|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

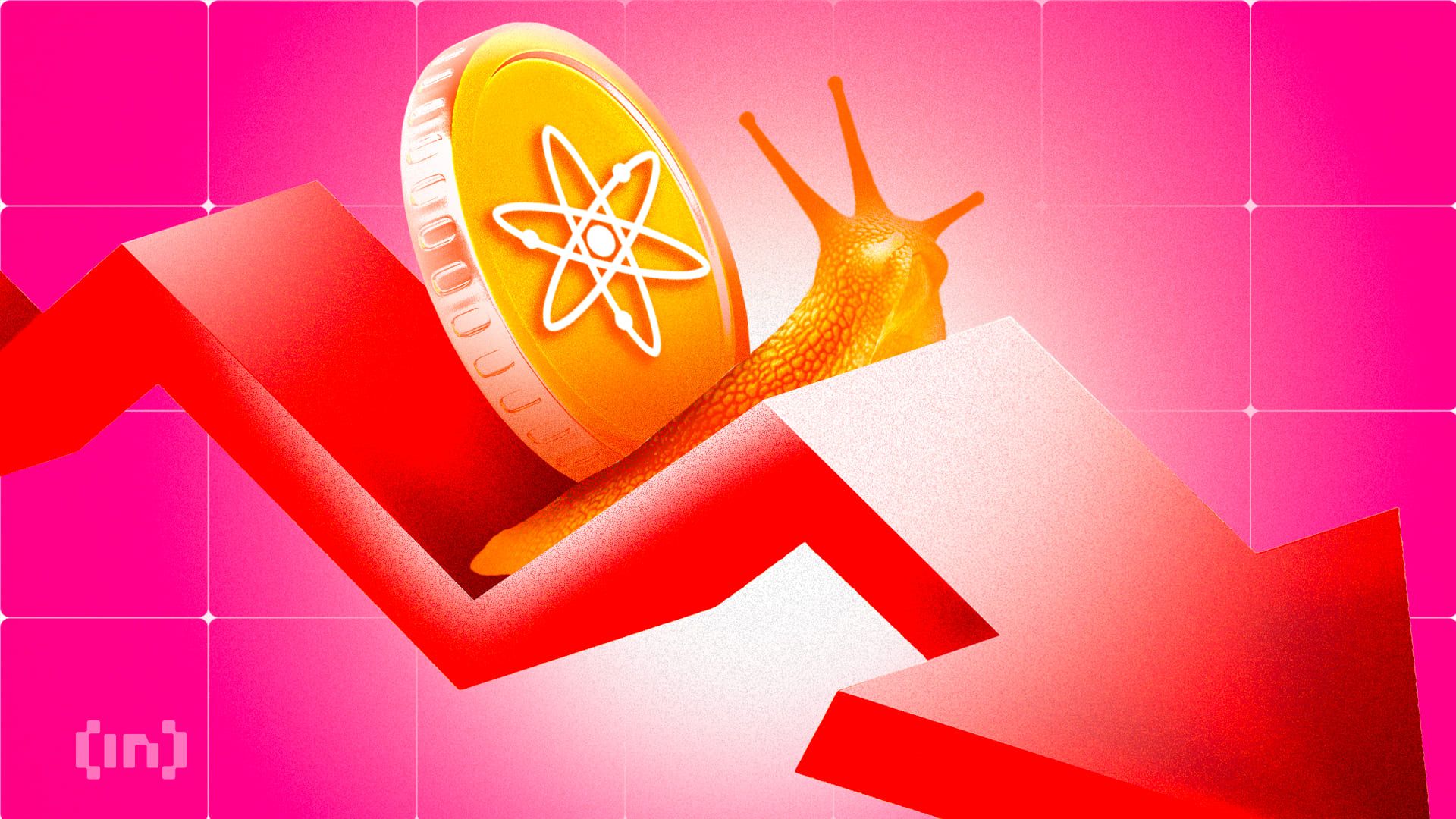

Cosmos (ATOM) Price Prediction: A Rally Toward $14.58 Or a Decline to $14.58?

Oct 22, 2024 at 02:30 am

Cosmos's native token ATOM has emerged as the top performer in the cryptocurrency market, with its price surging by nearly 10% in the past 24 hours.

Cosmos’s (CRYPTO: ATOM) native token has become the talk of the town, experiencing a remarkable price surge of nearly 10% in the past 24 hours. This uptick has coincided with a significant increase in open interest, reaching its highest level since June. As a result, ATOM’s price now hovers around $4.86, accompanied by a two-month high trading volume of $228 million.

When an asset’s price rally occurs with high volume, it usually indicates strong buying interest from many participants. This suggests that the price movement is supported by broad market activity, making it more sustainable. In the case of ATOM, it indicates that the rising price is not merely a short-term fluctuation driven by a small group of traders.

Moreover, ATOM’s rising Relative Strength Index (RSI) further confirms the high demand for the altcoin. As of now, it is at 62.47 and in an upward trend.

This indicator tracks an asset’s overbought and oversold market conditions. RSI readings between 50 and 70 generally suggest that the asset is gaining strength, with buying pressure outweighing selling pressure. In this case, the RSI of 62.47 shows that ATOM has bullish momentum but has not reached extreme levels; therefore, there is still room for its price to grow.

Adding to the bullish case, ATOM’s open interest has climbed to a four-month high of $75.44 million, having surged by 10% over the past 24 hours.

An asset’s open interest measures the amount of its outstanding derivatives contract that is yet to be closed. A rising price with increasing open interest confirms that the uptrend is strong and sustainable. Traders opening new positions add momentum to the price’s upward movement, indicating that it is driven by increased demand for the asset.

To further gauge the potential direction of ATOM’s price, we can apply Fibonacci Retracement analysis, which identifies key support and resistance levels.

Based on this analysis, if ATOM’s buying momentum persists, a key price target to watch for is $7.81, which corresponds to the 23.6% Fibonacci Retracement level. A breakout above this level could push the token toward $14.58, which marks the 50% Fibonacci Retracement level and a price not reached since March.

On the other hand, if profit-taking increases, it could drag ATOM’s price down to $3.63, which corresponds to the 76.4% Fibonacci Retracement level.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

- Ethereum (ETH) Shows Signs of Recovery, But Faces Resistance at $2,000

- Apr 03, 2025 at 01:45 pm

- ETH is currently trading at $1,901, with analysts pointing to a potential bull run if the asset can reclaim key resistance levels. The Relative Strength Index (RSI) is signaling a possible reversal, while trading volumes are climbing—suggesting an increase in buying pressure.

-

-