|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Avalanche (AVAX) Faces Critical Challenges Despite Bullish Market Sentiment, Death Cross Looms

Nov 22, 2024 at 07:11 am

Avalanche (AVAX) has been one of the notable performers in the cryptocurrency market, recently reaching new heights and breaking into the top 15 cryptocurrencies. Despite the overall positive market sentiment and growing bullishness surrounding AVAX, the token faces critical challenges that could prevent its price from breaking out further.

Despite being one of the top performers in the cryptocurrency market, with a recent entry into the top 15 cryptocurrencies and reaching new price heights, Avalanche (AVAX) faces critical challenges that could prevent its price from breaking out further.

While the overall market sentiment remains positive and bullish for AVAX, there are increasing signs of bearish pressure that could stall the rally and cause the price to retrace before continuing its upward movement.

Strong Bullish Momentum Meets Resistance

After bouncing back from its lows in November, Avalanche has shown a consistent uptrend. The price has been testing the upper resistance of a rising parallel channel that has supported its price action over the last few weeks. This is a positive sign as it shows that the bulls are actively pushing the price higher. However, there has been a consistent failure to break above this resistance, which has raised concerns that the bullish momentum could be running out of steam.

The inability to break through this resistance, combined with an increase in bearish presence, suggests that the market may be at a critical juncture. If AVAX fails to stay above key support levels, we could see a pullback that would invalidate this rally. A break below these support levels would confirm the onset of a bearish trend and could lead to a significant price drop.

Technical Indicators Raise Concerns

While AVAX’s price action on the medium-term time frame remains generally bullish, there are several bearish indicators that could spell trouble. One of the most concerning signals is the drop in trading volume. After hitting yearly highs around $37.50, we can see that the price action is accompanied by a noticeable decrease in trading activity, signaling that traders may have taken their profits and are now waiting for a better entry point to trade. This reduced volume often leads to diminished liquidity, which can prevent the price from sustaining its upward movement.

Moreover, the Moving Average Convergence Divergence (MACD) has shown a significant decline in buying pressure. The MACD is a critical tool for gauging momentum, and the recent bearish crossover on the weekly time frame indicates a weakening of the bullish trend. As a result, this could trigger increased selling activity, pushing the price lower.

Additionally, the On-Balance Volume (OBV) has shown a bearish divergence, which is another sign that this rally may be losing strength. The OBV tracks buying and selling pressure, and this divergence suggests that the bears are gaining more control over the price action. This could lead to a continuation of the downtrend, especially if other indicators line up to confirm this bearish momentum.

Death Cross Looms on Weekly Chart

One of the most significant bearish signals for AVAX is the potential formation of a ‘Death Cross’ on the weekly chart. The Death Cross occurs when the 50-day moving average crosses below the 200-day moving average, signaling a shift from bullish to bearish momentum.

Recently, the AVAX price had crossed over to form a ‘Golden Cross,’ which brought optimism to the market. However, without a significant bullish breakout, the 50-day and 200-day moving averages are now on the verge of crossing, signaling that a pullback could occur.

This pullback could potentially bring AVAX’s price to around $30 before any consolidation or recovery takes place. However, despite the potential for a short-term downturn, the broader market sentiment remains bullish. If AVAX can consolidate and hold above key support levels, it may set the stage for a fresh rally, and the price could push higher again in the coming months.

Conclusion

In conclusion, while the bullish sentiment around Avalanche remains strong, the price faces multiple bearish signals that could hinder its immediate progress. The inability to break resistance, coupled with a decline in volume and weakening momentum indicators, suggests that a short-term pullback is possible. However, if AVAX can consolidate above key support levels and the broader cryptocurrency market continues its bullish trend, the token may still see further upside in the future. Investors will need to closely monitor the price action to determine whether the bears can maintain control or if the bulls will manage to push through resistance for a breakout.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

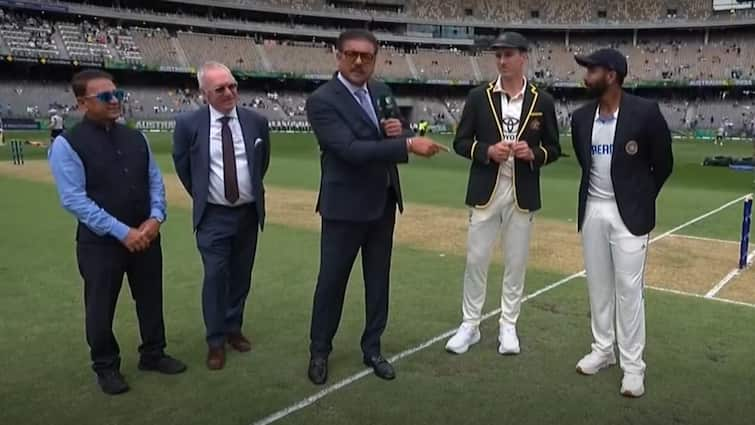

- Border-Gavaskar Trophy 2024-25: India are batting first in the first Test match of the Border-Gavaskar Trophy 2024-25 series at Optus Stadium in Perth after Jasprit Bumrah won the coin toss, and there are some fesh faces to be seen in action today.

- Nov 22, 2024 at 02:30 pm

- The reigning BGT champions have handed debuts to all-rounder Nitish Kumar Reddy and pacer Harshit Rana, and Devdutt Paddikal comes in place of injured Shubman Gill.

-

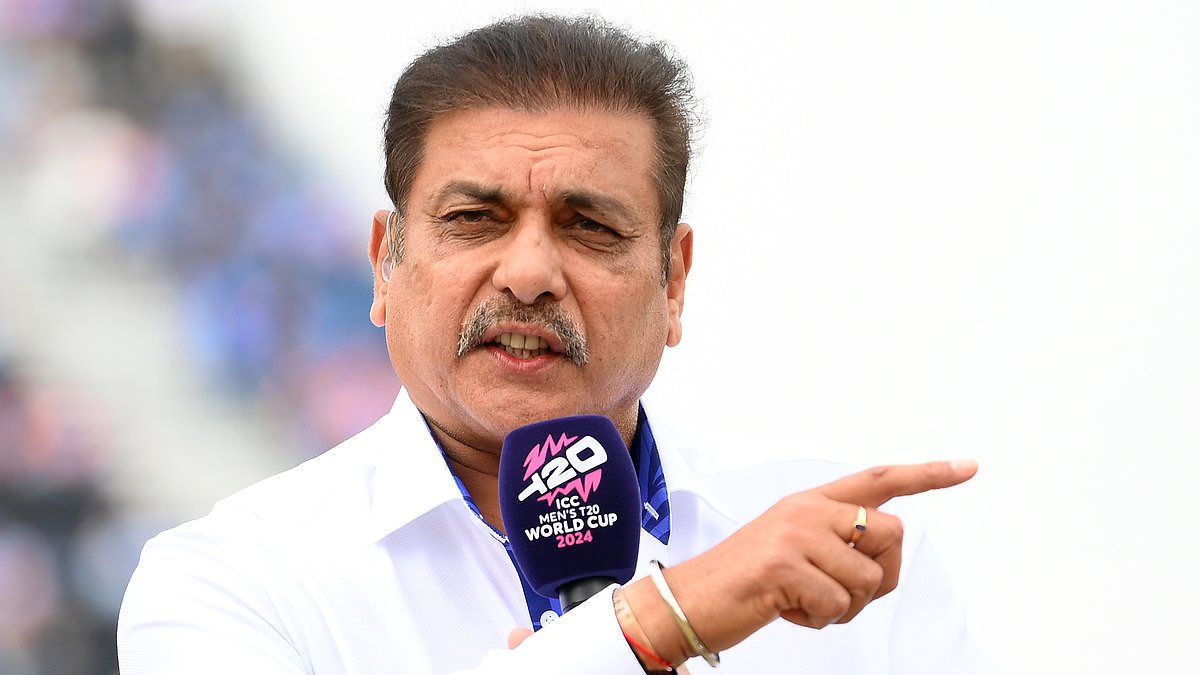

- Ravi Shastri steals the show with over-the-top theatrics at the toss that has cricket fans in splits

- Nov 22, 2024 at 02:30 pm

- The highly anticipated Test series between India and Australia got off to an incredible start before a ball had even been bowled on Friday courtesy of a head-turning performance by the legendary Ravi Shastri.

-

-

-

- Rollblock (RBLK) Presale Skyrockets 260% Amidst Growing Anticipation in the Crypto Market

- Nov 22, 2024 at 02:25 pm

- Rollblock's unique revenue-sharing mechanism offers consistent passive income for investors, a feature Ethereum and Avalanche lack. Rollblock's deflationary tokenomics creates scarcity, boosting value over time. With seamless integration of over 20 cryptocurrencies and 7,000 games, Rollblock delivers unmatched utility. Rollblock's rapid growth positions it as a standout in the crypto market and GambleFi sector.

-

-

-

-