|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

dYdX Overview: A Complete Guide to the Leading Decentralized Exchange (DEX)

Nov 07, 2024 at 05:16 pm

This article provides a complete overview of dYdx, covering what it is, how it evolved, how it works, why it's different (and better), what's in store for the future, and more.

dYdX is a decentralized cryptocurrency exchange (DEX) that offers perpetual futures contracts for various cryptocurrencies. It was founded in 2017 by Antonio Juliano, a former Coinbase engineer, with the aim of creating a non-custodial and on-chain solution for perps trading in crypto.

dYdX initially launched its exchange on the Ethereum blockchain, but later shifted to its own Layer-1 (L1) chain, known as dYdX Chain, which is optimized for high-frequency spot and derivatives trading and offers sub-one percent or even zero percent trading fees.

The exchange was initially deployed on Ethereum, but as it gained traction, especially with dYdX subsidizing users' gas fees, continuing on Ethereum became unsustainable. So in 2021, dYdX deployed its v3 iteration on the Ethereum Layer-2 (L2), Starkware.

However, for v4, the project built its independent L1, i.e. dYdX Chain, leveraging the Cosmos SDK. This marked a key milestone in the project’s journey towards full decentralization. Unlike previous iterations, every component of the dYdX v4 protocol is deployed on-chain.

Currently, the dYdX Chain powers the entire dYdX ecosystem, including the DEX, core validator nodes, indexer, and clients. It’s a fully open-source and permissionless environment where anyone can build or verify.

How Does dYdX Work?

One of the key innovations included in v4 is the off-chain yet decentralized orderbook and matching process. So when a user initiates an order, it triggers validator activity under the hood.

Each dYdX validator runs an ‘in-memory orderbook’ that is not committed to the chain’s Tenderment Proof-of-Stake (PoS) consensus mechanism.

However, though the orderbook remains off-chain in this sense, the users’ orders/cancellations propagate through the network as ordinary blockchain transactions. This ensures validator nodes are ultimately in sync, eliminating manipulation or foul play.

This process helps dYdX achieve very high throughput—100x the number of traders per second—while remaining decentralized.

Besides decentralized order processing, another key aspect of dYdX’s functioning is community governance. Since dYdX is a PoS blockchain, $DYDX holders can earn voting rights and rewards by staking their coins to secure the network.

Simply put, the governance process begins with community members submitting a dYdX Request for Comments (DRC). Once submitted, DRCs are subject to active discussion, followed by multiple voting stages until approval.

dYdX community members can vote on most crucial aspects of the protocol’s future, including platform upgrades, market expansions, fee adjustments, etc. This ensures that the platform’s and the community’s interests are closely aligned, both short-term and long-term.

What Sets dYdX Apart?

dYdX stands out in the crypto exchange landscape due to several key attributes:

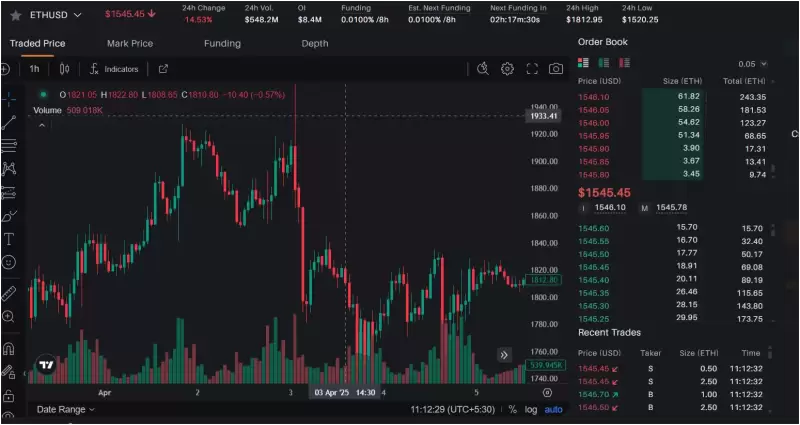

Decentralized Perpetual Futures Contracts: Aimed at experienced traders seeking to hedge their positions or engage in advanced trading strategies, dYdX offers perpetual futures contracts for over 143 cryptocurrencies, including BTC, ETH, SOL, APT, and SUI, as well as memecoins like DOGE and FOXY.

High Leverage for Margin Trading: Catering to traders seeking to amplify their profits, dYdX provides up to 50x leverage on perps trades, expanding their potential earnings.

Moreover, features like cross-margin accounts and isolated margin sub-accounts cater to traders' needs, enabling them to efficiently navigate volatile markets.

Fast and Seamless CEX-Like Experience: Despite offering decentralized trading, dYdX prioritizes user experience, providing a fast and seamless interface that mirrors centralized exchanges (CEXs).

This caters to traders accustomed to CEX platforms, offering a familiar and efficient environment for their trades.

Self-Custody with Decentralized Exchange: Unlike CEXs, which hold traders' assets, dYdX emphasizes self-custody, enabling traders to retain complete control over their funds throughout the trading process.

Moreover, the exchange's open-source code and API structure foster innovation, inviting developers to build on top of the platform.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- BlackRock's iShares Ethereum Trust (ETHA) ETF Launches Options Trading, Opening a New Era

- Apr 20, 2025 at 12:20 pm

- Ethereum (ETH) has just scored a landmark win in its path toward mainstream financial adoption, as the U.S. Securities and Exchange Commission (SEC) has officially approved options trading for several Ethereum-based exchange-traded funds (ETFs). This bold step ushers in a new era for ETH investors

-

-

- Hidden Road Obtains U.S. Broker-Dealer Registration from FINRA, Expanding Its Fixed-Income Prime Brokerage Services

- Apr 20, 2025 at 12:20 pm

- The license, granted to Hidden Road Partners CIV US LLC, authorizes the company to offer compliant clearing, financing, and trading services to institutional clients across traditional fixed-income markets.

-

- Tron (TRX) seeks to enter the top 5 cryptocurrency rankings in 2025 based on its active network activity and the predictions of its founder Justin Sun

- Apr 20, 2025 at 12:20 pm

- Mutuum Finance (MUTM) continues to experience growth through its fourth presale phase where it has acquired $6.9 million from 8400 holders.

-

-

-