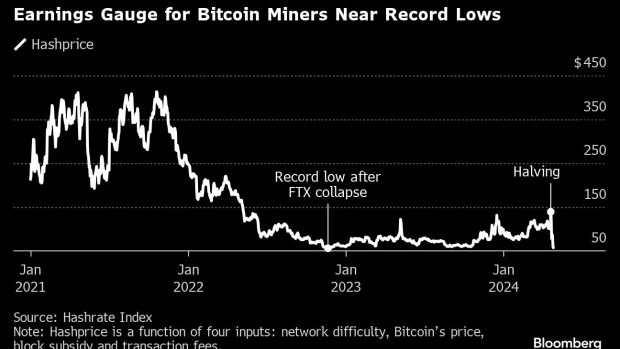

Bitcoin mining profitability metric, the hashprice, plunges near its all-time low, indicating challenging times for miners. The metric, which represents the revenue earned by miners per computing power, has fallen to $57 due to Bitcoin's halving, geopolitical tensions, and interest rate expectations. The halving has not provided a significant boost to Bitcoin's price, leaving miners increasingly reliant on fee revenue and price gains.

Bitcoin Mining Faces Adversity as Hashprice Plummets to Near Record Low

Amidst an array of economic challenges, the cryptocurrency industry is witnessing a significant downturn in Bitcoin mining profitability. The hashprice, a metric that gauges the profitability of Bitcoin mining, has reached a level close to its all-time low in the aftermath of the collapse of Sam Bankman-Fried's FTX. This development indicates dire prospects for Bitcoin miners.

The precipitous decline in the hashprice follows Bitcoin's fourth "halving" event, which took place on April 20, 2023. During a halving, the reward miners receive for securing the Bitcoin network is reduced by half. While this quadrennial event has historically benefited Bitcoin, its impact has been minimal this time around. Instead, geopolitical tensions and expectations of sustained high interest rates in the United States have weighed heavily on Bitcoin and other cryptocurrencies.

According to data from Hashrate Index, the hashprice fell to $57 on Friday, May 26, 2023. This figure reflects the amount a miner can potentially earn from one petahash per second of computing power per day. The hashprice reached its all-time low of $55 shortly after the FTX implosion in November 2022.

Immediately after the halving, the hashprice experienced a brief surge to $139. This increase was attributed to a spike in transaction fees due to the surge in activity surrounding the Rune protocol, which allows for the creation of non-fungible tokens (NFTs) on the Bitcoin blockchain. However, the rise proved短暂, as fees declined to pre-halving levels and mining difficulty escalated, as per data from CryptoQuant.

With Bitcoin mining becoming exponentially more challenging and rewards being slashed, miners are increasingly dependent on fee revenue and gains in the token's value. To mitigate potential disruptions, large-scale miners like Marathon Digital Holdings Inc. and Riot Platforms Inc. have invested billions of dollars in mining equipment and data center infrastructure. Smaller and less well-capitalized entities, however, face the threat of market displacement.

The Bitcoin mining industry remains in a state of flux, grappling with a confluence of economic headwinds. As the hashprice continues to hover near all-time lows, the profitability of Bitcoin mining is severely compromised, with smaller miners particularly vulnerable to elimination from the market. The long-term implications of this downturn on the Bitcoin network and the cryptocurrency ecosystem at large remain uncertain.