|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

BlackRock's Bitcoin Explainer Video Warns There's 'No Guarantee' Bitcoin's 21 Million Supply Cap Won't Be Changed

Dec 19, 2024 at 08:50 pm

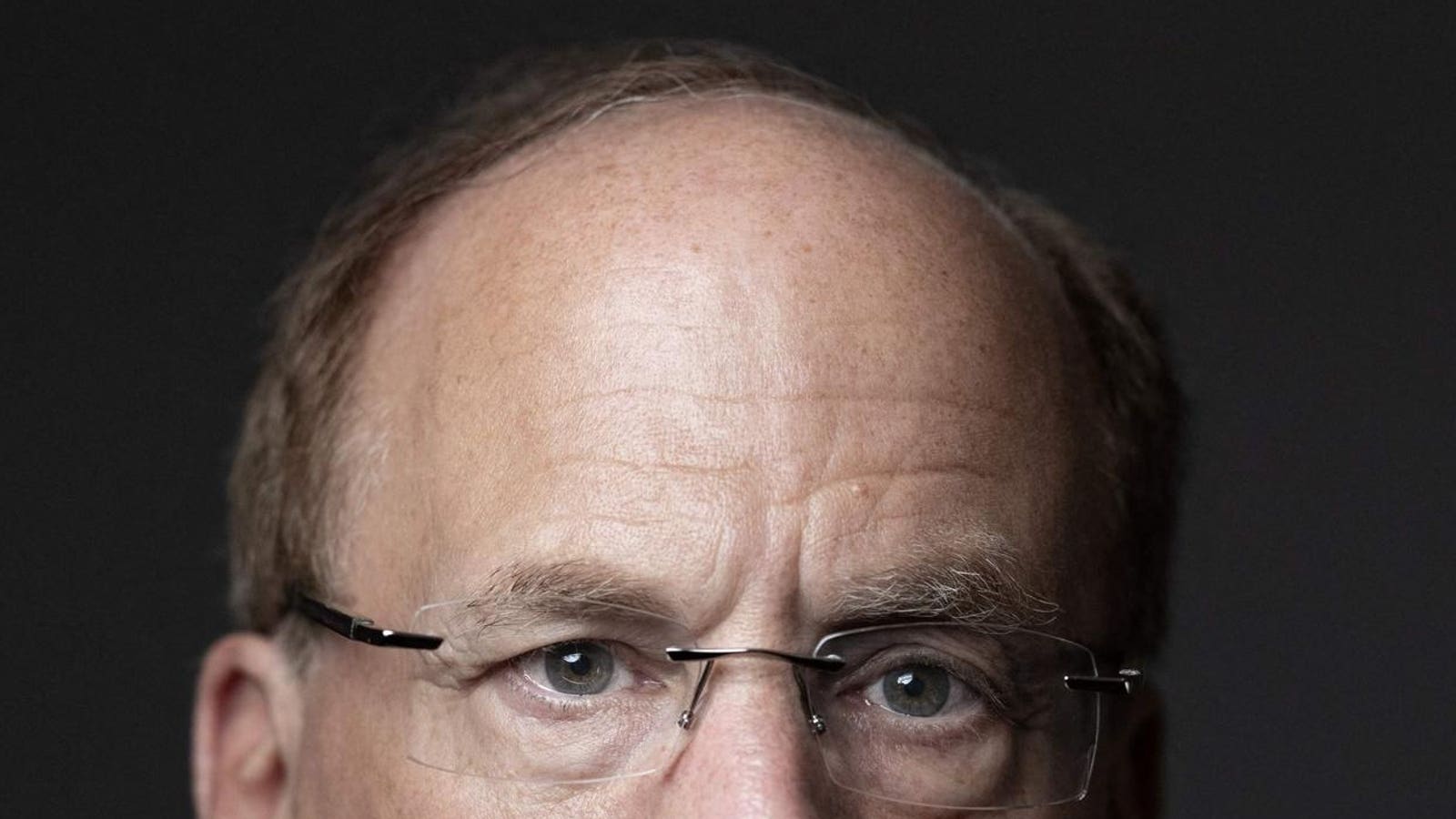

BlackRock chief executive Larry Fink has helped the bitcoin price surge this year.

Bitcoin price has doubled since August lows, driven by interest from Donald Trump and Elon Musk.

Now, as Trump reveals his grand plans for bitcoin, BlackRock has surprised some in the bitcoin community with a bitcoin explainer video that warns there’s “no guarantee” bitcoin’s 21 million supply cap won’t be changed in the future.

Bitcoin price has doubled since August lows, driven by interest from Donald Trump and Elon Musk. Now

Falling Back Under North Korean Assault, A Ukrainian Brigade Turned A River Into A Natural Barrier

BlackRock CEO Larry Fink has helped propel the bitcoin price surge this year.

In the BlackRock video, which was given a boost when it was shared by MicroStrategy's Michael Saylor, bitcoin was described as having a fixed supply of 21 million—"this hard-coded rule controls supply, purchasing power and helps avoid the potential misuse of printing more and more currency."

However, a disclaimer appeared next to the description, adding: "There is no guarantee that bitcoin's 21 million supply cap will not be changed"—something that undermines bitcoin's growing reputation as a scarce digital asset on par with gold.

BlackRock's admission that bitcoin's supply cap could be changed has been interpreted by some as confirmation that BlackRock's embrace of bitcoin will lead to it being "hijacked."

"They're getting everyone used to this eventuality," Joel Valenzuela, a sales and marketing executive at cryptocurrency issuer dash, wrote on X. "When the supply cap increase happens, it will have 'always been part of the plan.' And today, in 2024, people have the nerve to say bitcoin wasn't hijacked."

Bitcoin's supply is set at around 21 million, although the last bitcoin is not expected to be created—through a process called mining—until around the year 2140, over a century from now.

The number of bitcoin that can be issued is written into bitcoin's code and changing it would require agreement among those who secure the bitcoin network in exchange for newly minted bitcoin, known as miners. If a majority of miners did vote to increase the supply of bitcoin, the network would split, or fork, and the minority would continue to direct their computing power toward the network that is capped at around 21 million bitcoin.

The bitcoin price has surged to an all-time high above $100,000 per bitcoin this year, driven by BlackRock fueling a Wall Street rush to bitcoin and crypto.

BlackRock led a campaign to get a spot bitcoin exchange-traded fund (ETF) approved in the U.S. last year, with the funds making their debut in January.

U.S. spot bitcoin ETFs broke $100 billion in net assets for the first time in November, according to data from Bloomberg Intelligence, while BlackRock's iShares Bitcoin Trust (IBIT) now has nearly $60 billion in assets under management, making it one of the fastest growing ETFs ever.

Earlier this year, arch-bitcoin critic Jamie Dimon, the CEO of JPMorgan, said he believes the supply of bitcoin could be changed in the future.

"How the hell do you know that it’s going to stop at 21 [million]," Dimon asked on the sidelines of the World Economic

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Super Micro Computer (NASDAQ: SMCI) Stock Price Jumps 3% as Rosenblatt Securities Initiates Coverage With a Buy Rating

- Mar 12, 2025 at 08:50 am

- Rosenblatt Securities reinitiated coverage of Super Micro Computer (NASDAQ: SMCI) with a Buy rating and set a 12-month price target of $60. This renewed optimism underscores Super Micro's dominant position in the rapidly growing AI-driven computing sector.

-

-

- New Zealand Military Medal awarded to Aylward for heroic actions during Battle of the Green Islands

- Mar 12, 2025 at 08:50 am

- Aylward served for 5 years in the Navy and in 1941 worked as a Navy stoker, known now as a marine technician. In 1944, he was in a group on a barge providing cover to a platoon making a flank attack on an enemy position during the Battle of the Green Islands

-

- Michael Saylor urges the US to buy Bitcoin, similar to its historic land purchases

- Mar 12, 2025 at 08:45 am

- Saylor claimed that the US had purchased 78% of its land for $40 million during the previous centuries. The acquired land spread across Manhattan, Louisiana, California, and Alaska is worth $23 trillion today.

-

-

-

-

-