|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

纳斯达克告诉 CNBC,IBIT 在周二交易的前 60 分钟内交易了 73000 份期权合约,使该基金跻身最活跃的非指数期权前 20 名。

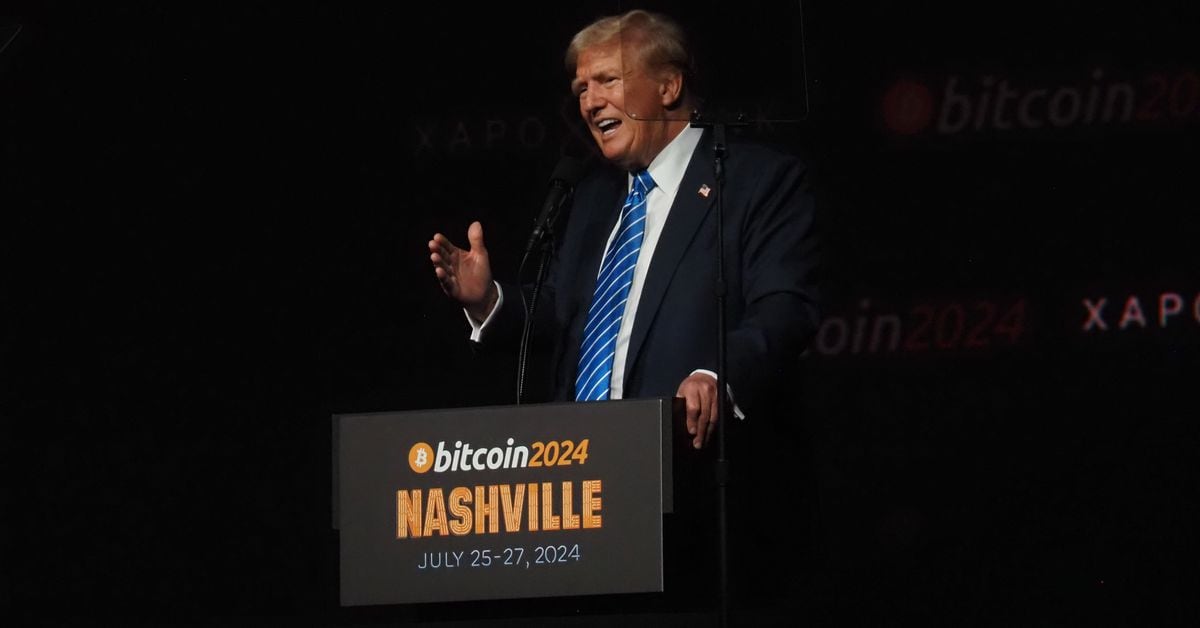

Options on BlackRock's iShares Bitcoin Trust ETF (IBIT) began trading on the Nasdaq on Tuesday, offering a new way to trade and speculate on the price of bitcoin.

贝莱德 iShares 比特币信托 ETF (IBIT) 的期权周二开始在纳斯达克交易,提供了一种交易和投机比特币价格的新方式。

IBIT options trading hit 73,000 contracts in the first 60 mins of trading Tuesday, Nasdaq told CNBC, putting the fund in the top 20 of the most active nonindex options.

纳斯达克告诉 CNBC,IBIT 期权交易在周二交易的前 60 分钟内就达到了 73,000 个合约,使该基金跻身最活跃的非指数期权前 20 名。

Options allow investors to capitalize on bitcoin's volatility by letting them buy or sell an asset at a predetermined price based on whether they anticipate the price will rise or fall in a given period.

期权允许投资者根据他们预计价格在给定时期内是否上涨或下跌的情况,以预定价格买卖资产,从而利用比特币的波动性。

"Bitcoin has a lively derivatives market, but in the U.S. it is still tiny compared to other asset classes, and is largely limited to institutional players," said Noelle Acheson, an economist and author of the "Crypto is Macro Now" newsletter. "A deeper onshore derivatives market will enhance the growing market sophistication. This will reinforce investor confidence in the asset, bringing in new cohorts while enabling a greater variety of investment and trading strategies … [That] should, all else being equal, dampen both volatility and downside."

“比特币拥有一个活跃的衍生品市场,但在美国,与其他资产类别相比,它的规模仍然很小,而且很大程度上仅限于机构参与者,”经济学家、《加密货币现在是宏观》时事通讯的作者诺埃尔·艾奇逊表示。 “更深层次的在岸衍生品市场将提高日益增长的市场复杂性。这将增强投资者对该资产的信心,引入新的群体,同时实现更多样化的投资和交易策略……在其他条件相同的情况下,这应该会抑制波动性和缺点。”

The market for options contracts on major ETFs can be extremely active and are widely used by more sophisticated traders. For example, over the past five business days, Interactive Brokers clients have had more options orders on the Invesco QQQ Trust (QQQ) and the SDPR S&P 500 ETF Trust (SPY) than for the funds themselves, according to data from the brokerage.

主要 ETF 的期权合约市场非常活跃,并被更成熟的交易者广泛使用。例如,根据经纪公司的数据,在过去的五个工作日里,盈透证券的客户对Invesco QQQ Trust (QQQ)和SDPR S&P 500 ETF Trust (SPY)的期权订单比对基金本身的订单还要多。

The launch of the bitcoin ETF options will likely also lead to new funds that incorporate those options, said Todd Sohn, ETF strategist at Strategas.

Strategas 的 ETF 策略师托德·索恩 (Todd Sohn) 表示,比特币 ETF 期权的推出也可能会催生包含这些期权的新基金。

"Grayscale already did a filing for a covered call [fund], and I'm sure BlackRock will come out with it too. And then we're going to get buffers, and then we're going to get whatever other trend-following-type strategy that folks think of. I think the ecosystem's really going to start to fly here," Sohn said.

“灰度已经提交了备兑看涨期权[基金]的申请,我确信贝莱德也会提出申请。然后我们将获得缓冲,然后我们将获得任何其他趋势跟踪我认为生态系统真的会开始在这里飞翔,”索恩说。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。