|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Remains Unfazed as Ray Dalio Warns of Impending Global Economic Crisis

Apr 15, 2025 at 01:15 pm

As financial markets brace for impact, Bitcoin is quietly standing its ground. In a recent interview with CNBC, billionaire investor Ray Dalio said that the world may not be

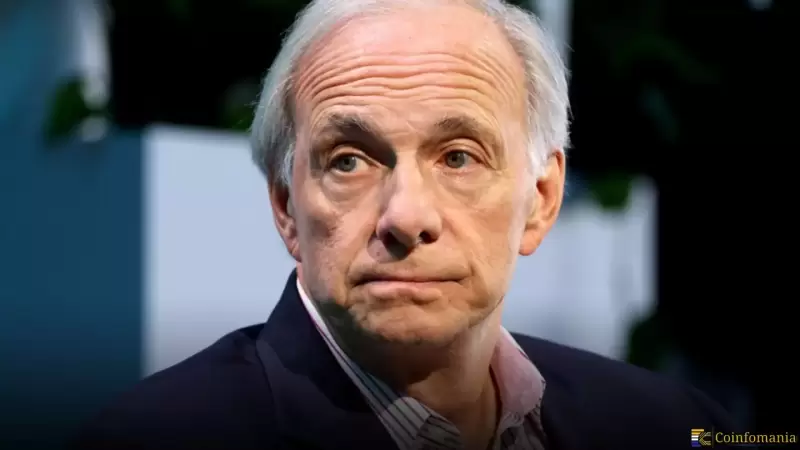

Billionaire investor Ray Dalio has issued a stark warning, saying in a recent interview with CNBC that the world may not be heading strictly for a recession but rather for a global economic crisis.

As financial markets brace for impact, Bitcoin (BTC) is quietly standing its ground. In a recent interview with CNBC, billionaire investor Ray Dalio issued a stark warning, saying that the world may not be heading strictly for a recession but rather for a global economic crisis.

As financial markets brace for impact, Bitcoin (BTC) is quietly standing its ground. In a recent interview with CNBC, billionaire investor Ray Dalio issued a stark warning, saying that the world may not be heading strictly for a recession but rather for a global economic crisis – a basic breakdown of our economic and political systems.

With US debt growing and trust in the global monetary structure fading, Dalio characterized the current context as comparable to past historic junctures, such as the end of the gold standard in 1971 and the 2008 financial crisis. In the midst of all of this, the BTC price is increasing, breaking free from a heavy three-month downtrend and moving slowly toward $85,000.

One of Dalio’s top concerns is the rapidly expanding U.S. deficit. He says lawmakers need to bring it down to 3% of GDP before the imbalance between debt supply and investor demand sparks serious trouble. According to Dalio, these stress points could trigger a global economic crisis. Bond markets are showing signs of distress already, with a 10-year yield around 4.5% and a 30-year yield around 5%. The new tariff confusion and weakening U.S. dollar, which just dipped below 100 on the DXY, certainly give investors no shortage of reasons to be worried.

As traditional markets wobble, Bitcoin appears to be gaining strength. The rising BTC price suggests some investors are eyeing it as a possible safe haven amid the growing risk of a global economic crisis. Its recent breakout might be more than just technical, it could reflect growing trust in Bitcoin’s role during financial uncertainty. As Dalio warns of deeper systemic risks, Bitcoin’s performance becomes even more interesting. Let’s now take a closer look at the latest BTC price action and what the charts are signaling.

The BTC price mostly moved sideways throughout the April 14th session, with action on the 5-minute chart staying bounded between $83,000 support and $85,000 resistance. Early signs showed a descending channel, with the price briefly testing the lower range before bouncing back into an ascending channel, highlighting a market in tug-of-war mode. Around 03:00 UTC, BTC spiked above resistance but quickly pulled back, hinting at stop-loss triggers or liquidity grabs rather than strong buying momentum.

Chart 1, Analyzed by Alokkp0608, Published on April 14th, 2025

The RSI revealed rapid swings between overbought and oversold conditions, underlining the high intraday volatility. Each extreme correlated with short-term highs and lows in BTC, making RSI particularly useful for short-timeframe decisions.

Meanwhile, MACD also reflected the choppiness, with golden crosses at 02:30 and 14:30 bringing short bursts of bullish momentum, while death crosses after 04:30 and 16:00 signaled brief declines. All told, the indicators reveal a market without clear direction, reacting to every micro-shift.

Amid the global chaos and Dalio’s unsettling proclamation about a possible global recession, Bitcoin is still moving along. Bitcoin currently sits at approx. $85,000; the current BTC price indicates a potential shift in overall investor sentiment – there exists a possibility that the market sees Bitcoin as a hedge during a period of uncertainty. While traders have volatility viewed, direction still uncertain, traders are watching the next potential breakout or breakdown closely. As pressure mounts on traditional markets, BTC performance could become a leading signal in a world that’s still trying to find its footing.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Henry Winkler Knows How to Make a Good First Impression

- Apr 17, 2025 at 08:45 am

- During an appearance on the What In The Winkler?! podcast, hosted by the actor's wife Stacey Weitzman and daughter Zoe Winkler, Henry's daughter-in-law Jessica Barden — who is married to his son Max — recalled her introduction to the Happy Days star.

-

- Ethereum Classic (ETC) Price Faces Renewed Selling Pressure, Testing Critical Support at $14.30

- Apr 17, 2025 at 08:40 am

- Ethereum Classic (ETC) is navigating through turbulent waters as its price faces renewed selling pressure. Despite the recent volatility, ETC continues to hover just above a critical support level

-

-

-

- Use BetMGM bonus code WTOP1500 to claim the best welcome offer in your state for the NBA Play-In Tournament

- Apr 17, 2025 at 08:40 am

- Use BetMGM bonus code WTOP1500 to claim the best welcome offer in your state for the NBA Play-In Tournament. Sign up here to win bonus bets or place your favorite wager of the week.

-

- Arthur Hayes, CEO of BitMex, Says China's Response to President Trump's Tariffs Will Trigger the Bitcoin (BTC) Bull Cycle

- Apr 17, 2025 at 08:30 am

- Arthur Hayes, co-founder and CEO of BitMex, says China’s response to President Trump’s tariffs will trigger the Bitcoin (BTC) bull cycle. Several countries are adjusting