|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

ETH/BTC Forward Term Structure Slips Into Backwardation, Signaling Market Anticipates Altcoins Will Underperform in Coming Months

Jan 08, 2025 at 08:00 pm

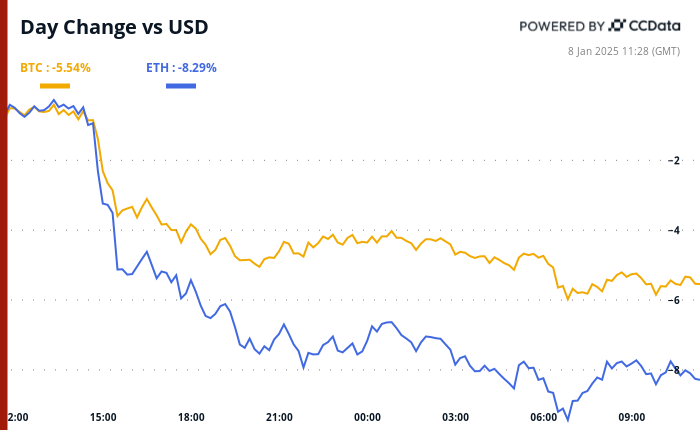

Markets: Crypto markets turned sharply defensive on Thursday, with bitcoin’s 24-hour losses reaching 5% amid a broader risk-off session in traditional markets.

The session’s theme was largely set by a batch of U.S. economic data, which showed growth at services providers picked up in December, with prices jumping to the highest levels since 2023. The upbeat activity numbers, coupled with the sticky inflation readings, are likely sparking concerns about the Federal Reserve pausing its rate cuts.

Traders are now pricing in a less-than-50% probability of a March rate cut, CME’s FedWatch tool showed. The next rate cut is not seen happening before June, according to the market. This is particularly bearish for ether, which is touted as an internet bond, offering a fixed-income like yield through staking rewards.

Unsurprisingly, a major momentum study called the “Guppy multiple moving average indicator” is about to flip bearish for ETH. Here’s how to use it.

Elsewhere, the Deribit exchange’s ETH/BTC forward term structure has slipped into backwardation, according to data tracked by crypto financial platform BloFin. It means that some of the sharpest minds in the derivatives market are anticipating that ETH and other altcoins will underperform in the coming months.

The backwardation structure is better than what we saw before the U.S. election, but it still leaves investors feeling uncertain. BloFin Academy put it best: “it merely suggests that the situation may not get worse.”

A backwardation structure is usually seen when the market anticipates an asset’s price to rise in the future, prompting traders to pay a premium for futures at longer maturities. In this case, some traders might be expecting bitcoin to outperform ether in the coming months.

Markets: Crypto markets turned sharply defensive on Thursday, with bitcoin’s 24-赫尔小时 losses reaching 5%, as a broader risk-off session hit traditional markets.

The session’s theme was largely set by a batch of U.S. economic data, which showed growth at services providers picked up in December, with prices jumping to the highest levels since 2023. The upbeat activity numbers, coupled with the sticky inflation readings, are likely sparking concerns about the Federal Reserve pausing its rate cuts.

Traders are now pricing in a less-than-50% probability of a March rate cut, CME’s FedWatch tool showed. The next rate cut is not seen happening before June, according to the market. This is particularly bearish for ether, which is touted as an internet bond, offering a fixed-income like yield through staking rewards.

Unsurprisingly, a major momentum study called the “Guppy multiple moving average indicator” is about to flip bearish for ETH. Here’s how to use it.

Elsewhere, the Deribit exchange’s ETH/BTC forward term structure has slipped into backwardation, according to data tracked by crypto financial platform BloFin. It means that some of the sharpest minds in the derivatives market are anticipating that ETH and other altcoins will underperform in the coming months.

The backwardation structure is better than what we saw before the U.S. election, but it still leaves investors feeling uncertain. BloFin Academy put it best: “it merely suggests that the situation may not get worse.”

A backwardation structure is usually seen when the market anticipates an asset’s price to rise in the future, prompting traders to pay a premium for futures at longer maturities. In this case, some traders might be expecting bitcoin to outperform ether in the coming months.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- TVP Reveals 767% Explosion in Early-Stage Bitcoin Startup Funding

- Apr 04, 2025 at 09:45 am

- On Thursday, Austin's Trammell Venture Partners (TVP), an early-stage Bitcoin venture capital firm, published its third annual report on the cryptocurrency's emerging venture capital landscape, revealing a 767% jump in "Bitcoin-native" pre-seed transactions.

-

-

-

- Cango, a publicly traded Chinese conglomerate, has agreed to sell its legacy China operations to an entity associated with peer Bitmain

- Apr 04, 2025 at 09:35 am

- Cango agreed to sell its legacy Chinese auto financing business to Ursalpha Digital Limited in a $352 million deal, according to the report.