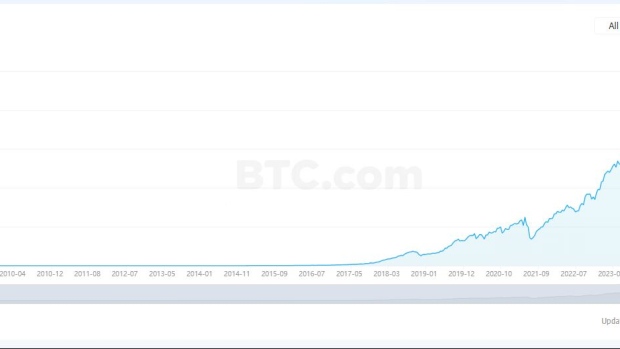

Bitcoin miners are expending record levels of computing power to mint the cryptocurrency ahead of a halving event on April 20th that will significantly reduce their revenue. Mining difficulty has reached an all-time high, driven by an almost 600% surge since the previous halving in 2020. This event, pre-programmed by Bitcoin's creator Satoshi Nakamoto, halves the number of new tokens issued to miners every four years to maintain a hard cap of 21 million tokens.

Bitcoin Miners Brace for Halving's Impact, Unleashing Unprecedented Computing Power

New York - Bitcoin miners are pushing their technological limits to generate unprecedented computing power in anticipation of a significant code adjustment within the next two weeks. This imminent adjustment, known as the "halving," will result in a dramatic reduction in revenue for these companies.

Mining difficulty, a metric indicative of the computational effort required to mint new Bitcoins, reached a record high on Wednesday. This represents the final bi-weekly update before the halving, scheduled to occur on or around April 20th. Since the previous halving in 2020, this metric has witnessed a staggering 600% increase. Concurrently, the rate of energy consumption has also experienced a steep rise.

The halving, a pre-programmed event orchestrated by Bitcoin's enigmatic creator, Satoshi Nakamoto, aims to maintain the cryptocurrency's total supply at a capped 21 million coins, thereby mitigating inflationary pressures. Every four years, the number of new tokens, also known as Bitcoin rewards, issued to miners undergoes a 50% reduction.

This halving event poses a significant challenge for miners, with the majority of their income derived from these rewards. The upcoming halving marks the fourth such event since 2012, with miners set to see their rewards slashed to 3.125 for successfully processing a transaction unit on the blockchain. This will result in a halving of the daily coin production from all miners, from 900 to 450.

To cushion the impending impact of the halving, Bitcoin mining companies are bolstering their cash reserves through various strategies. These include operating at full capacity, expanding operations to produce and sell more coins, and capitalizing on the recent surge in Bitcoin prices.

Market analysis reveals that Marathon Digital Holdings Inc., a prominent publicly-traded miner, experienced minimal fluctuations in its share price, holding steady around $17.50 on Thursday. Riot Platforms Inc., a smaller competitor, similarly showed little change, hovering around $9.86. Marathon has enjoyed a significant gain of approximately 70% over the past year, while Riot has faced a decline of 20%.

Experts contend that the upcoming halving will present miners with a formidable test. They emphasize the need for miners to adapt their strategies, embrace innovation, and explore alternative revenue streams to navigate the challenges posed by this significant code adjustment.