European regulators are moving to implement stricter rules for insurers investing in digital currencies, marking a significant shift in the EU's approach to cryptocurrencies.

European regulators are planning to impose stricter capital requirements on insurers investing in digital currencies, aiming to limit the institutions' exposure to the volatile crypto market.

The European Insurance and Occupational Pensions Authority (Eiopa) has recommended that insurers be required to hold capital equivalent to 100% of the value of any crypto assets they hold.

The proposal, part of Eiopa's suggestions for the upcoming Solvency II review, is intended to discourage further investment in digital assets by making it much more expensive for insurers to hold such assets.

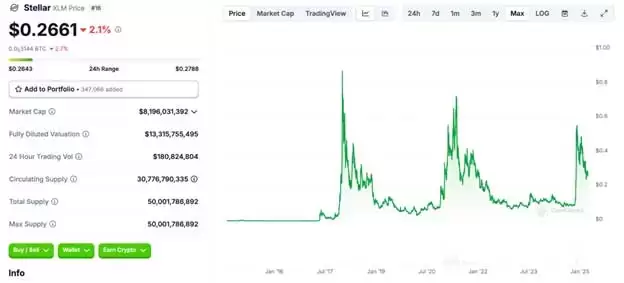

Currently, most insurers must allocate capital covering between 60% and 80% of their crypto holdings. However, the new regulation would impose full capital coverage for all crypto assets, including popular cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins and tokenized assets linked to traditional financial instruments such as debt or equities.

This would be the first time Eiopa has set such stringent capital requirements on any asset class held by insurers.

While the proposed rules present a tougher stance on cryptocurrencies, they are not anticipated to have a major immediate impact. At the end of 2023, European insurers held a total of €655 million worth of crypto assets, which represents less than 0.01% of their overall assets, valued at €9.6 trillion.

The majority of these holdings are in Luxembourg, suggesting that the exposure is likely through investment funds rather than direct crypto ownership.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.