|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solv Protocol 是一个为比特币等资产提供原生收益的 DeFi 项目,其 TVL 显着增加。 Solv 的价值从 4 月份的 1.14 亿美元飙升至 6.72 亿美元,已跻身 TVL 排名前 40 的 DeFi 协议之列。 Solv 专注于比特币,提供可产生收益的代币化交易策略,其中包括 SolvBTC,它提供了第一个有收益的比特币。 Solv 扩展到包括 Merlin 在内的五个区块链网络,使其在 Merlin 上占据主导地位,拥有超过 50% 的 TVL。

Solv Protocol Surges in April, Bringing Yield to Bitcoin and Beyond

Solv 协议在 4 月份飙升,为比特币及其他领域带来收益

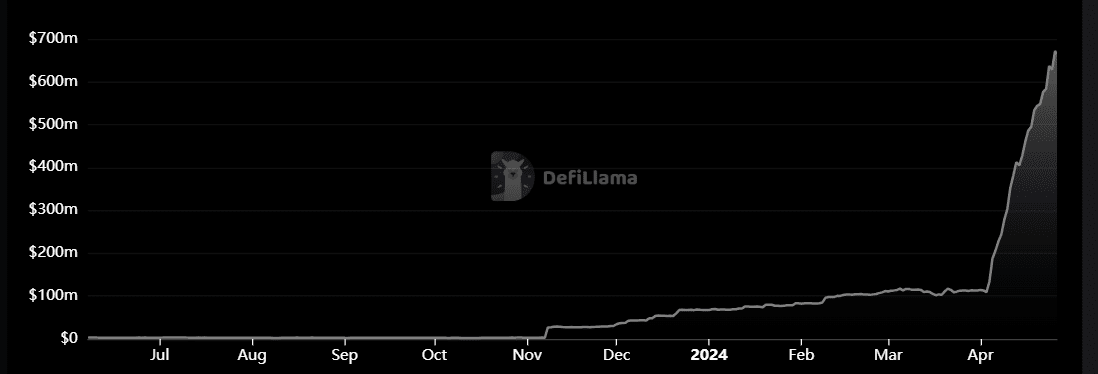

Solv Protocol, a trailblazing decentralized finance (DeFi) project, has witnessed an extraordinary surge in April, propelling it into the ranks of the top 40 DeFi protocols by total value locked (TVL). According to data from DefiLlama, Solv's TVL has skyrocketed from a mere $114 million at the month's outset to an impressive $672 million as of this writing, representing a remarkable 490% increase in just four weeks.

Solv Protocol 是一个开创性的去中心化金融 (DeFi) 项目,在 4 月份见证了非凡的飙升,使其跻身锁定总价值 (TVL) 排名前 40 的 DeFi 协议行列。根据 DefiLlama 的数据,Solv 的 TVL 从本月初的区区 1.14 亿美元飙升至撰写本文时的 6.72 亿美元,在短短四个星期内增长了 490%。

Solv's meteoric rise stems from its innovative approach to yield generation, particularly for Bitcoin, which has traditionally lacked a robust staking ecosystem akin to that of Ethereum. By leveraging tokenized trading strategies, Solv offers native yield on multiple networks, effectively unlocking the potential for earning passive income from Bitcoin.

Solv 的迅速崛起源于其创新的收益生成方法,特别是对于比特币而言,传统上缺乏类似于以太坊的强大质押生态系统。通过利用代币化交易策略,Solv 在多个网络上提供原生收益,有效释放从比特币赚取被动收入的潜力。

For instance, users can seamlessly deposit Bitcoin into Solv's trading strategy vault and receive SolvBTC, a liquid strategy token compatible with Ethereum and DeFi apps. Crucially, SolvBTC offers native yield by accruing Solv points, making it the first yield-bearing Bitcoin product. While Solv supports a diverse range of tokens, Bitcoin commands an overwhelming 80% share of all deposits, totaling over $535 million.

例如,用户可以将比特币无缝存入 Solv 的交易策略金库并接收 SolvBTC,这是一种与以太坊和 DeFi 应用程序兼容的流动策略代币。至关重要的是,SolvBTC 通过累积 Solv 积分来提供原生收益,使其成为第一个产生收益的比特币产品。虽然 Solv 支持多种代币,但比特币占据了所有存款的 80% 的压倒性份额,总额超过 5.35 亿美元。

Solv's presence spans five blockchain networks, with Merlin, a Bitcoin layer 2 solution, accounting for the lion's share of its TVL. Solv has emerged as the undisputed frontrunner on Merlin, contributing over 50% of its overall TVL. To date, Solv boasts an impressive user base of over 90,000 and has generated a substantial $6.4 million in yield.

Solv 的业务横跨五个区块链网络,其中 Merlin(比特币第 2 层解决方案)占据了其 TVL 的最大份额。 Solv 已成为 Merlin 无可争议的领跑者,贡献了其总 TVL 的 50% 以上。迄今为止,Solv 拥有超过 90,000 名令人印象深刻的用户群,并产生了高达 640 万美元的收益。

Furthermore, Solv is actively exploring the potential of financial non-fungible tokens (NFTs). The team has introduced the ERC-3525 token standard on Ethereum, paving the way for the creation of semi-fungible tokens applicable across DeFi, real-world asset (RWA) protocols, and social applications. The Ethereum Foundation officially embraced the ERC-3525 as its 35th ERC standard in late 2022.

此外,Solv 正在积极探索金融不可替代代币(NFT)的潜力。该团队在以太坊上引入了 ERC-3525 代币标准,为创建适用于 DeFi、现实世界资产 (RWA) 协议和社交应用程序的半同质化代币铺平了道路。以太坊基金会于 2022 年底正式接受 ERC-3525 作为其第 35 个 ERC 标准。

Solv is currently testing stUSD, a groundbreaking stablecoin vault that harnesses the power of the ERC-3525 standard. With over $1.5 million in testing capital, stUSD offers a variable yield to stablecoin holders. Through the use of ERC-3525, stUSD serves as a share token for the vault, enabling access to yield-bearing assets for stablecoin holders.

Solv 目前正在测试 stUSD,这是一个突破性的稳定币金库,利用了 ERC-3525 标准的力量。 stUSD 拥有超过 150 万美元的测试资本,为稳定币持有者提供可变收益率。通过使用 ERC-3525,stUSD 作为金库的股份代币,使稳定币持有者能够访问有收益的资产。

This surge in April is a testament to Solv's unique approach to yield generation and its unwavering commitment to innovation in the DeFi space. As Solv continues to expand its offerings and explore new frontiers, it is poised to remain a driving force in the rapidly evolving DeFi landscape.

4 月份的飙升证明了 Solv 独特的收益生成方法及其对 DeFi 领域创新的坚定承诺。随着 Solv 不断扩展其产品并探索新领域,它有望继续成为快速发展的 DeFi 领域的驱动力。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 区块链技术的兴起为金融解决方案的新时代铺平了道路

- 2025-03-09 10:45:45

- 分散的金融(DEFI)已成为一种革命性的选择,提供了透明度,安全性和可及性,而无需依赖中介机构。

-

-

- XRP价格预测如果SEC的批准通过

- 2025-03-09 10:30:46

- 如果SEC批准Ripple Labs的申请将其令牌注册为安全性,则本文探讨了XRP的潜在价格

-

- Vechain(VET)将参加伦敦的“缠绕Web3”活动

- 2025-03-09 10:30:46

- 该活动将以引人注目的演讲者和讨论,例如区块链,数字身份和人工智能。

-

- BTFD硬币领导这项指控,筹集了627万美元的预售

- 2025-03-09 10:30:46

- 想象一下,醒来,找到您在模因硬币中的100美元投资,一夜之间变成了六位数。听起来像是梦?

-

-

- Binance Coin(BNB)长期以来一直是加密货币市场的主食

- 2025-03-09 10:30:46

- 随着3月份的临近,专家们预测,BNB的潜在价格上涨,这会增加市场乐观和二进制生态系统中发展效用。

-

-