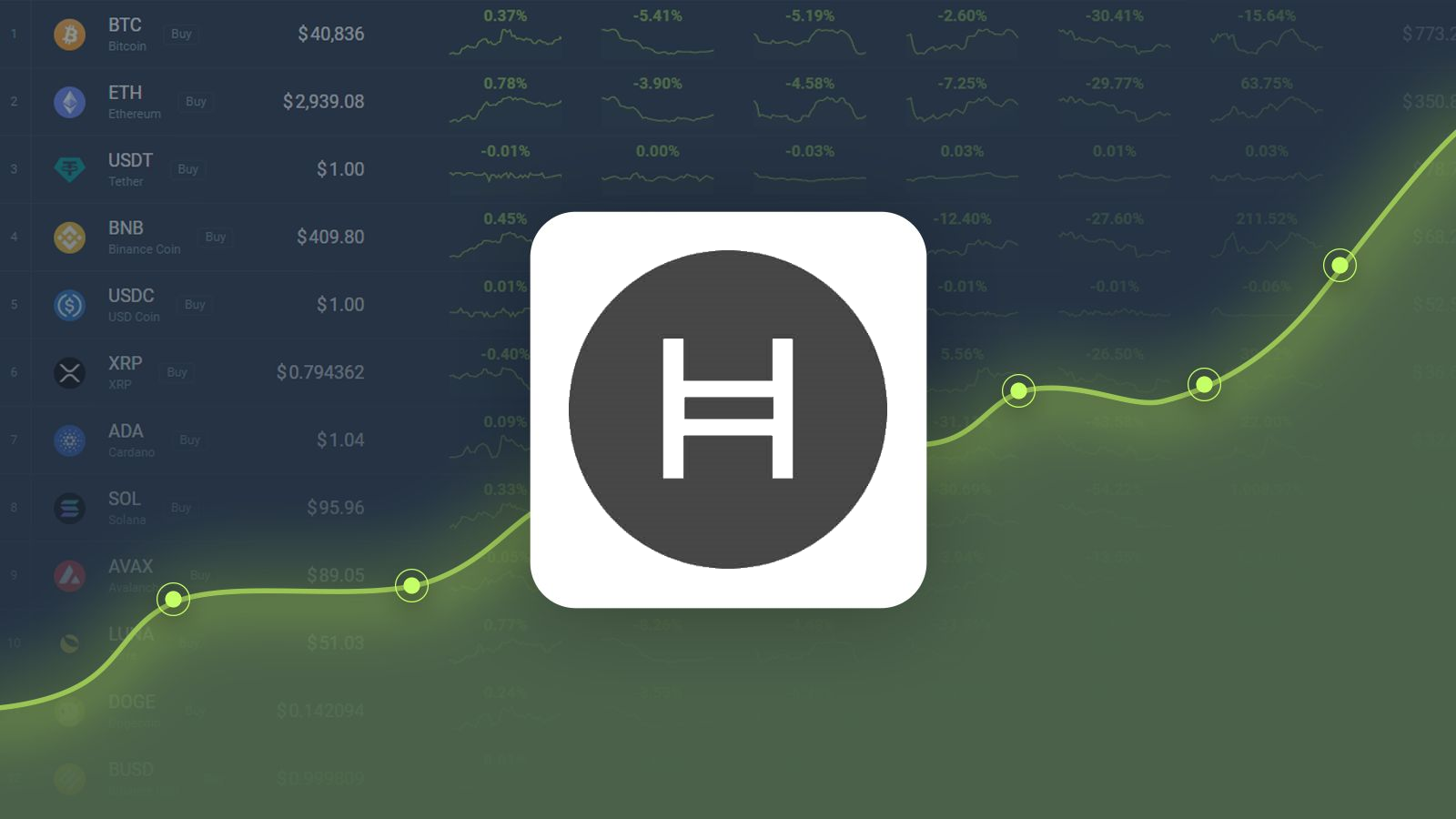

Despite market uncertainty, Bitcoin (BTC) demonstrated resilience with new all-time highs of $69,000, which emerged as tentative support. Jerome Powell's cautious remarks and the Fed's reluctance to cut interest rates reassured investors, providing support for risk assets like Bitcoin. The likelihood of a June interest rate cut is 61%, while March's PCE Index met expectations and reaffirmed the Fed's assessment of inflationary pressures.

Bitcoin Soars, Buoyed by Powell's Cautious Outlook and Rate Cut Anticipations

Amidst market volatility and economic uncertainties, Bitcoin (BTC) has exhibited remarkable resilience, with potential support hovering around its previous all-time high of $69,000.

Jerome Powell, Chair of the United States Federal Reserve, delivered reassuring remarks at the Macroeconomics and Monetary Policy Conference in San Francisco, fostering optimism in the market. Powell maintained a cautious stance on inflation and economic prospects, emphasizing the Fed's reluctance to hasten interest rate reductions due to robust economic growth and a buoyant labor market.

Powell's measured comments instilled confidence among investors, particularly those holding risk assets such as Bitcoin. The market has become increasingly receptive to the possibility of an interest rate cut, with June emerging as a favored timeframe for such a move. According to data from CME Group's FedWatch Tool, the probability of a 0.25% reduction at the June Federal Open Market Committee (FOMC) meeting stands at 61%.

Powell's cautious approach underscores the Fed's commitment to thorough deliberation before implementing policy adjustments. On March 29, the release of the latest Personal Consumption Expenditures (PCE) Index, a key inflation gauge monitored closely by the Fed, aligned with expectations and registered at 2.5%. This data corroborated the Fed's assessment of inflationary pressures, further shaping market expectations regarding future monetary policy decisions.

Technical analysis provides further insights into Bitcoin's price dynamics. Analysts have identified $69,000 as a pivotal level, with a close above it signaling a potential breakout for the cryptocurrency. On-chain signals, including the moving average convergence/divergence (MACD) oscillator, also offer positive indications for BTC's price trajectory.

Traders are paying close attention to the MACD oscillator on daily time frames, which is positioned for a potential cross-up. This technical indicator suggests a shift to bullish momentum, coinciding with the possibility of Bitcoin surpassing its previous all-time high near $74,000. These positive on-chain signals complement the prevailing market sentiment, mirroring rising investor confidence.

In conclusion, Bitcoin has demonstrated resilience in the face of market uncertainties, supported by expectations of an interest rate cut and a cautious outlook from the Federal Reserve. Technical analysis and on-chain indicators reinforce the positive sentiment surrounding the cryptocurrency, suggesting the potential for further price appreciation in the near future.