Bitcoin's plunge to $65,977 triggered a market correction, resulting in double-digit declines for Layer 3 cryptocurrencies such as Aavegotchi, Dream Machine Token, and Degen. Layer 3 tokens have become popular for combining speed from Layer 2 chains and security from Layer 1 chains like Ethereum, but they also face volatility influenced by Bitcoin's price fluctuations.

Bitcoin-Driven Market Correction Impacts Layer 3 Tokens

On Friday, April 5th, the price of Bitcoin took a precipitous plunge to a low of $65,977, triggering a cascading correction throughout the cryptocurrency markets. This sudden drop in Bitcoin's value had a particularly pronounced impact on Layer 3 tokens, a class of cryptocurrencies that combine the speed of Layer 2 blockchains with the security of Layer 1 blockchains.

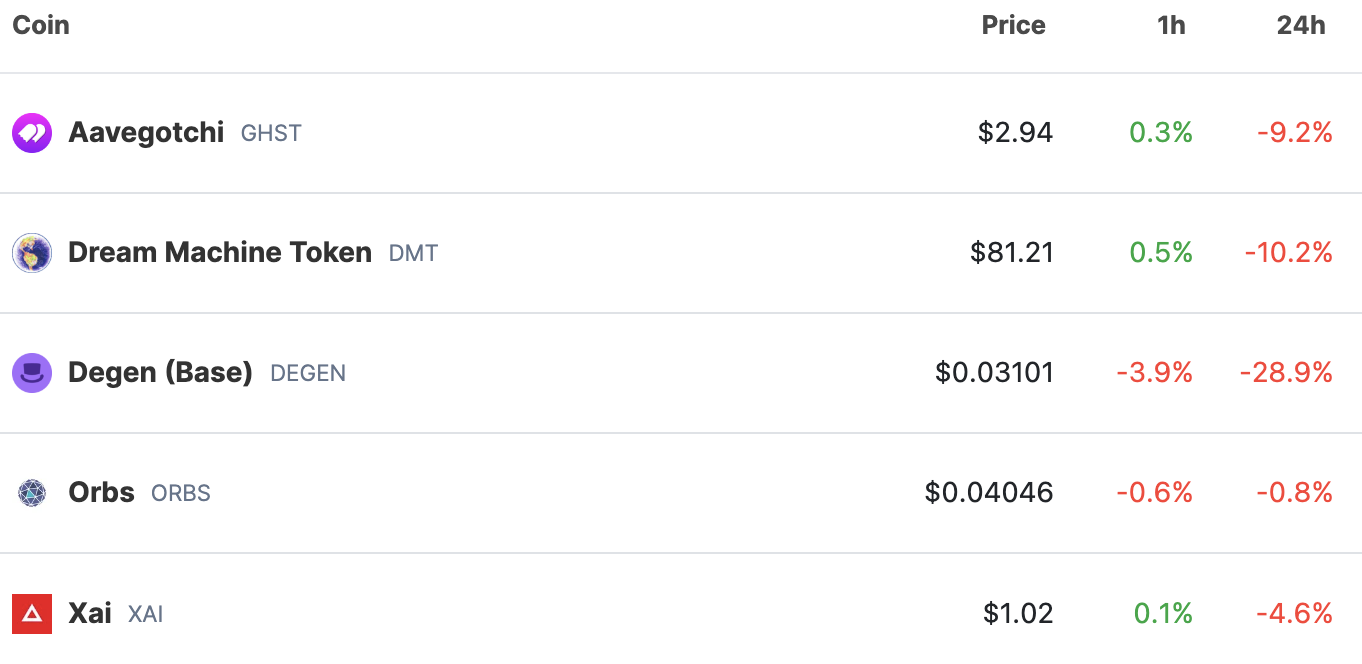

Layer 3 tokens suffered double-digit declines across the board. Aavegotchi (GHST), Dream Machine Token (DMT), and Degen (DEGEN) all experienced losses exceeding 10%. Orbs (ORBS) and Xai (XAI) fared even worse, with their prices plummeting by 12% and 18%, respectively, over the weekly timeframe.

The Layer 3 narrative has gained significant traction in the cryptocurrency community, with many tokens promising to prioritize user experience while leveraging the speed and security of existing blockchain protocols. However, the recent correction in Bitcoin's price has cast doubt on the resilience of these tokens.

The decline in Layer 3 token prices is likely due to the fact that many traders and investors hold these tokens as a proxy for Bitcoin. As a result, when Bitcoin's price falls, so too do the prices of Layer 3 tokens.

While it is too early to say whether Layer 3 tokens will regain their lost ground in the coming weeks, the recent correction serves as a reminder of the inherent volatility of the cryptocurrency markets. Investors should be aware of the risks associated with trading Layer 3 tokens and other cryptocurrencies, and they should only invest what they can afford to lose.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.