|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Historic Quarter for Stock Market Fueled by Optimism and AI Hype

Apr 01, 2024 at 10:07 pm

Global equity markets experienced an exceptional quarter, with the MSCI World index surging 7.7%, marking its best performance in five years. Optimism surrounding a soft landing in the US economy and excitement about AI advancements fueled this rally. Notably, the S&P 500 Index recorded its strongest first-quarter gain in five years, climbing 10.2%, while the Dow Jones had its most robust performance since 2021, rising 5.6%.

Stock Market Surges in Historic Quarter, Fueled by Optimism and AI Enthusiasm

The global stock market has witnessed an exceptional quarter, with the MSCI World Index soaring by 7.7%, marking its best performance in five years. This surge has been driven by hopes of a soft economic landing in the United States and the burgeoning enthusiasm surrounding artificial intelligence (AI).

S&P 500 and Dow Jones Post Strong Gains

In the United States, the S&P 500 Index has logged its best first-quarter performance since 2019, gaining an impressive 10.2%. The Dow Jones Industrial Average has also had its strongest first quarter since 2021, advancing by 5.6%. This momentum has been fueled by optimism about the economy and the performance of major corporations.

Tech Stocks Drive Nasdaq Higher

The Nasdaq Composite Index has joined the rally, surging by 9.1% on the back of strong gains in technology stocks. Companies involved in AI, cloud computing, and semiconductors have been particularly successful, reflecting the growing importance of these technologies in the modern economy.

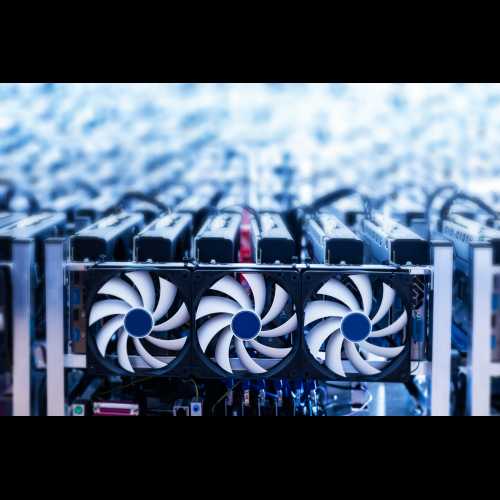

Bitcoin and Cryptocurrency Sector Flourish

The first quarter of 2024 has also witnessed a surge in the cryptocurrency sector, with Bitcoin and related stocks leading the way. The largest cryptocurrency by market capitalization has been on an unstoppable rally, driven by growing adoption and the launch of spot Bitcoin exchange-traded funds (ETFs).

Energy Sector Leads Gains in March

The energy sector has also performed well in March, with oil prices rising due to supply concerns and geopolitical tensions. This increase has benefited energy companies and ETFs that track the sector.

Gold Regains Luster Amidst Economic Uncertainty

Gold has regained its allure as a safe haven asset due to expectations of upcoming U.S. interest rate reductions. The precious metal has traditionally been seen as a reliable store of value during periods of economic uncertainty, and the upcoming U.S. presidential election and conflicts in Ukraine and Gaza have heightened its appeal. Silver and other precious metals have also gained in value.

Cocoa Prices Skyrocket Due to Supply Shortages

In agricultural commodities, cocoa prices have more than doubled in just three months, skyrocketing to $10,000 a ton from $3,000 a ton at the start of the year. This surge is attributed to supply shortages caused by three consecutive years of poor harvests in West Africa.

Three Standout ETFs from the First Quarter

Given the divergent performances of different sectors and asset classes, we have identified three ETFs that have been among the best and worst performers in the first quarter of 2024:

Best ETFs

- Bitcoin - Grayscale Bitcoin Trust (GBTC): Up 92.5%

- Roundhill Cannabis ETF (WEED): Up 45.1%

- VanEck Vectors Semiconductor ETF (SMH): Up 28.7%

Worst ETFs

- United States Natural Gas Fund (UNG): Down 28.2%

- Invesco WilderHill Clean Energy ETF (PBW): Down 21.9%

- Lithium - Sprott Lithium Miners ETF (LITP): Down 20.7%

Conclusion

The first quarter of 2024 has been a rollercoaster for global stock markets. While some sectors and asset classes have thrived, others have faced challenges. The strong performance of Bitcoin, technology stocks, and energy stocks has been particularly notable, reflecting the changing dynamics of the economy and the growing importance of AI and digital assets. Investors should continue to monitor geopolitical events and economic data to make informed decisions about their portfolios in the coming months.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Polymarket Bets on Elon Musk’s Removal From the Trump Administration

- Jan 09, 2025 at 03:31 am

- Crypto gamblers are placing bets on Elon Musk's removal from the Trump administration, as shown by data from Polymarket. The platform indicates only a 6% chance of Musk staying in his current role, with $1,029,604 in trading volume tied to this speculation.

-

-

- Dogecoin and Solana Price Prediction: What Could Come This January?

- Jan 09, 2025 at 03:31 am

- With January now underway, the crypto market is gaining more ground thanks to Dogecoin (DOGE) and Solana (SOL). They are both looking at possible growth, and market analysts like Mister Crypto and Crow are making bold price predictions.

-

- Rexas Finance (RXS): The Next Crypto Revolution Replicating Strategies of Ripple (XRP) and Solana (SOL)

- Jan 09, 2025 at 03:31 am

- The crypto market never sleeps, and new players constantly rise to challenge established giants. Recent AI analysis reveals an altcoin, Rexas Finance (RXS), replicating strategies seen during Ripple’s (XRP) and Solana’s (SOL) formative years.

-

-

-

-

- XRP: The Revolutionary Cryptocurrency Transforming the Financial Industry

- Jan 09, 2025 at 03:30 am

- Dive into the world of XRP, a cryptocurrency designed to facilitate faster, more affordable cross-border payments. Unlike many other digital currencies that are primarily speculative, XRP was built with a practical purpose in mind: to enhance the global financial system by improving the speed and efficiency of money transfers across borders.