|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

利率变化通过改变投资者行为和市场动态来显着影响加密货币价格。美联储(Fed)的货币政策,特别是利率调整,影响包括加密货币在内的资产价格。当利率较低时,投资者寻求更高的回报,从而推高加密货币价格。相反,利率上升使传统储蓄途径更具吸引力,导致人们放弃加密货币等高风险投资,并可能导致价格下跌。

Federal Interest Rate Adjustments and Their Impact on Cryptocurrency Markets

联邦利率调整及其对加密货币市场的影响

The Federal Reserve (Fed), the central bank of the United States, plays a pivotal role in shaping economic conditions by managing interest rates. These rates influence the cost of borrowing money and impact financial markets, including cryptocurrency markets.

美联储(Fed)是美国的中央银行,通过管理利率在塑造经济状况方面发挥着关键作用。这些利率会影响借贷成本并影响金融市场,包括加密货币市场。

Interest Rates and Asset Pricing

利率和资产定价

Interest rates act as a fundamental benchmark against which asset prices are evaluated. In general, when interest rates rise, the value of assets tends to decline. This inverse relationship is observed in various asset classes, including stocks, bonds, and cryptocurrencies.

利率是评估资产价格的基本基准。一般来说,当利率上升时,资产价值往往会下降。这种反比关系在各种资产类别中都可以观察到,包括股票、债券和加密货币。

Impact on Cryptocurrency Markets

对加密货币市场的影响

Cryptocurrencies, with their inherent volatility and nascent financial history, exhibit heightened sensitivity to interest rate changes. When interest rates are low, investors may be more inclined to seek higher returns in riskier assets like cryptocurrencies, driving up their prices.

加密货币由于其固有的波动性和新生的金融历史,对利率变化表现出高度的敏感性。当利率较低时,投资者可能更倾向于在加密货币等风险较高的资产中寻求更高的回报,从而推高其价格。

Conversely, rising interest rates increase the appeal of safe-haven assets such as savings accounts and bonds. This shift in investor preferences can lead to a reduction in cryptocurrency investments and potential price declines.

相反,利率上升增加了储蓄账户和债券等避险资产的吸引力。投资者偏好的这种转变可能会导致加密货币投资的减少和潜在的价格下跌。

Behavioral Effects of Interest Rates

利率对行为的影响

Beyond their direct impact on asset valuations, interest rates also influence investor behavior. Low interest rates may encourage risk-taking and increased demand for cryptocurrencies. However, rising interest rates can make savings more attractive and dissuade investors from engaging in riskier investments.

除了对资产估值的直接影响之外,利率还会影响投资者的行为。低利率可能会鼓励冒险行为并增加对加密货币的需求。然而,利率上升可以使储蓄更具吸引力,并阻止投资者进行风险较高的投资。

Historical Context

历史背景

Empirical evidence confirms the sensitivity of cryptocurrency markets to interest rate fluctuations. During periods of interest rate hikes, cryptocurrency prices have historically experienced declines. This is attributed to a reduction in risk appetite and a shift towards more conservative investments.

经验证据证实了加密货币市场对利率波动的敏感性。在加息期间,加密货币价格历来都会经历下跌。这是由于风险偏好下降和转向更加保守的投资。

Impact on the Cryptocurrency Ecosystem

对加密货币生态系统的影响

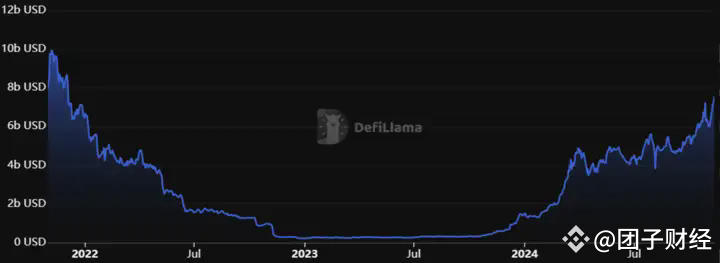

The consequences of interest rate adjustments can extend beyond price fluctuations. When cryptocurrency prices fall, liquidity tends to diminish within decentralized finance (DeFi) platforms. Blockchain ecosystems may witness a decrease in user activity and transaction volumes, resulting in what has been referred to as "ghost town" scenarios.

利率调整的后果可能不仅仅限于价格波动。当加密货币价格下跌时,去中心化金融(DeFi)平台内的流动性往往会减少。区块链生态系统可能会出现用户活动和交易量减少的情况,从而导致所谓的“鬼城”场景。

Conclusion

结论

Interest rate decisions by the Federal Reserve have a significant impact on cryptocurrency markets. By understanding the interplay between interest rates and asset pricing, investors can make informed decisions and navigate the complexities of these dynamic markets.

美联储的利率决定对加密货币市场产生重大影响。通过了解利率和资产定价之间的相互作用,投资者可以做出明智的决策并应对这些动态市场的复杂性。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- Cardano (ADA) 价格瞄准高位,ADA 目标价为 10 美元

- 2024-11-13 03:45:02

- 卡尔达诺价格引发了新的乐观情绪,分析师最近将其目标从 0.349 美元调整为雄心勃勃的 10 美元

-

-

-

-

-

- 俄罗斯政府批准了一项对该国加密货币征税的法案

- 2024-11-13 02:15:01

- 根据该法案,数字货币被赋予财产地位,并引入了单独的税基计算,税基定义为资产价值超过其购买或提取成本的部分。

-

- 随着选举集会的延长,比特币取代白银成为世界第八大资产

- 2024-11-13 02:15:01

- 白银上周下跌 6.24%,市值达到 1.732 万亿美元,而比特币同期增长了约 30%。

-

-