|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

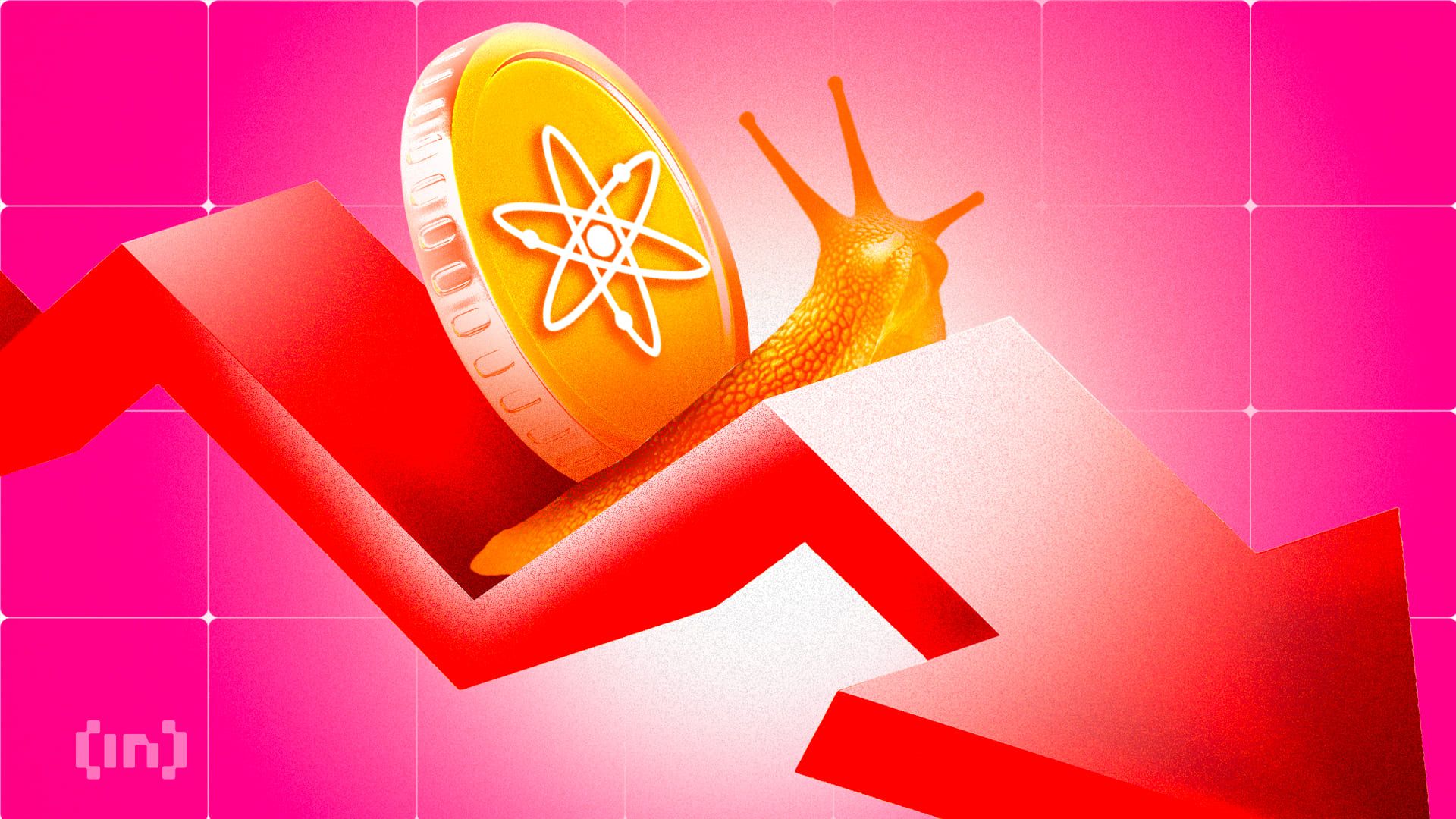

Cosmos 的原生代币 ATOM 已成为加密货币市场中表现最好的,其价格在过去 24 小时内飙升近 10%。

Cosmos’s (CRYPTO: ATOM) native token has become the talk of the town, experiencing a remarkable price surge of nearly 10% in the past 24 hours. This uptick has coincided with a significant increase in open interest, reaching its highest level since June. As a result, ATOM’s price now hovers around $4.86, accompanied by a two-month high trading volume of $228 million.

Cosmos(加密货币代码:ATOM)原生代币已成为热门话题,在过去 24 小时内价格飙升近 10%。这一上升与未平仓合约的大幅增加同时发生,达到 6 月份以来的最高水平。因此,ATOM 的价格目前徘徊在 4.86 美元左右,交易量达到两个月高点 2.28 亿美元。

When an asset’s price rally occurs with high volume, it usually indicates strong buying interest from many participants. This suggests that the price movement is supported by broad market activity, making it more sustainable. In the case of ATOM, it indicates that the rising price is not merely a short-term fluctuation driven by a small group of traders.

当资产价格大幅上涨时,通常表明许多参与者有强烈的购买兴趣。这表明价格走势受到广泛市场活动的支持,使其更具可持续性。就ATOM而言,这表明价格上涨不仅仅是少数交易者推动的短期波动。

Moreover, ATOM’s rising Relative Strength Index (RSI) further confirms the high demand for the altcoin. As of now, it is at 62.47 and in an upward trend.

此外,ATOM 不断上升的相对强度指数(RSI)进一步证实了对山寨币的高需求。目前为62.47,呈上升趋势。

This indicator tracks an asset’s overbought and oversold market conditions. RSI readings between 50 and 70 generally suggest that the asset is gaining strength, with buying pressure outweighing selling pressure. In this case, the RSI of 62.47 shows that ATOM has bullish momentum but has not reached extreme levels; therefore, there is still room for its price to grow.

该指标跟踪资产的超买和超卖市场状况。 RSI 读数在 50 至 70 之间通常表明该资产正在走强,买入压力超过卖出压力。在本例中,RSI 为 62.47,表明 ATOM 具有看涨势头,但尚未达到极端水平;因此,其价格仍有上涨空间。

Adding to the bullish case, ATOM’s open interest has climbed to a four-month high of $75.44 million, having surged by 10% over the past 24 hours.

ATOM 的未平仓合约已攀升至 7544 万美元的四个月高点,在过去 24 小时内飙升了 10%,这进一步加剧了看涨的情况。

An asset’s open interest measures the amount of its outstanding derivatives contract that is yet to be closed. A rising price with increasing open interest confirms that the uptrend is strong and sustainable. Traders opening new positions add momentum to the price’s upward movement, indicating that it is driven by increased demand for the asset.

资产的未平仓合约衡量其尚未平仓的未平仓衍生品合约的数量。价格上涨和未平仓合约增加证实上升趋势强劲且可持续。交易者开设新头寸增加了价格上涨的动力,表明价格上涨是由资产需求增加推动的。

To further gauge the potential direction of ATOM’s price, we can apply Fibonacci Retracement analysis, which identifies key support and resistance levels.

为了进一步判断 ATOM 价格的潜在方向,我们可以应用斐波那契回撤分析,该分析可识别关键支撑位和阻力位。

Based on this analysis, if ATOM’s buying momentum persists, a key price target to watch for is $7.81, which corresponds to the 23.6% Fibonacci Retracement level. A breakout above this level could push the token toward $14.58, which marks the 50% Fibonacci Retracement level and a price not reached since March.

根据此分析,如果 ATOM 的购买势头持续存在,则需要关注的关键价格目标是 7.81 美元,对应于 23.6% 斐波那契回撤位。突破该水平可能会将代币推向 14.58 美元,这标志着 50% 斐波那契回撤水平,也是 3 月份以来未达到的价格。

On the other hand, if profit-taking increases, it could drag ATOM’s price down to $3.63, which corresponds to the 76.4% Fibonacci Retracement level.

另一方面,如果获利回吐增加,可能会将 ATOM 的价格拖至 3.63 美元,相当于 76.4% 斐波那契回撤位。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 在2024年12月达到顶峰的3.91万亿美元之后

- 2025-04-03 14:05:12

- 这种低迷的总市值降低到了2.5万亿美元以上,这使短期投资者在数字资产中充满信心。

-

-

- 加密货币巨头Coinbase正在考虑为至少一些帐户支付利息的想法

- 2025-04-03 14:00:12

- 这意味着许多新概念定期出现,最近一个这样的概念到达了加密货币巨型coinbase。

-

-

- 赚取比特币和山寨币的前6个免费云挖掘平台

- 2025-04-03 13:55:12

- 随着比特币和Altcoins继续主导金融景观,免费的云挖掘平台已成为革命性的工具

-

- 随着鲸鱼累积蘸酱,Pendle Coin(Pendle)价格飙升6.8%

- 2025-04-03 13:55:12

- 在比特币激增的$ 85,000之后,加密货币市场正在4月初获得恢复势头。

-

- 在解放日关税公告后,DXY再次下降。

- 2025-04-03 13:50:12

- 澳元大,大,然后做得很少。铅靴今天将很有趣。黄金到月球。油顶。

-

-