|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cypherpunk Holdings 于 2024 年 9 月中旬更名为 Sol Strategies,其股价大幅上涨(股票代码:HODL)

Cypherpunk Holdings, now known as Sol Strategies, is a Canadian publicly traded investment firm. The company’s main focus was on new technologies and cryptocurrencies, but with the rebrand, it shifted to the Solana ecosystem.

Cypherpunk Holdings,现称为 Sol Strategies,是一家加拿大上市投资公司。该公司的主要重点是新技术和加密货币,但随着品牌重塑,它转向了 Solana 生态系统。

Sol Strategies’ main strategy now involves staking Solana’s native token, SOL, and investing in DeFi projects and infrastructure. The company’s stock provides regulated exposure to Solana via its validator services and strategic investments.

Sol Strategies 目前的主要策略包括质押 Solana 的原生代币 SOL,以及投资 DeFi 项目和基础设施。该公司的股票通过其验证器服务和战略投资提供了 Solana 的受监管敞口。

Investors can purchase Sol Strategies shares by opening an account with a brokerage that offers access to either the CSE or OTC markets. Once the account is set up, investors can place orders through the brokerage’s trading platform or get help from their financial advisor.

投资者可以通过在可进入 CSE 或 OTC 市场的经纪公司开设账户来购买 Sol Strategies 股票。账户设立后,投资者可以通过经纪商的交易平台下订单或向财务顾问寻求帮助。

Here are a few possible explanations for the recent rise in Sol Strategies stock price.

以下是 Sol Strategies 股价近期上涨的一些可能解释。

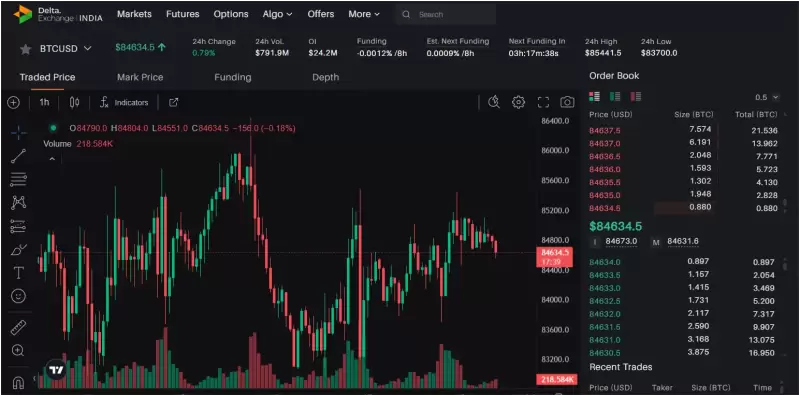

Sol Strategies stock technical indicators | Source: Tradingview

Sol Strategy 股票技术指标| Allbiz来源:Tradingview

First, a stock for a company that focuses on staking Solana and investing in its ecosystem extends Solana’s reach in a regulated environment.

首先,一家专注于质押 Solana 并投资其生态系统的公司的股票扩大了 Solana 在受监管环境中的影响力。

Second, FTX’s bankruptcy plan, which allows customers to be repaid with up to $16.5 billion in recovered assets after the exchange’s collapse, has also been a factor.

其次,FTX 的破产计划也是一个因素,该计划允许客户在交易所倒闭后以高达 165 亿美元的追回资产进行偿还。

Sol Strategies managed to recover $611,494 in USDC from the Lucy Labs Flagship Offshore Fund SPC, thanks to Lucy Labs’ recovery of capital held at FTX Trading Limited.

由于 Lucy Labs 收回了在 FTX Trading Limited 持有的资金,Sol Strategies 成功从 Lucy Labs 旗舰离岸基金 SPC 收回了 611,494 美元的 USDC。

In other news, Sol Strategies also revealed its investment portfolio to the public. The company’s SOL holdings increased to 100,763.0230 SOL. Furthermore, the company’s staking revenue had generated a gross profit of $266,680 as of June 2024. The company also holds 56.2406 Bitcoin in Coinbase custody.

其他消息中,Sol Strategies 还向公众披露了其投资组合。该公司持有的SOL增至100,763.0230 SOL。此外,截至 2024 年 6 月,该公司的质押收入已产生毛利润 266,680 美元。该公司还在 Coinbase 托管下持有 56.2406 比特币。

A third reason for the surge was the additional acquisition of SOL holdings. On October 10th, the company acquired 4,134.80 SOL, increasing its total holdings to 105,249.82 SOL.

激增的第三个原因是额外收购 SOL 控股公司。 10月10日,该公司收购了4,134.80 SOL,将其总持仓量增加至105,249.82 SOL。

Another bullish development that may have contributed to Sol Strategies’ stock price increase is the rise in delegated stake to its validator.

另一个可能导致 Sol Strategies 股价上涨的看涨事态发展是其验证者委托权益的增加。

As of October 15, 2024, approximately 225,158.82 SOL (equivalent to CAD $48,086,433.94*) had been staked with the company’s validator. Of this, 105,288.99 SOL was delegated by the company itself, while the remainder was contributed by third-party delegators.

截至 2024 年 10 月 15 日,公司验证人已质押约 225,158.82 SOL(相当于 48,086,433.94 加元*)。其中,105,288.99 SOL 由公司本身委托,其余部分由第三方委托人贡献。

With a flurry of recent acquisitions, combined with the company’s strong bullish stance on the Solana ecosystem, this suggests promising developments ahead. As Solana enters the regulatory sphere through HODL stocks, the value of SOL’s token may rise, which could then impact the value of Sol Strategies.

通过最近的一系列收购,再加上该公司对 Solana 生态系统的强烈看涨立场,这表明未来的发展前景光明。随着 Solana 通过 HODL 股票进入监管领域,SOL 代币的价值可能会上涨,这可能会影响 Sol Strategies 的价值。

Additionally, it is likely that Sol Strategies’ staking and acquisition activities will continue in the future, much like MicroStrategy’s ongoing investments in Bitcoin.

此外,Sol Strategies 的质押和收购活动未来可能会继续下去,就像 MicroStrategy 对比特币的持续投资一样。

View the latest Sol Strategies stock price on Tradingview here.

在此处查看 Tradingview 上最新的 Sol Strategies 股票价格。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 坦桑尼亚的经常账户赤字缩小到21.6亿美元

- 2025-04-18 19:00:13

- 坦桑尼亚的经常账户赤字在更强大的商品和服务出口中,截至2月的一年缩小到21.6亿美元,标志着改进

-

- 不仅需要笔记,而且对硬币的需求也在迅速增加

- 2025-04-18 19:00:13

- 不仅需要票据,而且对硬币的需求也在迅速增加,这可以以巨大的价格出售。您可以在国际市场上出售1卢比硬币。

-

- Litecoin(LTC)继续证明这是加密货币支付部门的领导者

- 2025-04-18 18:55:13

- 如今,加密付款处理器BITPAY发布了新数据,显示Litecoin再次成为数字资产交易的首选

-

-

- 加密预售以及为什么重要?

- 2025-04-18 18:50:13

- 加密货币通过预售经历了快速发展,这是新项目开发中的基本时期。

-

-

- Shiba Inu(Shib)10x会吗?还是Ozak AI会窃取节目?

- 2025-04-18 18:45:13

- 2025年的加密市场正在迅速发展,投资者的注意力从模因硬币转变为公用事业驱动的项目。