|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

奥本海默将 Coinbase Global(纳斯达克股票代码:COIN)的目标价格从 200.00 美元上调至 276.00 美元,理由是该公司强劲的收入增长和加密货币的日益普及。该分析师目前对该加密货币交易所的股票给予跑赢大盘的评级,表明他们对 Coinbase 未来表现的乐观前景。

Coinbase Global: A Promising Investment in the Crypto Economy

Coinbase Global:加密经济的一项有前途的投资

Oppenheimer Upgrades Target Price, Citing Strong Growth Prospects

奥本海默上调目标价,理由是强劲的增长前景

In a recent research note, Oppenheimer analysts have raised their target price for Coinbase Global (NASDAQ: COIN) to $276.00, reflecting a significant increase from the previous target of $200.00. This upgrade underscores the firm's optimism about Coinbase's long-term growth potential, particularly in the rapidly expanding cryptocurrency market.

在最近的一份研究报告中,Oppenheimer 分析师将 Coinbase Global(纳斯达克股票代码:COIN)的目标价格上调至 276.00 美元,较之前的 200.00 美元目标价格大幅上涨。此次升级凸显了该公司对 Coinbase 长期增长潜力的乐观态度,尤其是在快速扩张的加密货币市场。

Industry Analysts Echo Positive Sentiment

行业分析师表达了积极的情绪

Coinbase Global's positive outlook is further supported by the favorable ratings and target price adjustments from other industry analysts. Canaccord Genuity Group has maintained a buy rating with a target price of $240.00, while Wedbush has raised its target price to $200.00, reaffirming its outperform rating. Goldman Sachs has also upgraded the stock from a sell rating to a neutral rating, indicating a shift in sentiment. Notably, Citigroup has raised its target price to $151.00 and maintained a neutral rating.

其他行业分析师的有利评级和目标价格调整进一步支持了 Coinbase Global 的积极前景。 Canaccord Genuity Group维持买入评级,目标价为240.00美元,而Wedbush则将目标价上调至200.00美元,重申其跑赢大市评级。高盛也将该股评级从卖出评级上调至中性评级,表明市场情绪发生转变。值得注意的是,花旗集团已将目标价上调至151.00美元,并维持中性评级。

Broad Analyst Consensus Points to Hold Rating

分析师普遍一致认为维持评级

Overall, the consensus among equity research analysts is to hold Coinbase Global stock. Out of the total analysts covering the stock, eight have issued buy ratings, three have a sell rating, and nine have assigned a hold rating. MarketBeat reports that Coinbase Global currently holds an average rating of Hold, with an average target price of $148.60.

总体而言,股票研究分析师的共识是持有 Coinbase Global 股票。在研究该股的分析师总数中,有八位给予买入评级,三位给予卖出评级,九位给予持有评级。 MarketBeat 报道称,Coinbase Global 目前维持平均评级为“持有”,平均目标价为 148.60 美元。

Strong Financial Performance Drives Optimism

强劲的财务业绩推动乐观情绪

Coinbase Global's recent financial results have exceeded market expectations, contributing to the positive analyst ratings. The company reported earnings per share (EPS) of $1.04 for the quarter ending December 31, 2022, surpassing the consensus estimate by a significant margin. Moreover, revenue of $953.80 million exceeded analysts' expectations of $826.10 million, showcasing the company's robust revenue growth. Coinbase Global's revenue is expected to grow by 51.6% year-over-year, further bolstering the bullish outlook.

Coinbase Global 最近的财务业绩超出了市场预期,从而获得了积极的分析师评级。该公司公布的截至 2022 年 12 月 31 日的季度每股收益 (EPS) 为 1.04 美元,大幅超出市场普遍预期。此外,9.538亿美元的收入超出了分析师8.2610亿美元的预期,显示了该公司收入的强劲增长。 Coinbase Global 的收入预计将同比增长 51.6%,进一步支撑了看涨的前景。

Insider Trading Indicates Confidence

内幕交易显示信心

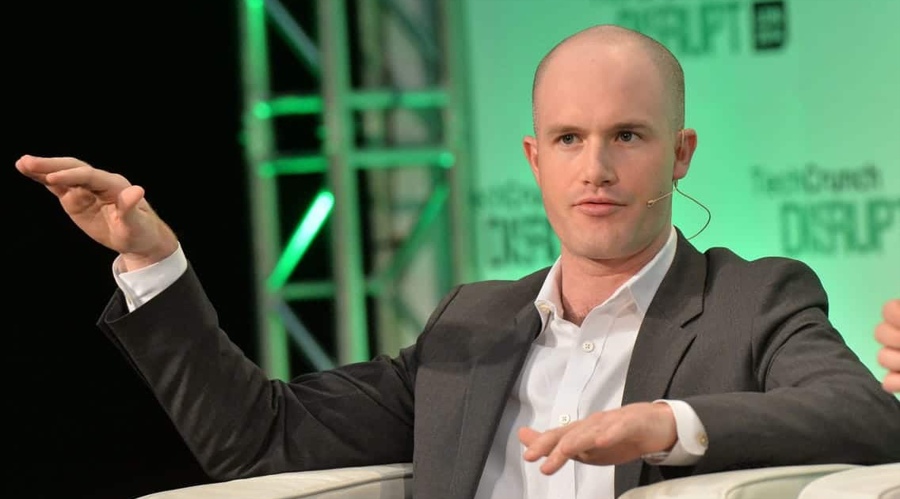

Positive sentiment towards Coinbase Global is also reflected in insider trading activities. Key executives, including Director Frederick Ernest Ehrsam III and CEO Brian Armstrong, have recently sold shares of the company, potentially indicating a belief in the stock's current valuation. However, it's important to note that insider selling can have various motivations and should not be solely relied upon for investment decisions.

对 Coinbase Global 的积极情绪也反映在内幕交易活动中。包括董事 Frederick Ernest Ehrsam III 和首席执行官 Brian Armstrong 在内的主要高管最近出售了该公司的股票,这可能表明对该股当前估值的信心。然而,值得注意的是,内幕销售可能有多种动机,不应仅仅依赖内幕销售来做出投资决策。

Institutional Investors Increasing Stake

机构投资者增持股份

Institutional investors have also shown a growing appetite for Coinbase Global shares. Vanguard Group Inc. has increased its holdings by 19.8%, while Price T Rowe Associates Inc. MD has significantly increased its stake by over 740%. These investments demonstrate institutional confidence in the company's future prospects.

机构投资者对 Coinbase Global 股票的兴趣也日益浓厚。 Vanguard Group Inc. 增持了 19.8%,而 Price T Rowe Associates Inc. MD 则大幅增持了 740% 以上的股份。这些投资表明了机构对公司未来前景的信心。

Strong Market Position and Long-Term Growth

强大的市场地位和长期增长

Coinbase Global is well-positioned to capitalize on the growing adoption of cryptocurrencies. As the leading cryptocurrency exchange, the company provides a secure and convenient platform for users to buy, sell, and trade digital assets. The company is likely to continue benefiting from the increasing popularity of cryptocurrencies and the broader adoption of blockchain technology.

Coinbase Global 处于有利位置,可以利用加密货币日益普及的趋势。作为领先的加密货币交易所,该公司为用户购买、出售和交易数字资产提供安全、便捷的平台。该公司可能会继续受益于加密货币的日益普及和区块链技术的更广泛采用。

Conclusion

结论

The recent surge in analysts' target prices and positive sentiment towards Coinbase Global reflects the company's strong financial performance, market position, and growth potential. With a hold rating from analysts and ongoing insider trading, investors should consider Coinbase Global as a promising investment opportunity in the rapidly growing cryptocurrency sector.

最近分析师目标价格的飙升以及对 Coinbase Global 的积极情绪反映了该公司强劲的财务业绩、市场地位和增长潜力。鉴于分析师的持有评级和持续的内幕交易,投资者应将 Coinbase Global 视为快速增长的加密货币领域一个有前途的投资机会。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

- DOGE:重塑美国经济的机会?

- 2024-11-18 22:40:02

- 唐纳德·特朗普重返白宫带来了一项大胆的创新:政府效率部,绰号为 DOGE。

-

-

-

- Nubank 推出 BTC / ETH / SOL / UNI 的 USDC 掉期

- 2024-11-18 22:40:02

- 金融科技新银行逐渐成为加密货币交易中心

-

-

- 为何2024年比特币交易量如此之高?

- 2024-11-18 22:35:14

- 比特币(BTC)已发展成为世界上交易量最大的数字资产之一。其交易量反映了人们对这种加密货币的巨大兴趣