|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

CoinDesk 20 Index Drops, But Ether Bucks Correction

May 01, 2024 at 12:01 am

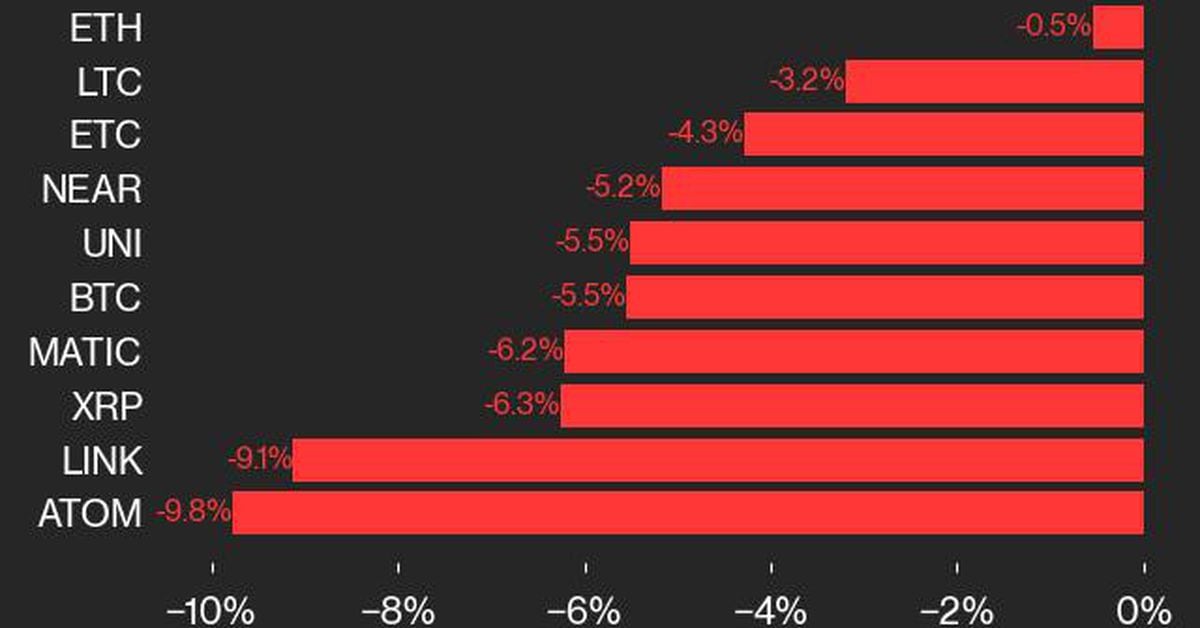

CoinDesk Indices' bi-weekly market update reveals a decline in the CoinDesk 20 Index (CD20) by 6.8% over the past week. Despite the correction, Ether outperformed the index, experiencing a minimal 0.5% drop. Alternative Layer 1 assets like Solana, Cardano, and Aptos witnessed significant declines of over 10%. The broader CoinDesk Market Index (CMI) comprises 180 tokens across seven crypto sectors, providing a comprehensive representation of the market's performance.

CoinDesk 20 Index Slumps, but Ether Defies Correction

April 30, 2024

The crypto market experienced a widespread correction over the past week, with all 20 assets in the CoinDesk 20 Index (CD20) posting declines. The benchmark index plummeted 6.8%, extending its monthly losses to 21%.

Ether (ETH), the second-largest cryptocurrency by market capitalization, emerged as a beacon of relative stability amidst the broader market downturn. ETH declined by a mere 0.5%, marking the smallest drop among the CD20 constituents.

The Index's underperformance was largely attributed to sharp sell-offs in alternative Layer 1 tokens. Solana (SOL), Cardano (ADA), and Aptos (APT) bore the brunt of the correction, plunging by over 10%.

"The launch of bitcoin and ether ETFs in Hong Kong failed to provide a boost to the market, indicating that investors remain cautious despite the regulatory approval," commented Tracy Stephens, Senior Index Manager at CoinDesk Indices.

The broader CoinDesk Market Index (CMI), which encompasses approximately 180 tokens, also witnessed a decline. The index, which represents seven crypto sectors, fell by 5.3% over the past week.

Despite the market correction, ETH managed to hold its ground, primarily due to its strong fundamentals. The network's upcoming Ethereum Shanghai upgrade, scheduled for March 2023, is widely anticipated to enhance scalability and transaction speed.

"ETH remains a top choice for developers and investors due to its robust ecosystem and technical advancements," said Stephens. "The Shanghai upgrade is expected to further strengthen ETH's position in the market."

The crypto market remains highly volatile, and investors are advised to exercise caution. However, the resilience of ETH during this correction serves as a testament to its underlying strength and long-term potential.

About CoinDesk Indices

CoinDesk Indices is a leading provider of digital asset indices and analytics. The CoinDesk 20 Index is a benchmark index that tracks the performance of the top 20 cryptocurrencies by market capitalization. The CoinDesk Market Index is a broader index that encompasses approximately 180 tokens across various crypto sectors.

Disclaimer

Please note that this article does not constitute financial advice. Investors should conduct their own research and consult with financial professionals before making any investment decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Bhutan’s Gelephu Mindfulness City (GMC) to Set Up Strategic Crypto Reserve Including Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB)

- Jan 08, 2025 at 11:35 pm

- A newly-created economic hub in Bhutan has expressed intentions to set up a strategic crypto reserve comprising prominent digital assets such as Bitcoin (BTC), Ethereum (ETH) and other major projects.

-

-

-

-