|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

链上数据显示,在过去一周下跌 26% 的情况下,只有 69% 的 PEPE 投资者保持盈利。 IntoTheBlock 的分析显示,很大一部分(27%)面临亏损,这表明随着利润抛售在较低的盈利水平下耗尽,可能会形成底部。

PEPE Investors Facing Diminished Returns as Market Profitability Declines

随着市场盈利能力下降,PEPE 投资者面临回报减少

On-chain data analysis reveals a significant decline in the profitability of PEPE investors, with only 69% of addresses currently carrying gains. This represents a sharp drop from the previous week, during which the memecoin experienced a 26% plunge in value.

链上数据分析显示,PEPE投资者的盈利能力大幅下降,目前仅有69%的地址实现盈利。这与前一周相比大幅下跌,此前 Memecoin 的价值暴跌了 26%。

Measuring Investor Profitability

衡量投资者的盈利能力

IntoTheBlock, a leading market intelligence platform, utilizes on-chain history to gauge investor profitability. By comparing the average cost basis of an address with the current spot price, IntoTheBlock categorizes addresses as either "in the money," "out of the money," or "at the money."

IntoTheBlock 是领先的市场情报平台,利用链上历史记录来衡量投资者的盈利能力。通过将地址的平均成本基础与当前现货价格进行比较,IntoTheBlock 将地址分类为“价内”、“价外”或“价内”。

PEPE's Profitability Breakdown

PEPE的盈利能力分析

According to IntoTheBlock's analysis, 69% of PEPE addresses are currently "in the money," meaning their cost basis is lower than the current spot price. Conversely, 27% of addresses are "out of the money," while 4% are "at the money."

根据 IntoTheBlock 的分析,69% 的 PEPE 地址目前处于“价内”状态,这意味着它们的成本基础低于当前现货价格。相反,27% 的地址处于“价外”状态,而 4% 的地址处于“价内”状态。

Comparison with Other Cryptocurrencies

与其他加密货币的比较

The profitability ratio for PEPE is significantly lower compared to other major cryptocurrencies. For instance, 89% of Bitcoin investors are currently in profit, highlighting the recent price drawdown experienced by PEPE.

与其他主要加密货币相比,PEPE 的盈利率明显较低。例如,89% 的比特币投资者目前处于盈利状态,这突显了 PEPE 最近经历的价格下跌。

Implications for Market Dynamics

对市场动态的影响

Historically, addresses carrying gains tend to be more likely to sell, potentially triggering mass selloffs when the market is heavily overextended. Conversely, low profitability levels can indicate potential bottom formations, as profit-selling becomes exhausted.

从历史上看,带来收益的地址往往更有可能被出售,当市场严重过度扩张时,可能会引发大规模抛售。相反,低盈利水平可能表明潜在的底部形成,因为利润抛售已经耗尽。

PEPE's Current Market Position

PEPE目前的市场地位

Currently, neither green (profitable) nor red (unprofitable) investors dominate the PEPE market. However, during bull runs, profitability levels typically remain higher, suggesting that any cooldown in investor profitability could provide a catalyst for price rebounds.

目前,绿色(盈利)和红色(无利可图)投资者均未主导 PEPE 市场。然而,在牛市期间,盈利水平通常会保持较高水平,这表明投资者盈利能力的任何降温都可能成为价格反弹的催化剂。

PEPE Price Performance

PEPE 性价比

Following the recent price decline, PEPE has returned to the $0.0000050913 mark. The chart below depicts the memecoin's performance over the past month, highlighting the significant drop in the last few days.

继近期价格下跌后,PEPE 已回到 0.0000050913 美元大关。下图描绘了 memecoin 在过去一个月的表现,突出显示了过去几天的大幅下跌。

[Chart of PEPEUSD performance over the past month]

【PEPEUSD近一个月表现图表】

Conclusion

结论

The decline in PEPE investor profitability to 69% aligns with the recent price drop. While the profitability ratio is not excessively low, it indicates the potential for a bottom formation if the bullish market trend is to continue. However, it is crucial for investors to conduct their own due diligence and recognize the risks associated with any investment decision.

PEPE 投资者盈利能力下降至 69%,与近期价格下跌一致。虽然盈利率并不算太低,但它表明如果牛市趋势继续下去,则有可能形成底部。然而,投资者进行自己的尽职调查并认识到与任何投资决策相关的风险至关重要。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

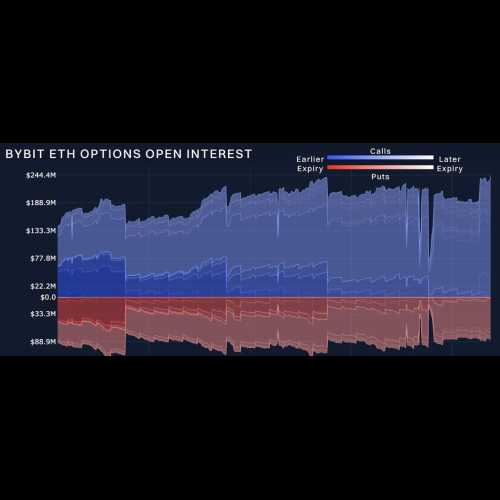

- 市场在年底期权到期前表现出弹性:Bybit x Block Scholes 加密衍生品报告

- 2024-12-27 01:05:02

-

-

-

-

-

-

- 今天购买哪种加密货币?牛市最佳加密货币分析

- 2024-12-27 01:05:02

- 如今,鲸鱼和买家不再想知道该购买哪种加密货币,而是将注意力转向寻找最适合牛市的加密货币。