|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024年第一季度,以太坊(ETH)价格飙升100%,创造了3.69亿美元的利润。区块链的盈利能力源于以 ETH 支付的交易费用,其中一部分被烧毁,从而减少了供应并增加了现有持有者的价值。此外,Dencun 升级的推出以及 blob 和第 2 层网络的采用降低了交易成本,推动收入增长 18% 至 33 亿美元。然而,ETH 的收入最近下降了 52%,部分原因是市场调整和投资者兴趣下降。

Ethereum's Surprising Profitability: A Deep Dive into the Blockchain's Revenue Model

以太坊令人惊讶的盈利能力:深入探讨区块链的收入模式

Introduction

介绍

In the first quarter of 2024, Ethereum (ETH) experienced an astonishing surge in value, soaring nearly 100%. Concurrently, the Ethereum blockchain generated an impressive $369 million in profits, raising questions about the mechanisms driving its profitability. This article delves into the intricacies of Ethereum's business model, exploring the sources of its revenue and the factors contributing to its financial success.

2024年第一季度,以太坊(ETH)价值出现惊人飙升,飙升近100%。与此同时,以太坊区块链创造了令人印象深刻的 3.69 亿美元利润,引发了人们对其盈利能力驱动机制的质疑。本文深入探讨了以太坊商业模式的复杂性,探讨其收入来源以及促成其财务成功的因素。

Transaction Fees: The Cornerstone of Revenue

交易费用:收入的基石

At the heart of Ethereum's revenue model lies the collection of transaction fees. Every interaction on the blockchain, from simple transfers to complex smart contract executions, requires users to pay fees in ETH. These fees serve as a primary income stream for the network.

以太坊收入模式的核心是交易费用的收取。区块链上的每一次交互,从简单的转账到复杂的智能合约执行,都需要用户以 ETH 支付费用。这些费用是网络的主要收入来源。

ETH Buyback: Enhancing Value for Holders

ETH 回购:增加持有者的价值

A portion of the transaction fees collected is burned, permanently removing ETH from circulation. Known as "ETH buyback," this mechanism reduces the supply of ETH, increasing its scarcity and value. As a result, existing ETH holders benefit from the reduced supply and enhanced scarcity.

收取的部分交易费用将被销毁,从而使 ETH 永久退出流通。这种机制被称为“ETH 回购”,它减少了 ETH 的供应,增加了其稀缺性和价值。因此,现有的 ETH 持有者受益于供应量的减少和稀缺性的加剧。

Block Rewards: Incentivizing Network Security

区块奖励:激励网络安全

In addition to transaction fees, Ethereum also issues new ETH tokens as rewards to validators who secure and maintain the network's integrity. These rewards are akin to stock-based compensation and encourage validators to participate actively in the network's operations. However, the issuance of new ETH dilutes the holdings of existing ETH holders.

除了交易费用之外,以太坊还发行新的 ETH 代币,作为对保护和维护网络完整性的验证者的奖励。这些奖励类似于基于股票的补偿,并鼓励验证者积极参与网络的运营。然而,新 ETH 的发行会稀释现有 ETH 持有者的持有量。

Daily Earnings: The True Measure of Profitability

每日收益:盈利能力的真正衡量标准

By subtracting the daily value of newly issued ETH (expenses) from the daily value of burned ETH (revenue), we can determine the daily earnings for existing ETH holders, effectively the owners of the Ethereum blockchain. This calculation provides a real-time assessment of Ethereum's profitability.

通过从销毁的 ETH 的每日价值(收入)中减去新发行的 ETH 的每日价值(费用),我们可以确定现有 ETH 持有者(实际上是以太坊区块链的所有者)的每日收入。该计算提供了以太坊盈利能力的实时评估。

Reduced Transaction Costs: A Catalyst for Growth

降低交易成本:增长的催化剂

The Ethereum ecosystem underwent significant changes in the first quarter of 2024 with the implementation of the Dencun upgrade and the introduction of blobs, a revolutionary data storage system. These advancements reduced congestion on the network and significantly lowered transaction costs on Layer 2 networks like Arbitrum (ABR), Polygon (MATIC), and Coinbase's Base.

随着Dencun升级的实施和革命性数据存储系统blob的引入,以太坊生态系统在2024年第一季度发生了重大变化。这些进步减少了网络拥塞,并显着降低了 Arbitrum (ABR)、Polygon (MATIC) 和 Coinbase's Base 等第 2 层网络的交易成本。

Impact on Revenue: A Positive Trajectory

对收入的影响:积极的轨迹

The combined effects of the Dencun upgrade and reduced transaction costs have had a profound impact on Ethereum's revenue. According to Token Terminal data, the blockchain's revenue witnessed an impressive 18% annualized increase, amounting to a staggering $3.3 billion. This surge in revenue can be directly attributed to the enhanced efficiency and cost-effectiveness of the network.

Dencun升级和交易成本降低的综合效应对以太坊的收入产生了深远的影响。根据Token Terminal的数据,区块链的收入年化增长了18%,达到惊人的33亿美元。收入的激增可直接归因于网络效率和成本效益的提高。

Market Volatility and Investor Sentiment: Temporary Challenges

市场波动和投资者情绪:暂时的挑战

Despite the positive revenue growth, Ethereum has faced headwinds in the second quarter of 2024 due to market corrections and dampened investor interest. The blockchain's revenue has declined by over 52% in the past 30 days, reflecting broader market dynamics and waning investor enthusiasm.

尽管收入出现积极增长,但由于市场调整和投资者兴趣减弱,以太坊在 2024 年第二季度面临阻力。过去 30 天内,区块链的收入下降了 52% 以上,反映出更广泛的市场动态和投资者热情的减弱。

Market Capitalization and Trading Volume: Indicators of Performance

市值和交易量:绩效指标

Ethereum's market capitalization (fully diluted) has decreased by 15.2% over the past 30 days to $358.47 billion, indicating a decline in the collective value of all ETH in circulation. Similarly, the token trading volume has dropped by 18.6% over the same period, totaling $586.14 billion.

以太坊的市值(完全稀释)在过去 30 天里下降了 15.2%,至 3584.7 亿美元,表明所有流通中的 ETH 的集体价值下降。同样,代币交易量同期下降了18.6%,总计5861.4亿美元。

ETH Price: Navigating Uncertainties

ETH 价格:应对不确定性

At the time of writing, ETH is trading at $3,042, up 0.4% in the last 24 hours. The price chart indicates a downward trend, and it remains uncertain whether the reduced fees and other changes will positively impact ETH's price performance in the second quarter of the year, particularly in light of the potential for increased trading volume.

截至撰写本文时,ETH 交易价格为 3,042 美元,在过去 24 小时内上涨 0.4%。价格图表显示出下降趋势,目前尚不确定费用降低和其他变化是否会对 ETH 在今年第二季度的价格表现产生积极影响,特别是考虑到交易量增加的潜力。

Conclusion

结论

Ethereum's profitability stems from a combination of transaction fees, ETH buybacks, block rewards, and reduced transaction costs. The Dencun upgrade and the adoption of blobs have significantly enhanced the network's efficiency and revenue generation capabilities. However, market volatility and investor sentiment can impact the blockchain's financial performance. As the year progresses, it remains to be seen how these factors, coupled with potential changes in trading volume and ETH's price, will shape Ethereum's future profitability.

以太坊的盈利能力源于交易费用、ETH 回购、区块奖励和交易成本降低的组合。 Dencun 的升级和 blob 的采用显着提高了网络的效率和创收能力。然而,市场波动和投资者情绪可能会影响区块链的财务表现。随着时间的推移,这些因素,加上交易量和 ETH 价格的潜在变化,将如何影响以太坊未来的盈利能力,还有待观察。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

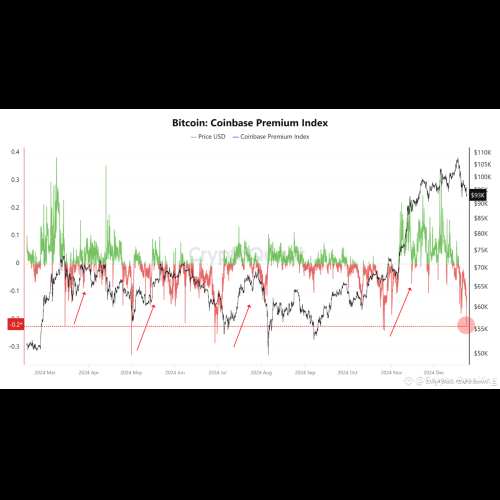

- Quant 表示,比特币 Coinbase 溢价给出了潜在的买入信号

- 2024-12-25 14:35:02

- 一位量化分析师解释了比特币 Coinbase 溢价指数的最新趋势如何意味着该资产的买入机会。

-

- 2024年加密行业回顾

- 2024-12-25 14:30:59

- 2024 年对于加密行业来说是动荡的一年。比特币现货ETF推出,机构加速采用,带来行业繁荣

-

-

-

-

- 莱特币(LTC)今年平均每日活跃地址显着增加

- 2024-12-25 14:30:59

- 链上数据显示,今年莱特币每日活跃地址指标较去年大幅增长。

-

-

- 由于停产和竞争压力,丰田 11 月全球销量停滞不前

- 2024-12-25 14:30:59

- (彭博社)——由于需求低迷加上两家工厂暂停生产,丰田汽车公司 11 月份的全球销量趋于稳定。

-