|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Tether CTO Says New aUSDT Stablecoin Is Backed by Gold, Not Bitcoin, Because the Precious Metal Is More Stable

Sep 10, 2024 at 02:45 am

In a new interview with Bloomberg, Paolo Ardoino says the firm could have chosen Bitcoin to back aUSDT but BTC's tendency to go through wild price swings made gold a more preferable option.

Stablecoin giant Tether (USDT) has announced the launch of a new synthetic dollar (USD) product backed by gold.

According to Tether, the synthetic USD is part of its new Alloy product line, which aims to track the price of reference assets through over-collateralization with liquid assets and secondary market liquidity pools.

The stablecoin issuer says that the synthetic aUSDT is backed by gold rather than Bitcoin (BTC) because the precious metal is more stable in price than the crypto king.

In a new interview with Bloomberg, Tether CTO Paolo Ardoino says that the firm could have chosen Bitcoin to back aUSDT, but BTC’s tendency to go through wild price swings made gold a more preferable option.

“Until 1971, the US dollar was backed by gold and we often hear interest from our customers to have optionality…

[So] we also see the opportunity to provide an [option] for others that want to see a more transparent backing of a synthetic dollar and gold is probably the best asset to make that happen because it’s much less volatile than Bitcoin. We could have done Bitcoin but gold is probably a better choice for the short term.”

Earlier this year, Tether announced that it would be launching aUSDT, which is described as a digital asset over-collateralized by Tether Gold (XAUT), a gold-pegged stablecoin. Each XAUT coin represents exposure to physical gold secured in vaults in Switzerland.

The launch of aUSDT comes amid increasing demand for synthetic assets, which are designed to provide investors with exposure to the performance of an underlying asset without having to directly own the asset.

Synthetic assets are typically created by a financial institution and are backed by a pool of assets, such as stocks, bonds, commodities or fiat currencies. They can be traded on exchanges like other cryptocurrencies.

However, synthetic assets are often more complex than standard cryptocurrencies and may carry additional risks, such as counterparty risk.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Crypto.com and Yorkville America Digital Partner to Launch TMTG-branded Exchange-Traded Funds (ETFs)

- Apr 24, 2025 at 05:25 am

- TMTG, the company behind Truth Social, has finalized a deal with Crypto.com and Yorkville America Digital. The arrangement leads to the creation of a series of exchange-traded funds (ETFs) that come out under the TruthFi brand.

-

-

- Ice Open Network Partners with Unich Exchange to Become Part of the Leading Pre-TGE Finance Platforms

- Apr 24, 2025 at 05:20 am

- Ice Open Network has formed a new partnership with Unich Exchange to become part of the leading pre-TGE finance platforms. Ice Open Network continues to establish its web3 platform hub

-

![The AI agent ai16z [AI16Z] token created its symmetrical triangle breakout The AI agent ai16z [AI16Z] token created its symmetrical triangle breakout](/assets/pc/images/moren/280_160.png)

-

-

- “This is about as unethical as you can get,” said a spokesperson for Citizens for Responsibility and Ethics in Washington.

- Apr 24, 2025 at 05:15 am

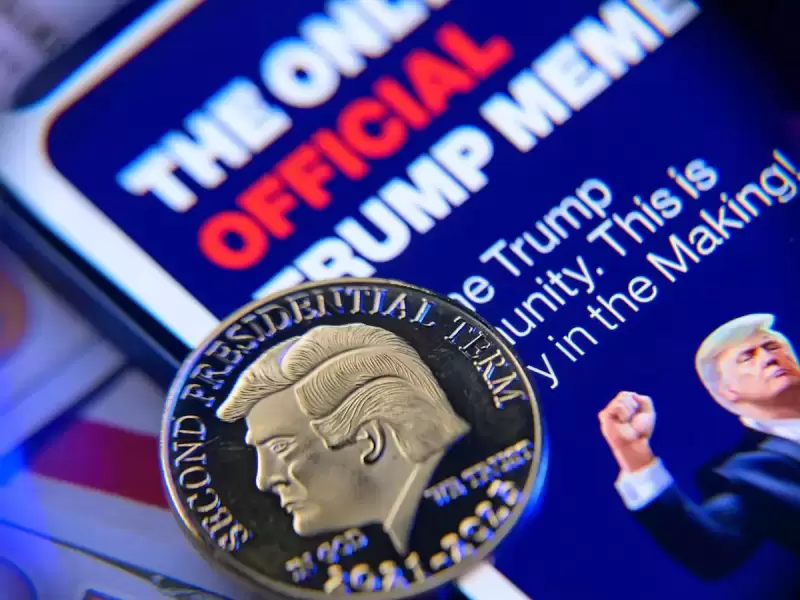

- The cryptocurrency Donald Trump launched days before returning to the Oval Office got a big boost on Wednesday afternoon, as the Trump-owned company behind the meme coin announced that its top holders would be invited to an exclusive dinner with the president—and the 25 leading buyers will get a special VIP tour of the White House.

-

-

-

- Is Now the Time to Bet $1,000 on AAVE? Here's What the Charts Say

- Apr 24, 2025 at 05:05 am

- AAVE price is trading above $166 after breaking out of a multi-month downtrend. The recent price action has caught the attention of traders, but the question remains: is this the start of a new rally, or just another pause before heading lower?

![The AI agent ai16z [AI16Z] token created its symmetrical triangle breakout The AI agent ai16z [AI16Z] token created its symmetrical triangle breakout](/uploads/2025/04/24/cryptocurrencies-news/articles/ai-agent-aiz-aiz-token-created-symmetrical-triangle-breakout/middle_800_480.webp)