|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在拉斯维加斯的交流会议上的演讲中,TMX Vettafi研究主管Todd Rosenbluth和高级投资策略师Cinthia Murphy

Financial advisors in the U.S. are committed to crypto exchange-traded funds (ETFs) and are ready to increase their holdings this year, according to data presented at the Exchange conference in Las Vegas.

根据在拉斯维加斯举行的交流会议上提供的数据,美国的财务顾问致力于加密交易所交易资金(ETF),并准备增加其持股量。

During a presentation on Wednesday, TMX VettaFi head of research Todd Rosenbluth and senior investment strategist Cinthia Murphy presented results of a survey sent to thousands of financial advisors in the U.S., arguing that crypto is “part of everybody’s conversation today.”

在周三的演讲中,TMX Vettafi研究主管Todd Rosenbluth和高级投资策略师Cinthia Murphy提出了一项向美国成千上万的财务顾问发送的调查结果,认为加密货币是“今天每个人对话的一部分”。

The results showed that 57% of advisors plan on increasing their allocations into crypto ETFs, while 42% will likely maintain their position. Only 1%, practically no one, want to decrease their position.

结果表明,有57%的顾问计划将其分配到加密ETF中,而42%的顾问可能会保持其位置。实际上,只有1%的人想降低其位置。

“I think last year the message was it’s a reputational risk. Today, there’s no advisor that can’t at least hold a basic conversation in crypto,” Murphy said.

墨菲说:“我认为去年的信息是声誉风险。今天,没有顾问至少无法在加密货币中进行基本对话。”

Though the U.S. Securities and Exchange Commission (SEC) approved spot bitcoin ETFs in January 2024, a year before U.S. President Donald Trump took office, the new administration’s enthusiastic embrace of the crypto industry has likely buoyed its wider institutional adoption. Regulators, including the SEC and the Commodity Futures Trading Commission (CFTC), have reversed course on crypto since the start of the Trump presidency, signaling a friendlier and clearer regulatory approach.

尽管美国证券交易委员会(SEC)在2024年1月批准了现场比特币ETF,即美国总统唐纳德·特朗普(Donald Trump)上任的一年,但新政府对加密货币行业的热情拥抱可能会激发其更广泛的机构采用。自特朗普总统职位开始以来,包括SEC和商品期货交易委员会(CFTC)在内的监管机构已经扭转了有关加密货币的课程,这表明了更友好,更清晰的监管方法。

Respondents said that they’re particularly interested in crypto equity ETFs, which are funds that invest in publicly traded companies with exposure to the crypto industry, such as Strategy (formerly MicroStrategy) or Tesla.

受访者说,他们对加密股权ETF特别感兴趣,这些资金是投资于具有加密行业的公开交易公司的资金,例如战略(以前是MicroStrategy)或特斯拉。

“You can’t keep up with the space which I think explains why crypto equity has been popular because it’s maybe a little easier to understand and put your fingers around it," Murphy added.

墨菲补充说:“您无法跟上我认为加密货币为什么流行的空间,因为它可能更容易理解并将手指放在它上。”

Since Trump took the Oval Office, Michael Saylor's MSTR stock has seen a more than 100% rally, making crypto-linked equities more lucrative to both retail and institutional investors. MSTR shares have pared some of their gains since hitting all-time highs; however, the survey results seem to suggest that it is still drawing interest from all parts of the market.

自从特朗普担任椭圆形办公室以来,迈克尔·塞勒(Michael Saylor)的MSTR股票已经进行了100%以上的集会,这使得与加密货币的股票对零售和机构投资者都更加有利可图。自从达到历史最高点以来,MST的股票已削减了一些收益。但是,调查结果似乎表明它仍然引起了市场各个部分的兴趣。

Spot and multi-token ETFs

斑点和多型ETF

Crypto equity-linked ETFs aren't the only ones gaining momentum with financial advisors. About 22% of the survey respondents said they’re looking to allocate capital to spot crypto ETFs, such as the spot bitcoin (BTC) or spot ether (ETH) ETFs.

与财务顾问相关的加密股权ETF并不是唯一获得势头的人。大约22%的受访者表示,他们正在寻求分配资本以发现加密ETF,例如现货比特币(BTC)或斑点Ether(ETH)ETF。

The third largest group, which about 19% of respondents said they were interested in, was crypto asset funds that hold multiple tokens.

大约19%的受访者表示对他们感兴趣的第三大集团是持有多个令牌的加密资产基金。

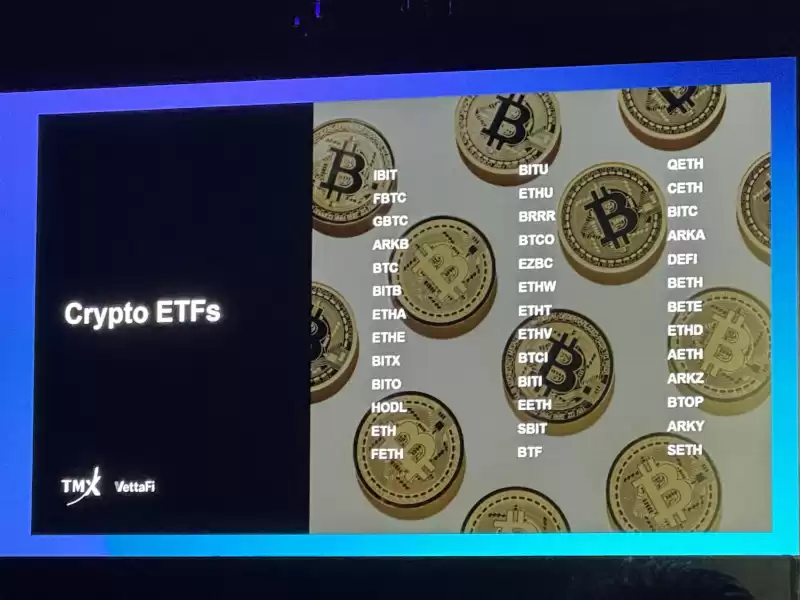

There are numerous crypto ETFs trading on exchanges, with several more in the process of receiving approval from the SEC to be listed in the future.

交易所进行了许多加密ETF交易,在将来获得SEC批准的过程中还有更多的交易。

The past few months have seen a particularly large number of index-based ETFs, meaning they hold a basket of crypto assets that go behind bitcoin and ether. Other launches have included managed funds that provide downside protection for price volatility by allocating a percentage in U.S. Treasuries, for example.

在过去的几个月中,基于索引的ETF数量特别大,这意味着它们拥有一篮子加密货币资产,这些资产落后于比特币和乙醚。其他发布会包括托管资金,例如通过分配美国国债的百分比来为价格波动提供下行保护。

Several issuers have filed to bring further spot crypto ETFs, including Solana (SOL), XRP and Litecoin (LTC), to the '/')

几位发行人已申请将包括Solana(Sol),XRP和Litecoin(LTC)在内的更多点加密ETF带到'/')

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 不要亏本出售…

- 2025-04-22 10:00:19

- 从最强的货币中学习!

-

- Coinbase的储备权(RSR)代币上市与Paul Atkins的SEC提名相吻合

- 2025-04-22 10:00:19

- 加密货币交易所Coinbase已宣布将增加对储备权(RSR)的支持

-

- Microsoft将每个帐户和ENTRA ID令牌签名键移至硬件安全模块中

- 2025-04-22 09:55:12

- 吹捧它所谓的“历史上最大的网络安全工程项目”

-

-

- Dogecoin(Doge)杯子并处理图案信号,潜在的激增向1美元

- 2025-04-22 09:50:13

- Dogecoin(Doge)助长了市场上新的乐观情绪,分析师预测潜在的激增向1美元。

-

-

- 雪崩卡已揭幕:它会为阿瓦克斯(Avax)带来看涨的动力吗?

- 2025-04-22 09:45:13

- 在过去的一年中,雪崩生态系统的发展得到了显着增长。

-

- 韩国银行(BOK)决定在塑造韩国的稳定框架方面发挥积极作用。

- 2025-04-22 09:45:13

- 随着中央银行越来越关注这些数字资产可能对该国的货币和金融体系构成的风险,此举越来越多。

-