|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

周一交易结束时,加密货币市场飙升,比特币达到 67,000 美元。此次上涨是在周末减半事件之后发生的,减半事件减少了比特币的发行量,导致比特币上涨 3%。尽管以太坊小幅上涨,但市场情绪依然乐观,10,000 种加密货币中有 171 种出现上涨。以数字资产为主的股票也出现了飙升,Coinbase 和 MicroStrategy 涨幅显着。然而,人们仍然担心减半对矿商的影响以及潜在的市场波动。

Crypto Market Surges Post-Halving, Igniting Optimism and Concerns

减半后加密货币市场飙升,引发乐观和担忧

As the trading session closed on Monday, the cryptocurrency market soared, propelled by a renewed surge in Bitcoin. The leading cryptocurrency had briefly touched $67,000, alleviating fears of a steeper correction. This recent upturn followed the highly anticipated halving event over the weekend, which saw Bitcoin's new supply issuance slashed by half. Consequently, Bitcoin has gained over 3% in the past 24 hours, trading at approximately $66,500. Ethereum, although trailing slightly, experienced a modest 1.5% increase, reaching $3,200.

随着周一交易时段结束,在比特币再次飙升的推动下,加密货币市场飙升。领先的加密货币曾一度触及 67,000 美元,缓解了人们对更大幅度调整的担忧。最近的好转是在周末备受期待的减半事件之后发生的,比特币的新供应量减少了一半。因此,比特币在过去 24 小时内上涨了 3% 以上,交易价格约为 66,500 美元。以太坊虽然略有落后,但小幅上涨 1.5%,达到 3,200 美元。

This bullish trend extended across the board, with a staggering 171 out of nearly 10,000 cryptocurrencies listed on CoinMarketCap recording gains. The CoinDesk 20 Index (CDI), which encompasses leading cryptocurrencies, also surged by over 3%, largely influenced by a 15% jump in Near Protocol's native token, NEAR. The positive sentiment radiated into stocks focused on digital assets, with Coinbase (COIN) and MicroStrategy (MSTR) witnessing gains of 7% and 12%, respectively.

这种看涨趋势全面延伸,CoinMarketCap 上列出的近 10,000 种加密货币中有 171 种录得涨幅,令人震惊。涵盖领先加密货币的 CoinDesk 20 指数 (CDI) 也飙升了 3% 以上,这主要受到 Near Protocol 原生代币 NEAR 上涨 15% 的影响。积极情绪辐射到以数字资产为主的股票,Coinbase (COIN) 和 MicroStrategy (MSTR) 分别上涨 7% 和 12%。

Publicly traded mining companies also shared in the enthusiasm. Riot Platforms (RIOT) and Hut 8 Mining Corp (HUT) experienced increases between 15% and 20%, while Marathon Digital (MARA) climbed by 6%. The catalyst for this fervor was a surge in transaction fees, a critical revenue stream for these companies, hinting at potentially improved financial prospects.

上市矿业公司也表现出了同样的热情。 Riot Platforms (RIOT) 和 Hut 8 Mining Corp (HUT) 的股价上涨了 15% 至 20%,而 Marathon Digital (MARA) 则上涨了 6%。这种热情的催化剂是交易费用的飙升,交易费用是这些公司的关键收入来源,暗示财务前景可能会改善。

However, not all industry professionals are convinced by the buoyant market. Markus Thielen, founder of 10x Research, expressed skepticism in a recent interview with CoinDesk TV, arguing that Bitcoin's halving does not necessarily signal a bullish trend. He anticipates a fragile market in the coming months, potentially leading to a deeper decline. Thielen's concerns stem from the possibility that miners may sell around $5 billion worth of Bitcoin to sustain operations after their revenues were halved.

然而,并非所有行业专业人士都相信蓬勃发展的市场。 10x Research 创始人 Markus Thielen 在最近接受 CoinDesk TV 采访时表达了怀疑,认为比特币减半并不一定预示着看涨趋势。他预计未来几个月市场将变得脆弱,可能导致更严重的下跌。蒂伦的担忧源于矿工在收入减半后可能会出售价值约 50 亿美元的比特币以维持运营的可能性。

Thielen's views resonate with historical data on Bitcoin's price movements post-halving. Traditionally, Bitcoin has experienced a significant rise 50-100 days after the event. Additionally, crypto hedge fund QCP Capital recently highlighted this pattern, suggesting that bullish investors may soon become more aggressive in their positions.

蒂伦的观点与比特币减半后价格走势的历史数据产生共鸣。传统上,比特币会在事件发生后 50-100 天经历大幅上涨。此外,加密货币对冲基金 QCP Capital 最近强调了这种模式,表明看涨投资者可能很快就会变得更加激进。

Funding rates, particularly for leveraged positions in derivatives trading, add another layer of complexity to the market dynamics. These rates have cooled considerably, with some even falling into steep negative territory, especially for less mainstream cryptocurrencies. This situation sets the stage for a potential rapid rebound if investor appetite for risk returns.

资金利率,尤其是衍生品交易中的杠杆头寸,给市场动态增添了另一层复杂性。这些利率已经大幅下降,有些甚至跌入陡峭的负值区域,特别是对于不太主流的加密货币。如果投资者对风险回报有兴趣,这种情况将为潜在的快速反弹奠定基础。

Emerging Trends and Layer 2 Solutions

新兴趋势和第 2 层解决方案

The Bitcoin halving event also marked the beginning of "Epoch V," which introduced Runes, a new protocol for creating meme coins on the Bitcoin network. This launch, combined with the halving, has spurred the creation of hundreds of tokens, resulting in skyrocketing transaction fees. The average cost has exceeded $70, a significant leap from previous levels.

比特币减半事件也标志着“Epoch V”的开始,它引入了 Runes,一种在比特币网络上创建 meme 硬币的新协议。这次发行,加上减半,刺激了数百种代币的创建,导致交易费用飙升。平均成本已超过 70 美元,较之前水平有了显着飞跃。

This surge in transaction fees on April 20, peaking at $128, could motivate users to migrate to alternative solutions like the Lightning Network or side chains such as Fedimint and Ark. Bitcoin Core developer Ava Chow believes that high fee environments will drive the community to explore these layer-2 solutions more actively.

4 月 20 日交易费用激增,达到 128 美元的峰值,可能会促使用户迁移到闪电网络等替代解决方案或 Fedimint 和 Ark 等侧链。 Bitcoin Core 开发人员 Ava Chow 认为,高费用环境将推动社区探索这些二层解决方案更加积极。

A recent report by Messari supports Chow's predictions, emphasizing the need for layer-2 solutions as Bitcoin evolves from digital gold to a broader platform for development. This transformation has partly been spurred by the Ordinals protocol, which allows data storage on Bitcoin's smallest units, satoshis, leading to a surge in transactions and NFT-like inscriptions.

Messari 最近的一份报告支持了 Chow 的预测,强调随着比特币从数字黄金发展到更广泛的开发平台,需要第二层解决方案。这种转变在一定程度上是由 Ordinals 协议推动的,该协议允许将数据存储在比特币的最小单位 satoshis 上,从而导致交易和类似 NFT 的铭文激增。

Furthermore, tokens associated with Bitcoin's layer-2 solutions have performed remarkably well. Post-halving, tokens like Elastos' ELA and SatoshiVM's SAVM have witnessed substantial gains, highlighting the market's growing focus on these secondary platforms.

此外,与比特币第二层解决方案相关的代币表现非常出色。减半后,亦来云的 ELA 和 SatoshiVM 的 SAVM 等代币都出现了大幅上涨,凸显了市场对这些二级平台的日益关注。

However, the surge in interest and activity on these layer-2 platforms poses a new challenge: accessibility. High transaction fees could potentially exclude users with smaller balances from utilizing non-custodial services like the Lightning Network. As Chow points out, each layer-2 solution still requires an on-chain transaction to function, exacerbating the issue.

然而,人们对这些第 2 层平台的兴趣和活动激增带来了新的挑战:可访问性。高额交易费用可能会导致余额较小的用户无法使用闪电网络等非托管服务。正如 Chow 指出的那样,每个第 2 层解决方案仍然需要链上交易才能发挥作用,这加剧了问题。

Despite these hurdles, solutions are emerging, such as custodial Lightning services that aim to mitigate transaction costs, ensuring that new users can access the Bitcoin market even in high-fee environments.

尽管存在这些障碍,解决方案仍在不断出现,例如旨在降低交易成本的托管闪电服务,确保新用户即使在高费用环境下也可以进入比特币市场。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

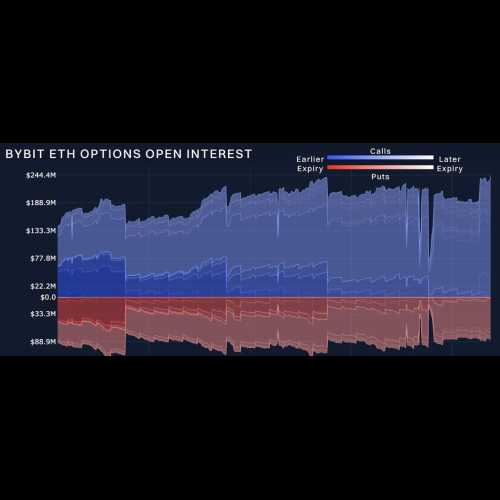

- 市场在年底期权到期前表现出弹性:Bybit x Block Scholes 加密衍生品报告

- 2024-12-27 01:05:02

-

-

-

-

-

-

- 今天购买哪种加密货币?牛市最佳加密货币分析

- 2024-12-27 01:05:02

- 如今,鲸鱼和买家不再想知道该购买哪种加密货币,而是将注意力转向寻找最适合牛市的加密货币。