|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币暴跌至 65,977 美元引发市场回调,导致 Aavegotchi、Dream Machine Token 和 Degen 等 Layer 3 加密货币出现两位数跌幅。第 3 层代币因结合了第 2 层链的速度和以太坊等第 1 层链的安全性而变得流行,但它们也面临着比特币价格波动影响的波动性。

Bitcoin-Driven Market Correction Impacts Layer 3 Tokens

比特币驱动的市场调整影响第三层代币

On Friday, April 5th, the price of Bitcoin took a precipitous plunge to a low of $65,977, triggering a cascading correction throughout the cryptocurrency markets. This sudden drop in Bitcoin's value had a particularly pronounced impact on Layer 3 tokens, a class of cryptocurrencies that combine the speed of Layer 2 blockchains with the security of Layer 1 blockchains.

4 月 5 日星期五,比特币价格急剧暴跌至 65,977 美元的低点,引发了整个加密货币市场的级联调整。比特币价值的突然下跌对第 3 层代币产生了特别显着的影响,第 3 层代币是一类将第 2 层区块链的速度与第 1 层区块链的安全性结合在一起的加密货币。

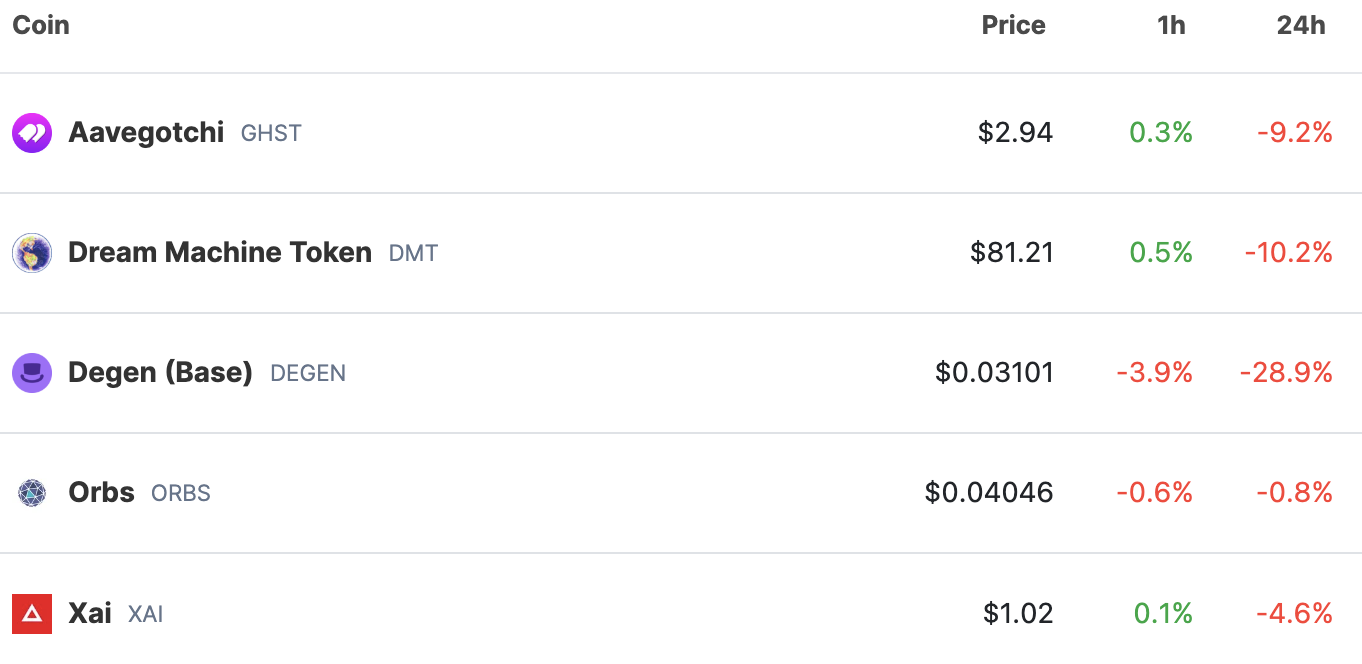

Layer 3 tokens suffered double-digit declines across the board. Aavegotchi (GHST), Dream Machine Token (DMT), and Degen (DEGEN) all experienced losses exceeding 10%. Orbs (ORBS) and Xai (XAI) fared even worse, with their prices plummeting by 12% and 18%, respectively, over the weekly timeframe.

Layer 3 代币全线出现两位数跌幅。 Aavegotchi (GHST)、Dream Machine Token (DMT) 和 Degen (DEGEN) 的损失均超过 10%。 Orbs (ORBS) 和 Xai (XAI) 的表现更糟,其价格在每周时间内分别暴跌 12% 和 18%。

The Layer 3 narrative has gained significant traction in the cryptocurrency community, with many tokens promising to prioritize user experience while leveraging the speed and security of existing blockchain protocols. However, the recent correction in Bitcoin's price has cast doubt on the resilience of these tokens.

第 3 层的叙述在加密货币社区中获得了巨大的关注,许多代币承诺优先考虑用户体验,同时利用现有区块链协议的速度和安全性。然而,最近比特币价格的调整让人们对这些代币的弹性产生了怀疑。

The decline in Layer 3 token prices is likely due to the fact that many traders and investors hold these tokens as a proxy for Bitcoin. As a result, when Bitcoin's price falls, so too do the prices of Layer 3 tokens.

Layer 3 代币价格的下跌可能是由于许多交易者和投资者持有这些代币作为比特币的代理。因此,当比特币价格下跌时,第三层代币的价格也会下跌。

While it is too early to say whether Layer 3 tokens will regain their lost ground in the coming weeks, the recent correction serves as a reminder of the inherent volatility of the cryptocurrency markets. Investors should be aware of the risks associated with trading Layer 3 tokens and other cryptocurrencies, and they should only invest what they can afford to lose.

虽然现在判断 Layer 3 代币是否会在未来几周内收复失地还为时过早,但最近的调整提醒人们加密货币市场固有的波动性。投资者应该意识到与交易 Layer 3 代币和其他加密货币相关的风险,并且他们应该只投资他们可以承受损失的部分。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- Dawgz AI - 严重效用的革命性模因硬币

- 2025-03-04 10:45:38

- $ DAGZ在拥挤的模因硬币市场中脱颖而出,不仅仅是一笔古怪的投资。将模因令牌的乐趣与

-

- 随着大型投资者继续出售股份

- 2025-03-04 10:45:38

- 在过去的24小时内,茉莉(Jasmycoin)[杂种]的购买压力大幅上涨,其价格上涨了10%以上。该运动与导数有关

-

-

-

-

- Dogecoin(Doge)已经开始恢复阶段,以历史最高

- 2025-03-04 10:45:38

- 在过去的几周中,Dogecoin一直面临持续的看跌压力,导致其抵抗关键支撑水平。但是,随着一般加密市场的反弹

-

-