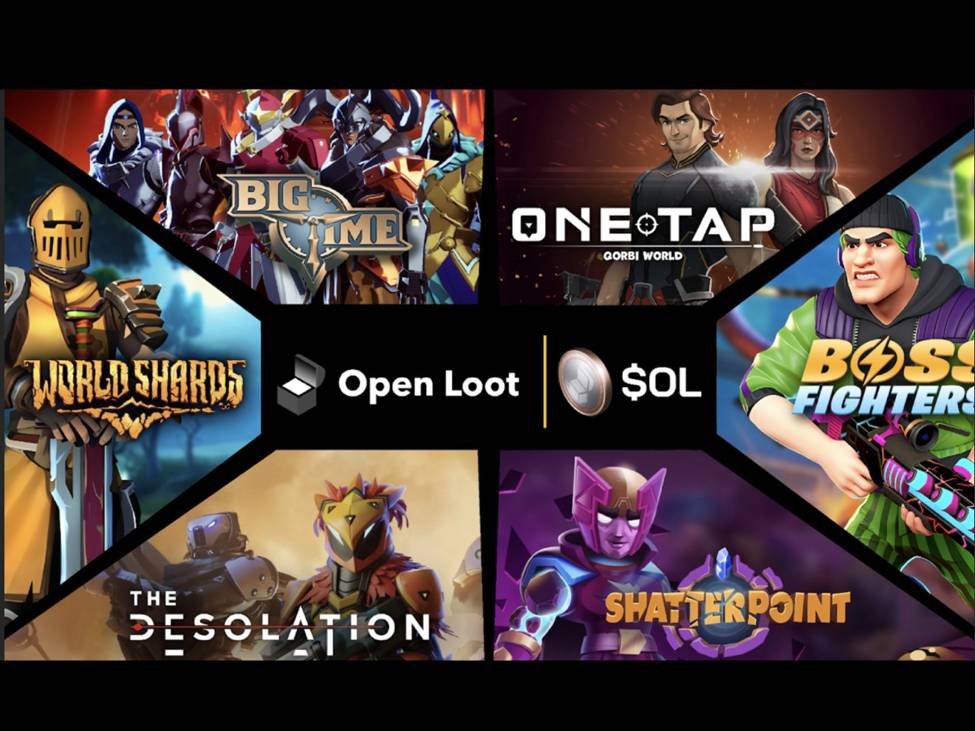

- Big Time Studios Introduces $OL Token to Supercharge Its Open Loot Web3 Gaming Platform and Marketplace

- Nov 19, 2024 at 06:30 pm

- Big Time Studios, a Web3 gaming trailblazer and creator of the Open Loot platform and hit game Big Time, which has already processed a half billion dollars in total transaction volume, is making waves again.

-

- The Next Shiba Inu? 5 Promising New Meme Coins to Watch in 2023

- Nov 19, 2024 at 06:30 pm

- Attention is turning to new digital coins that might match the spectacular rise of tokens like Shiba Inu. Innovative projects with strong communities are emerging, capturing interest with their unique ideas. These assets hold the potential for significant growth, sparking excitement among investors seeking the next big opportunity.

-

-

-

-

-