|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

全球最大的资产管理公司贝莱德正在制定全面的加密货币战略。该公司认识到数字资产和区块链技术的好处,投资了比特币、稳定币和代币化资产。贝莱德对加密货币和区块链的拥抱表明传统金融机构将这些技术整合到其运营中的方法发生了转变。

BlackRock Embraces Multifaceted Crypto Strategy, Signaling Transformation in Traditional Finance

贝莱德拥抱多层面的加密战略,标志着传统金融的转型

BlackRock, the world's leading asset manager with a staggering $10 trillion under its management, has embarked on a multifaceted crypto strategy, recognizing the transformative potential of digital assets and blockchain technology.

贝莱德是全球领先的资产管理公司,管理着惊人的 10 万亿美元资产,认识到数字资产和区块链技术的变革潜力,已开始实施多方面的加密战略。

Segmenting the Crypto Landscape

细分加密货币格局

According to Token Terminal, a specialized research firm in digital assets, BlackRock categorizes the crypto world into three distinct categories:

根据数字资产专业研究公司 Token Terminal 的说法,贝莱德将加密世界分为三个不同的类别:

- Crypto Assets: Encompassing cryptocurrencies like Bitcoin, offering accessibility and efficiency in global transactions.

- Stablecoins: Stablecoins like USD Coin, pegged to fiat currencies, provide stability and ease of use for everyday payments.

- Tokenized Assets: These represent traditional assets like bonds and real estate on the blockchain, facilitating fractional ownership and efficient trading.

Strategic Stakes and Partnerships

加密资产:包括比特币等加密货币,为全球交易提供可访问性和效率。稳定币:美元硬币等稳定币,与法定货币挂钩,为日常支付提供稳定性和易用性。代币化资产:代表债券和房地产等传统资产在区块链上,促进部分所有权和高效交易。战略股权和合作伙伴关系

BlackRock has strategically invested in key players across the crypto spectrum. Through its iShares Bitcoin Trust, it holds a significant stake in the Bitcoin Trust, with assets under management exceeding $18 billion. Additionally, the firm has equity interests in Circle, the issuer of USD Coin with a market cap of over $32 billion, and in Securitize, the transfer agent for BUIDL, a tokenized money market fund with $300 million in assets.

贝莱德对整个加密领域的关键参与者进行了战略投资。通过其iShares比特币信托,它持有比特币信托的大量股份,管理的资产超过180亿美元。此外,该公司还拥有市值超过 320 亿美元的 USD Coin 发行人 Circle 的股权,以及 BUIDL(资产达 3 亿美元的代币化货币市场基金)的转让代理 Securitize 的股权。

Leveraging Bitcoin's Attributes

利用比特币的属性

BlackRock recognizes the unique advantages of Bitcoin, including its global accessibility, cross-border transaction efficiency, and limited supply, which acts as a hedge against inflation. Capitalizing on these attributes, the asset management giant offers innovative products like IBIT, providing worldwide access to Bitcoin. Future plans hint at further expansion into other prominent cryptocurrencies like Ethereum and Solana.

贝莱德认识到比特币的独特优势,包括其全球可访问性、跨境交易效率以及供应有限(可以对冲通胀)。利用这些属性,这家资产管理巨头提供了 IBIT 等创新产品,在全球范围内提供对比特币的访问。未来的计划暗示将进一步扩展到以太坊和 Solana 等其他著名的加密货币。

Blockchain Revolutionizing Capital Markets

区块链彻底改变资本市场

Beyond individual cryptocurrencies, BlackRock sees blockchain technology as a transformative force in traditional capital markets. The firm anticipates benefits such as round-the-clock operational capabilities, enhanced transparency and accessibility for investors, reduced fees, and faster settlements.

除了个别加密货币之外,贝莱德还将区块链技术视为传统资本市场的变革力量。该公司预计将带来诸如全天候运营能力、提高投资者的透明度和可及性、降低费用和更快的结算等优势。

Token Terminal suggests that BlackRock may develop its own blockchain to consolidate recordkeeping of its vast holdings into a unified, interoperable, and transparent ledger. This strategy mirrors the approach of major platforms like Coinbase, which have established their own Layer-2 blockchain, Base.

Token Terminal 建议贝莱德可能开发自己的区块链,将其大量资产的记录整合到一个统一、可互操作和透明的分类账中。这一策略反映了 Coinbase 等主要平台的做法,这些平台已经建立了自己的第 2 层区块链 Base。

Industry-Wide Implications

对全行业的影响

BlackRock's embrace of digital assets marks a significant shift in the financial landscape, signaling the readiness of traditional financial institutions to integrate blockchain and cryptocurrency into their operations. Industry experts predict this could set precedents for asset management in the crypto sphere, with potential implications for the global financial system as adoption gains traction.

贝莱德对数字资产的拥抱标志着金融格局的重大转变,标志着传统金融机构已准备好将区块链和加密货币整合到其运营中。行业专家预测,这可能会为加密领域的资产管理开创先例,随着采用的普及,对全球金融体系产生潜在影响。

The upcoming Future of Digital Assets conference hosted by Benzinga on November 19th will delve into these developments and explore the far-reaching consequences of large-scale crypto adoption by major financial institutions. Participants will discuss the strategies employed by BlackRock and their potential impact on the future of finance.

Benzinga 将于 11 月 19 日主办的数字资产未来会议将深入探讨这些发展,并探讨主要金融机构大规模采用加密货币的深远影响。与会者将讨论贝莱德采用的策略及其对金融未来的潜在影响。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 为什么加密前提越来越流行

- 2025-04-05 23:25:12

- 对于希望在进行重大交流之前利用高增长项目的投资者来说,预售已成为有利可图的入口点。

-

-

- 这些狗少蛋的水平在链上抗性方面脱颖而出

- 2025-04-05 23:20:12

- 一位分析师指出了两个主要的狗狗毒素阻力水平,这可能会为下一个牛市的价格铺平道路。

-

- 万事达与新的数字资产计划扩展区块链集成

- 2025-04-05 23:20:12

- 随着加密货币继续吸引政治和监管界的吸引力,万事达卡正在加紧努力将区块链技术整合到其支付系统中。

-

- 数字资产全球竞争和韩国战略论坛举行

- 2025-04-05 23:15:12

- 韩国民主党的成员明尼·拜德·德克(Min Byung-Deok

-

-

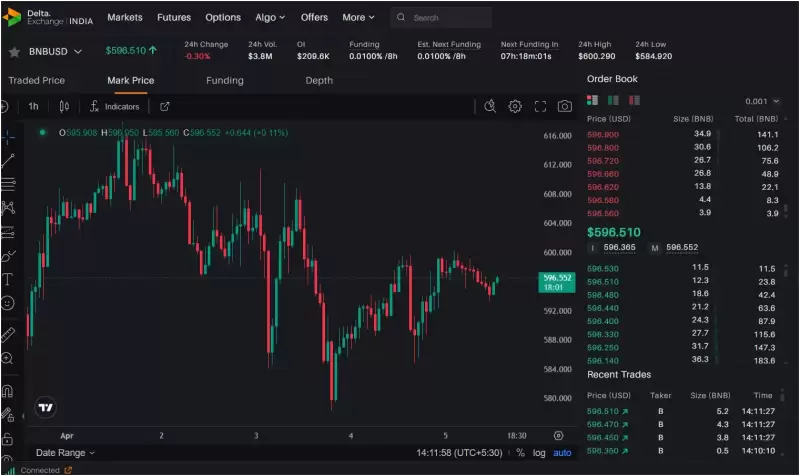

- 解码BNBUSD交易对的数字挂毯

- 2025-04-05 23:10:12

- 本文踏上了BNBUSD最近表演中心的旅程,试图解码嵌入其价格动作中的隐秘信息