|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Sol Strategies (HODL) Stock Up 500% Since 2024 Open as Solana (SOL) Enters Regulated Sphere

Oct 17, 2024 at 09:04 pm

Cypherpunk Holdings, which rebranded as Sol Strategies in mid-September 2024, has experienced a significant surge in its stock price (ticker: HODL)

Cypherpunk Holdings, now known as Sol Strategies, is a Canadian publicly traded investment firm. The company’s main focus was on new technologies and cryptocurrencies, but with the rebrand, it shifted to the Solana ecosystem.

Sol Strategies’ main strategy now involves staking Solana’s native token, SOL, and investing in DeFi projects and infrastructure. The company’s stock provides regulated exposure to Solana via its validator services and strategic investments.

Investors can purchase Sol Strategies shares by opening an account with a brokerage that offers access to either the CSE or OTC markets. Once the account is set up, investors can place orders through the brokerage’s trading platform or get help from their financial advisor.

Here are a few possible explanations for the recent rise in Sol Strategies stock price.

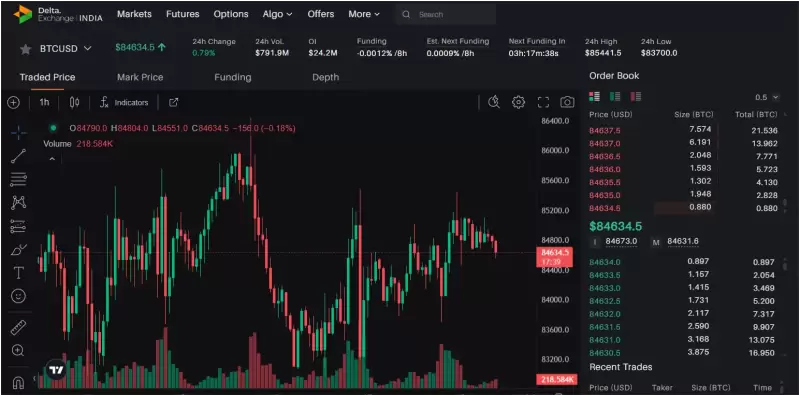

Sol Strategies stock technical indicators | Source: Tradingview

First, a stock for a company that focuses on staking Solana and investing in its ecosystem extends Solana’s reach in a regulated environment.

Second, FTX’s bankruptcy plan, which allows customers to be repaid with up to $16.5 billion in recovered assets after the exchange’s collapse, has also been a factor.

Sol Strategies managed to recover $611,494 in USDC from the Lucy Labs Flagship Offshore Fund SPC, thanks to Lucy Labs’ recovery of capital held at FTX Trading Limited.

In other news, Sol Strategies also revealed its investment portfolio to the public. The company’s SOL holdings increased to 100,763.0230 SOL. Furthermore, the company’s staking revenue had generated a gross profit of $266,680 as of June 2024. The company also holds 56.2406 Bitcoin in Coinbase custody.

A third reason for the surge was the additional acquisition of SOL holdings. On October 10th, the company acquired 4,134.80 SOL, increasing its total holdings to 105,249.82 SOL.

Another bullish development that may have contributed to Sol Strategies’ stock price increase is the rise in delegated stake to its validator.

As of October 15, 2024, approximately 225,158.82 SOL (equivalent to CAD $48,086,433.94*) had been staked with the company’s validator. Of this, 105,288.99 SOL was delegated by the company itself, while the remainder was contributed by third-party delegators.

With a flurry of recent acquisitions, combined with the company’s strong bullish stance on the Solana ecosystem, this suggests promising developments ahead. As Solana enters the regulatory sphere through HODL stocks, the value of SOL’s token may rise, which could then impact the value of Sol Strategies.

Additionally, it is likely that Sol Strategies’ staking and acquisition activities will continue in the future, much like MicroStrategy’s ongoing investments in Bitcoin.

View the latest Sol Strategies stock price on Tradingview here.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.