|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

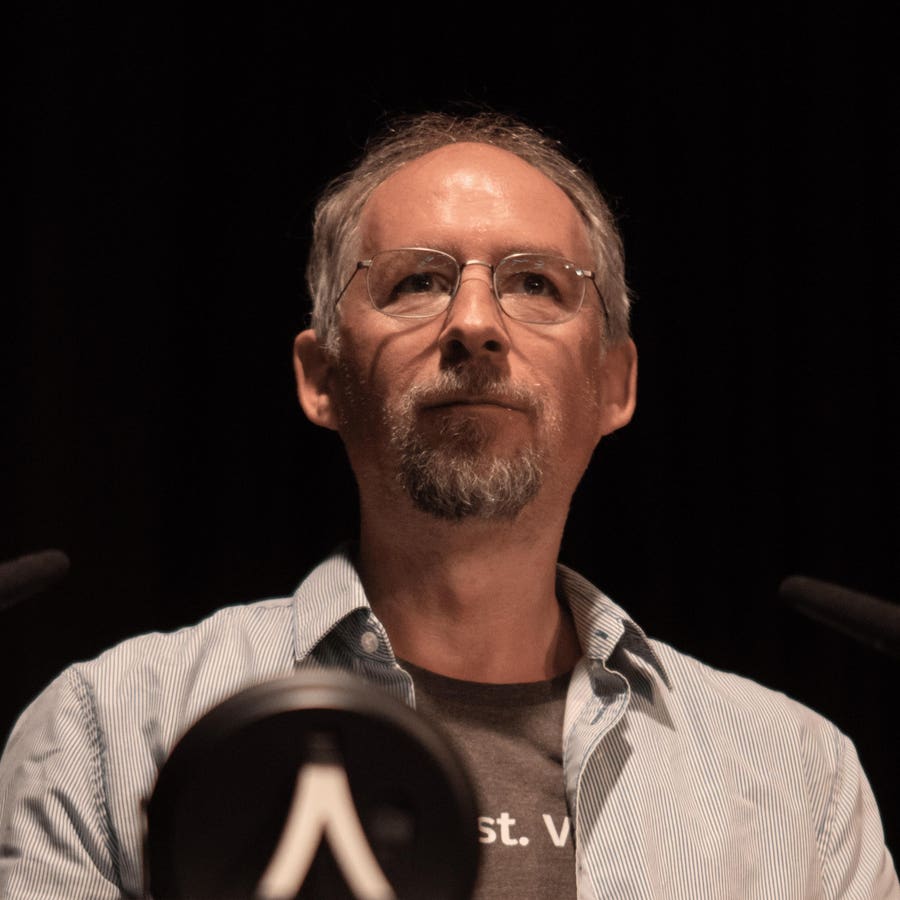

Adam Back 博士是 Blockstream 联合创始人兼首席执行官,英国密码学家和计算机科学家,因 1997 年发明 Hashcash 而广为人知

Dr. Adam Back, cofounder and CEO of Blockstream, is a British cryptographer and computer scientist, widely known for his 1997 invention of Hashcash, the proof-of-work system foundational to bitcoin mining.

Adam Back 博士是 Blockstream 的联合创始人兼首席执行官,是一位英国密码学家和计算机科学家,因其 1997 年发明的 Hashcash(比特币挖矿的基础工作量证明系统)而闻名。

As CEO of Blockstream, Dr. Back plays a central role in developing infrastructure and scaling solutions shaping the future of finance on Bitcoin. Key Blockstream innovations include the Liquid Network, Bitcoin’s first and leading sidechain, designed to enable faster, more confidential transactions, as well as the seamless issuance of digital assets, including stablecoins and tokenized real-world assets (RWAs). Back is widely known in the crypto community because he had communications with Satoshi Nakamoto before the pseudonymous bitcoin creator wrote his seminal white paper in 2008.

作为 Blockstream 的首席执行官,Back 博士在开发基础设施和扩展解决方案以塑造比特币金融的未来方面发挥着核心作用。 Blockstream 的关键创新包括 Liquid Network,这是比特币的第一个且领先的侧链,旨在实现更快、更保密的交易,以及数字资产的无缝发行,包括稳定币和代币化的现实世界资产 (RWA)。 Back 在加密货币社区中广为人知,因为在 2008 年匿名比特币创造者中本聪 (Satoshi Nakamoto) 撰写其开创性白皮书之前,他曾与中本聪进行过交流。

In this discussion, we briefly cover some of his early work on Bitcoin. However, the majority of it relates to his work at Blockstream, which just completed a $210 million convertible note offering to create more functionality on top of Bitcoin.

在本次讨论中,我们简要介绍了他关于比特币的一些早期工作。然而,其中大部分与他在 Blockstream 的工作有关,该公司刚刚完成了 2.1 亿美元的可转换票据发行,以在比特币之上创建更多功能。

Forbes: How did you first start working with Satoshi?

福布斯:您是如何开始与中本聪合作的?

Adam Back: I was the first person to receive an email from Satoshi before it [Bitcoin] was launched. It wasn't a very detailed conversation. I believe he had already developed the software, and the next thing he'd done was write the white paper describing how it worked. He was citing related work and asked for the correct way to cite Hashcash. The next thing I heard was him telling me he had published the white paper and wanted to know if I would download the source code for Bitcoin. That was around January 2009.

Adam Back:在比特币推出之前,我是第一个收到中本聪电子邮件的人。这不是一次非常详细的谈话。我相信他已经开发了该软件,接下来他要做的就是编写白皮书来描述它的工作原理。他正在引用相关工作,并询问引用 Hashcash 的正确方法。接下来我听到的是他告诉我他已经发布了白皮书并想知道我是否会下载比特币的源代码。那是在 2009 年 1 月左右。

Forbes: Do you think at this point it matters if we find out who Satoshi is?

福布斯:您认为目前我们找出中本聪是谁重要吗?

Back: I think it is mattering less and less because we've got a lot of years of history now of experiencing Bitcoin as a decentralized thing. I think it gets viewed more like a discovery because it’s decentralized and there’s no CEO or founder, unlike some of the other projects. Humanity discovered physical gold as a good type of money. Now we've discovered a better one: electronic digital gold. We’ve gone through enough dramatic changes, like the Blocksize Wars, where the market ultimately prevailed, that it would not matter much if Satoshi returns. That is quite a positive outcome if you think about it because the market is a proxy for the user's wishes regarding electronic cash.

Back:我认为这越来越不重要了,因为我们已经有很多年的历史来体验比特币作为一种去中心化的东西了。我认为它更像是一个发现,因为它是去中心化的,并且与其他一些项目不同,没有首席执行官或创始人。人类发现实物黄金是一种很好的货币。现在我们发现了一种更好的:电子数字黄金。我们已经经历了足够多的戏剧性变化,比如区块大小战争,市场最终占了上风,所以如果中本聪回归也没什么大不了的。如果你仔细想想,这是一个非常积极的结果,因为市场代表了用户对电子现金的意愿。

Forbes: Let's turn to Blockstream. The big use case for bitcoin right now is as a store of value. How do you reconcile that with your goal of making bitcoin a widespread payment system?

福布斯:让我们转向 Blockstream。目前比特币的最大用途是作为价值储存手段。您如何将其与使比特币成为广泛支付系统的目标相协调?

Back: We have a bit of a foot in two camps because we have one of the major implementations of Lightning, which is all about scalability and retail payments. Then we've got Liquid, which is more about trustless trades, smart contracts, assets, stablecoins and securities. While I have a computer science background, back in the mid-nineties, I was a fairly avid day trader and investor with my savings. I was interested to see what Bitcoin technology, like the blockchain, could do to improve the trading infrastructure.

返回:我们在两个阵营中都占有一席之地,因为我们拥有闪电网络的主要实现之一,这一切都与可扩展性和零售支付有关。然后我们有了 Liquid,它更多地涉及无需信任的交易、智能合约、资产、稳定币和证券。虽然我有计算机科学背景,但早在九十年代中期,我就用自己的积蓄成为了一名相当热衷的日内交易者和投资者。我很想知道比特币技术(如区块链)可以如何改善交易基础设施。

That dates back to events such as the Mt. Gox failure because you’re finding that you should have a piece of technology that allows you to do atomic swaps without giving up custody. In practice, everybody was giving custody to an exchange, meaning you need to trust somebody else. It was the same story with FTX. Liquid is doing multiple things. It's also been used for stablecoins and retail payments. There's a new phenomenon: a crossover Lightning wallet. There are three or four of them now. They look like a Lightning wallet, but actually, they are a Liquid wallet, and when you want to make a payment, they use a trustless swap to exchange Liquid bitcoin for Lightning or vice versa. So all your storage is done on Liquid.

这可以追溯到 Mt. Gox 失败等事件,因为你发现你应该拥有一项技术,允许你在不放弃监管的情况下进行原子交换。在实践中,每个人都将托管权交给交易所,这意味着你需要信任其他人。 FTX 的情况也是如此。 Liquid 正在做多种事情。它也被用于稳定币和零售支付。有一种新现象:交叉闪电钱包。现在有三四个人了。它们看起来像闪电钱包,但实际上,它们是液体钱包,当你想要付款时,它们使用去信任交换将液体比特币兑换成闪电网络,反之亦然。所以你所有的存储都是在 Liquid 上完成的。

We built a block explorer for Liquid, and there is now an ecosystem of companies around Liquid, kind of like what exists around Lightning. One startup called SideSwap offers a trustless central order book, but you can place limit orders along the way. We also made our own hardware wallet to innovate a bit faster. You approve the trade right on your hardware wallet. That’s pretty innovative and exciting because you haven't given up custody.

我们为 Liquid 构建了一个区块浏览器,现在围绕 Liquid 形成了一个由公司组成的生态系统,有点像闪电网络周围的生态系统。一家名为 SideSwap 的初创公司提供了一个无需信任的中央订单簿,但您可以在此过程中下限价订单。我们还制作了自己的硬件钱包,以加快创新速度。您可以在硬件钱包上批准交易。这是非常创新和令人兴奋的,因为你没有放弃监护权。

Regarding the store of value question, people have been thinking about inflation since Covid, and generally speaking, our currencies don't feel too stable from a short-term perspective. But I think what you've seen is growth in emerging markets. Remember that about 50% of the world's working population is the informal economy. They get paid in cash, there's no paperwork, and they don't have any government ID. Those people don't have direct access to the global economy. That’s pretty interesting and supports the transactional use case because as much as bitcoin is volatile, it’s

关于价值储存问题,自新冠疫情以来,人们一直在思考通货膨胀,总的来说,从短期角度来看,我们的货币感觉不太稳定。但我认为你看到的是新兴市场的增长。请记住,世界上大约 50% 的劳动人口从事非正规经济。他们的工资是现金,没有任何文书工作,也没有任何政府身份证件。这些人无法直接参与全球经济。这非常有趣并且支持交易用例,因为尽管比特币很不稳定,但它

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- Bonk价格预测:Meme Coin Mania,下一步是什么?

- 2025-07-04 12:30:13

- Bonk硬币是模因硬币世界中的下一个大事吗?让我们深入研究最新的价格预测,市场趋势以及促进炒作的原因。

-

-

-

-

-

-

- 稀有硬币投资:警告,价格和您需要知道的,纽约客风格

- 2025-07-04 12:55:12

- 想潜入稀有硬币吗?本指南分解了价格,潜在的奖励以及价格上的真正交易。在掉一毛钱之前先获取低点。

-

-