|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

全球最大的加密资产管理公司 Grayscale 已重新平衡其基金,从其数字大盘基金中删除了 Cardano (ADA) 代币,并从其智能合约平台 Ex-Ethereum 基金中删除了 Cosmos (ATOM) 代币。所得资金用于收购现有基金组成部分,其中比特币 (BTC) 目前占数字大盘基金的 70.96%,Solana (SOL) 占智能合约平台除以太坊基金的 58.41%。

Grayscale Rebalances Cryptocurrency Holdings, Removing ADA and ATOM

Grayscale 重新平衡加密货币持有量,删除 ADA 和 ATOM

Grayscale Investments, the world's largest crypto-focused asset manager, has announced a quarterly fund rebalancing that has seen the removal of Cardano's (ADA) token from its Grayscale Digital Large Cap Fund (GDLC) and Cosmos' (ATOM) token from its Grayscale Smart Contract Platform Ex-Ethereum Fund (GSCPxE).

全球最大的加密资产管理公司 Grayscale Investments 宣布进行季度基金再平衡,从其 Grayscale Digital Large Cap Fund (GDLC) 中删除了 Cardano (ADA) 代币,并从其 Grayscale Smart 中删除了 Cosmos (ATOM) 代币合约平台前以太坊基金(GSCPxE)。

GDLC Fund Changes

GDLC 基金变更

With ADA's removal, the GDLC fund's holdings now consist primarily of Bitcoin (BTC), accounting for 70.96% of the fund's assets. Ethereum (ETH) remains the second-largest holding at 21.84%, followed by Solana (SOL) at 4.52%, XRP (XRP) at 1.73%, and Avalanche (AVAX) at 0.95%.

随着 ADA 的移除,GDLC 基金的持股现在主要由比特币 (BTC) 组成,占该基金资产的 70.96%。以太坊 (ETH) 仍然是第二大持股,占 21.84%,其次是 Solana (SOL),占 4.52%,XRP (XRP) 占 1.73%,Avalanche (AVAX) 占 0.95%。

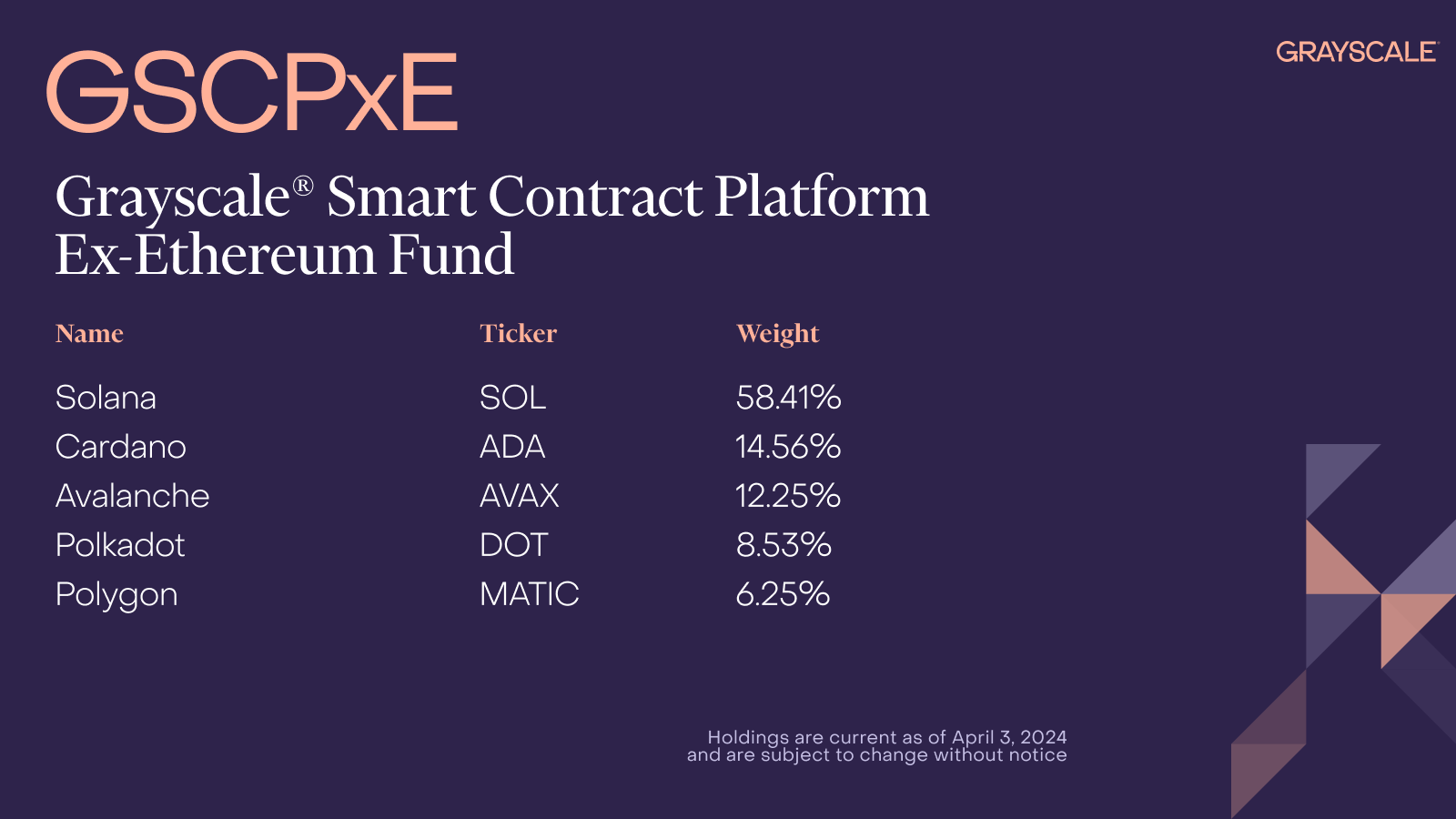

GSCPxE Fund Changes

GSCPxE 基金变动

After removing ATOM, the GSCPxE fund's portfolio now comprises:

删除 ATOM 后,GSCPxE 基金的投资组合现在包括:

- Solana (SOL): 58.41%

- Cardano (ADA): 14.56%

- Avalanche (AVAX): 12.25%

- Polkadot (DOT): 8.53%

- Polygon (MATIC): 6.25%

No Additions or Removals from DeFi Fund

Solana (SOL): 58.41% Cardano (ADA): 14.56% Avalanche (AVAX): 12.25% Polkadot (DOT): 8.53% Polygon (MATIC): 6.25% 没有从 DeFi 基金中添加或删除

Grayscale's DeFi Fund, which focuses on decentralized finance (DeFi) assets, has not seen any changes in its holdings. It continues to hold:

灰度旗下专注于去中心化金融(DeFi)资产的 DeFi 基金目前持仓未见任何变化。它继续保持:

- Uniswap (UNI): 48.74%

- MakerDAO (MKR): 20.41%

- Lido (LDO): 13.17%

- Aave (AAVE): 9.99%

- Synthetix (SNX): 7.69%

Rationale behind Fund Rebalancing

Uniswap (UNI): 48.74%MakerDAO (MKR): 20.41%Lido (LDO): 13.17%Aave (AAVE): 9.99%Synthetix (SNX): 7.69% 基金再平衡背后的理由

Grayscale's fund rebalancing is conducted to optimize portfolio performance and align with market conditions. The proceeds from the sale of ADA and ATOM were used to acquire additional holdings in the remaining fund constituents.

Grayscale 的基金再平衡旨在优化投资组合绩效并适应市场状况。出售 ADA 和 ATOM 的收益用于购买剩余基金成分的额外持股。

ADA and ATOM Underperform Market

ADA 和 ATOM 表现不佳

It's noteworthy that both ADA and ATOM have underperformed the broader cryptocurrency market year-to-date (YTD). ADA has declined by 8.1% YTD, while ATOM has dropped by 3.3%. In contrast, Bitcoin and Ether, the two largest cryptocurrencies, have gained 59% and 40%, respectively.

值得注意的是,年初至今(YTD),ADA 和 ATOM 的表现均逊于更广泛的加密货币市场。今年以来 ADA 下跌了 8.1%,而 ATOM 则下跌了 3.3%。相比之下,两种最大的加密货币比特币和以太币分别上涨了 59% 和 40%。

ADA's price has faced headwinds after falling below the $0.6 psychological level in early April and is currently trading at around $0.58. Its price remains significantly below its all-time high of $3.10 set in September 2021.

ADA 的价格在 4 月初跌破 0.6 美元的心理水平后面临阻力,目前交易价格约为 0.58 美元。其价格仍远低于 2021 年 9 月创下的历史高点 3.10 美元。

ATOM has also underperformed, trading at around $10.8, over 75% below its record high of $44.7 reached in September 2021.

ATOM 的表现也不佳,交易价格约为 10.8 美元,比 2021 年 9 月创下的历史高点 44.7 美元低了 75% 以上。

Conclusion

结论

Grayscale's fund rebalancing demonstrates the asset manager's commitment to actively managing its portfolios and adjusting its holdings based on market conditions. While the removal of ADA and ATOM could be seen as a negative sign for those tokens' short-term price prospects, it highlights Grayscale's focus on optimizing fund performance and maintaining a diversified portfolio of digital assets.

灰度的基金再平衡表明了资产管理公司积极管理其投资组合并根据市场状况调整其持仓的承诺。虽然 ADA 和 ATOM 的删除可能被视为这些代币短期价格前景的负面信号,但它凸显了 Grayscale 对优化基金业绩和维持多元化数字资产组合的关注。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- DTX 交易所 (DTX):正在崛起

- 2024-11-18 21:40:01

- 随着市场在最近的牛市中升温,DTX 交易所(DTX)正在成为主要参与者

-

-

-

-

-

-

-

-