|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Spot Solana ETF: a potential 900% gain for Solana?

Jun 28, 2024 at 11:00 pm

The cryptocurrency market has been booming since VanEck's announcement of a Solana spot ETF filing with the U.S. Securities and Exchange Commission (SEC).

The cryptocurrency market reacted positively on Monday after asset manager VanEck filed a Solana spot ETF application with the U.S. Securities and Exchange Commission (SEC). According to analysts at GSR Markets, this new financial product could multiply the current value of the SOL token by 9.

Solana (SOL) is one of the “3 big heads” of the crypto sector, alongside Bitcoin (BTC) and Ethereum (ETH), according to GSR Markets. The firm even anticipates in its report that SOL would be the next token to obtain approval for a spot ETF in the United States.

Perfect timing or coincidence? As we said, the same day the GSR Markets report was published, the asset manager filed its Solana spot ETF application with the SEC. As a reminder, VanEck and other fund managers launched Bitcoin spot ETFs in January, after lengthy discussions with US regulators.

Regarding price predictions, GSR Markets analysis assumes that Solana spot ETFs would capture 14% of the flows obtained by spot Bitcoin ETFs since their launch.

If this scenario comes to fruition, SOL price could reach over $1,300, 9 times higher than its current price of $145. At that price, the market capitalization of Solana’s cryptocurrency would exceed $600 billion.

Solana: a complex regulatory context

GSR Markets analysts also envision more bearish and moderate scenarios.

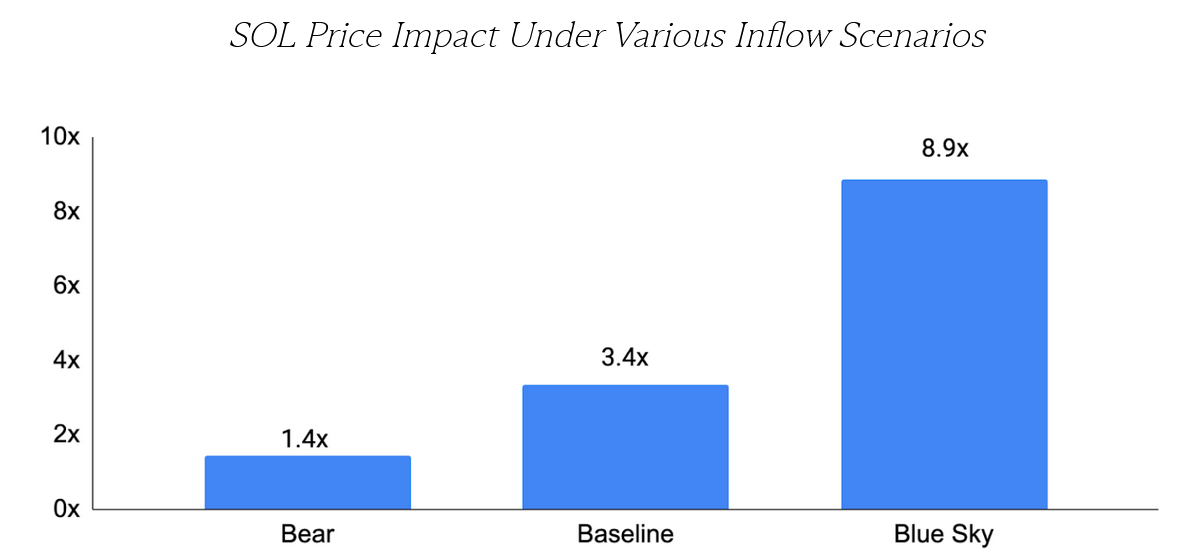

In a “bear” scenario, Solana spot ETFs would only capture 2% of flows from spot Bitcoin ETFs, which would result in a 140% increase in the price of SOL. In their baseline scenario, captured flows would amount to 5%, a price increase of 340%.

SOL price evolution in 3 different scenarios: bearish, moderate and bullish

Note that these estimates could be revised upwards if Solana spot ETFs included income from staking (hold tokens to earn rewards). This scenario remains unlikely at this time, as staking has not yet been authorized for SEC-approved Ethereum spot ETFs.

Despite GSR Market's analysis and optimism, approval of a Solana spot ETF is still far from certain. Eric Balchunas, an ETF analyst at Bloomberg, and other industry experts believe that a change in SEC chairman would be necessary for this project to come to fruition.

Indeed, the SEC and its current chairman, Gary Gensler, had described the SOL token as “unregulated financial security” as part of the legal proceedings against Binance and Coinbase. This position risks significantly complicating the approval of a Solana spot ETF, compared to already approved spot Bitcoin ETFs and spot Ethereum ETFs.

Despite regulatory obstacles, Solana’s future looks promising in the crypto sector and is already attracting interest from institutions. Earlier in June, the ecosystem and network received praise from Franklin Templeton, an asset manager worth nearly $1.5 trillion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- U.S. Senator Dave McCormick, Former Bridgewater CEO, Is Putting His Own Cash Into Bitcoin (BTC)

- Apr 25, 2025 at 05:30 am

- U.S. Senator Dave McCormick, the former chief executive of massive hedge fund Bridgewater Associates, is putting his own cash into bitcoin (BTC) as the committee he's on is at the tip of the spear for a legislative effort to regulate the digital assets industry.

-

-

-

-