|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tether已在乐观的OP SuperChain上推出了Crosschain Stablecoin USDT0,扩大了数字美元的可访问性

Tether has launched its crosschain stablecoin USDT0 on Optimism’s OP Superchain, expanding the accessibility of the digital dollar to Ethereum’s layer-2 ecosystem.

Tether已在乐观的OP SuperChain上推出了Crosschain Stablecoin USDT0,将数字美元的可访问性扩展到以太坊的第2层生态系统。

The launch, announced on Monday, marks a significant step in the adoption of stablecoins within decentralized finance (DeFi) and strengthens the growth of OP Superchain as one of the most dominant infrastructures in the sector.

该发布于周一宣布,标志着在分散融资(DEFI)内采用Stablecoins的重要一步,并增强了OP SuperChain作为该行业最主要的基础设施之一的增长。

The integration of USDT0 on this network aims to attract more assets, high-level applications, and partners, consolidating the role of stablecoins in the DeFi sector.

USDT0在该网络上的集成旨在吸引更多资产,高级应用程序和合作伙伴,从而巩固了Stablecoins在Defi行业中的作用。

Ethereum news: what is USDT0 launched by Tether and why it is relevant for DeFi

以太坊新闻:Tether推出了什么USDT0,以及为什么与Defi相关

USDT0 is a crosschain and bridged version of USDt, designed to facilitate the adoption of stablecoins on different blockchain networks.

USDT0是USDT的交叉链和桥接版本,旨在促进在不同的区块链网络上采用Stablecoins。

Tether introduced this resource in January in collaboration with LayerZero, an interoperability protocol, with the aim of improving the integration of stablecoins between different blockchains.

Tether在一月份与互操作性协议LoyeZero合作介绍了此资源,目的是改善不同区块链之间的稳定剂的集成。

Its first implementation took place on Ink, a layer-2 focused on DeFi developed by Kraken. A month later, Tether chose Arbitrum as the main infrastructure for USDT0, consolidating its presence in the Ethereum layer-2 landscape.

它的第一个实现是在墨水上进行的,这是Kraken开发的Defi的第2层。一个月后,系纤维选择了仲裁作为USDT0的主要基础设施,从而巩固了其在以太坊2层景观中的存在。

The implementation of USDT0 on Superchain reflects a broader strategy to increase the liquidity and scalability of stablecoins, making them more accessible to users operating in the DeFi ecosystem on Ethereum.

超级链上USDT0的实施反映了提高Stablecoins的流动性和可扩展性的更广泛策略,使其更容易在以太坊上的Defi生态系统中运行。

Superchain is a network of layer-2 chains based on OP Stack, designed to enhance the scalability of Ethereum. Its influence in the sector has increased rapidly.

SuperChain是基于OP堆栈的第2层链网络,旨在增强以太坊的可扩展性。它在该行业中的影响迅速增加。

According to Superchain data, the collective currently has 52% of total transactions on Ethereum layer-2, up from 36.6% recorded in September.

根据SuperChain数据,该集体目前拥有以太坊2层总交易的52%,高于9月的36.6%。

Ryan Wyatt, chief growth officer of Optimism, stated in February that Superchain could account for up to 80% of layer-2 transactions on Ethereum by the end of the year.

乐观主义首席成长官瑞安·怀亚特(Ryan Wyatt)在2月份表示,到今年年底,超级棋子最多可占以太坊交易的80%。

The total value locked (TVL) within Superchain has recently surpassed 4.2 billion dollars, marking a significant growth compared to the 4 billion in February.

SuperChain内的总价值锁定(TVL)最近超过了42亿美元,这标志着2月的40亿美元的显着增长。

The expansion of USDT0 on the network will contribute not only to the liquidity of stablecoins but will likely also attract new assets and protocols, further stimulating the adoption of Superchain.

USDT0在网络上的扩展不仅会促进稳定的流动性,而且还可能会吸引新的资产和协议,从而进一步刺激超级胸骨的采用。

The role of stablecoin in decentralized finance

Stablecoin在分散融资中的作用

Stablecoins have become a fundamental pillar for DeFi, facilitating fast and reliable transactions, protecting users from the typical volatility of cryptocurrencies.

稳定币已成为Defi的基本支柱,促进快速可靠的交易,保护用户免受加密货币的典型波动。

As of today, the total value of stablecoins in circulation has reached nearly 228 billion dollars, with a growth of 3.3% in the last 30 days.

截至今天,流通中的稳定蛋白的总价值已达到近2280亿美元,在过去30天内增长了3.3%。

Ethereum remains the dominant network for stablecoins, hosting 58% of the total supply. Among these, Tether’s USDt is the most used stablecoin globally, consolidating its central role within the sector.

以太坊仍然是Stablecoins的主要网络,占总供应的58%。其中,Tether的USDT是全球最常用的Stablecoin,它巩固了其在该行业中的核心作用。

According to the data from RWA.xyz, there are over 155 million stablecoin holders worldwide.

根据RWA.xyz的数据,全球有超过1.55亿个Stablecoin持有人。

This confirms how these cryptocurrencies pegged to the dollar have become indispensable tools in the blockchain landscape, ensuring stability and reliability for traders, DeFi users, and institutions.

这证实了这些加密货币如何固定在区块链环境中必不可少的工具,从而确保对交易者,Defi用户和机构的稳定性和可靠性。

Tether has played a pioneering role in the stablecoin market, establishing itself as one of the largest holders of United States Treasury assets.

Tether在Stablecoin市场中发挥了开创性的作用,确立自己是美国国库资产最大的持有人之一。

This has allowed the company to record significantly high profits in recent years, strengthening its position as a leader in the sector.

这使该公司近年来能够记录高利润,从而增强了其在该行业领导者的地位。

The expansion of USDT0 on OP Superchain demonstrates Tether’s willingness to ensure greater interoperability between different blockchains, facilitating the adoption of its stablecoin in broader and more diverse ecosystems.

USDT0在OP SuperChain上的扩展表明,Tether愿意确保不同区块链之间更大的互操作性,从而促进其在更广泛和更多样化的生态系统中采用其稳定性。

Regulatory Prospects for Stablecoins in the United States

美国稳定币的监管前景

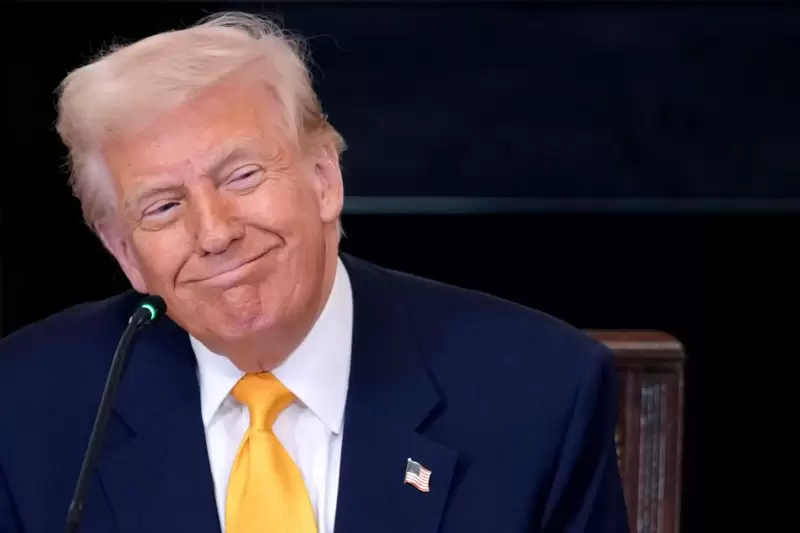

Stablecoins are under increasing scrutiny by regulatory institutions in the United States. With Donald Trump’s presidency, these digital financial instruments have become a central point of American economic policies.

美国的监管机构正在受到越来越多的审查。由于唐纳德·特朗普(Donald Trump)的总统职位,这些数字金融工具已成为美国经济政策的中心地点。

Recently, Bo Hines, head of the digital assets council of the Trump administration, stated at a conference in New York that a complete regulation on stablecoins could be approved within the next two months.

最近,特朗普政府数字资产委员会主管Bo Hines在纽约的一次会议上说,可以在未来两个月内批准对Stablecoins的完整法规。

This could have a significant impact on the sector, influencing the adoption and regulatory framework of stablecoins like USDT0.

这可能会对该行业产生重大影响,从而影响了像USDT0这样的Stablecoins的采用和监管框架。

The implementation of USDT0 on OP Superchain represents a step forward in the evolution of decentralized finance.

OP SuperChain上的USDT0实施代表了分散财务发展的一步。

Thanks to its interoperability and stability features, this stablecoin has the potential to attract more capital and stimulate the adoption of Superchain in the DeFi sector.

由于其互操作性和稳定性特征,这种稳定的稳定性有可能吸引更多资本并刺激在偏见行业中的超级链采用。

With Ethereum dominating the stablecoin market and Tether continuing to strengthen its position, the future of the sector will also depend on regulatory developments in the United States and the further growth of the layer-2 ecosystem.

随着以太坊占主导地位,稳定市场并继续加强其地位,该行业的未来也将取决于美国的监管发展以及第2层生态系统的进一步增长。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 雪崩卡已揭幕:它会为阿瓦克斯(Avax)带来看涨的动力吗?

- 2025-04-22 09:45:13

- 在过去的一年中,雪崩生态系统的发展得到了显着增长。

-

- 韩国银行(BOK)决定在塑造韩国的稳定框架方面发挥积极作用。

- 2025-04-22 09:45:13

- 随着中央银行越来越关注这些数字资产可能对该国的货币和金融体系构成的风险,此举越来越多。

-

-

-

-

-

-

- Mutuum Finance(MUTM)预售从8400多个买家筹集了700万美元

- 2025-04-22 09:30:12

- 该预测基于预期的网络升级,例如旨在提高可扩展性和提高其智能合同功能的LEIO更新。

-