|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025年美国衰退的可能性正在增长,分析师指出经济不确定性,并升级贸易紧张局势是关键风险。

output: A possibility of a U.S. recession in 2025 is growing, with analysts citing economic uncertainty and increasing trade war tensions as key risks, Chain News reports.

产出:Chain News报道,分析师以经济不确定性和贸易战紧张局势作为关键风险的情况,分析师的可能性正在增长,分析师的可能性正在增长。

Among pressing concerns are potential budget cuts and a reduction in federal jobs, which could have significant macroeconomic implications, the report notes.

报告指出,紧迫的担忧包括潜在的削减预算和减少联邦工作,这可能具有重大的宏观经济影响。

Market expert at Invictus Capital, Nic Puckrin, puts the chance of a recession in 2025 at about 40% and adds that the current economic climate is not optimal for risk assets, including cryptocurrencies.

Invictus Capital的市场专家Nic Puckrin在2025年将经济衰退的机会占40%,并补充说,当前的经济气候对于包括加密货币在内的风险资产并不是最佳的。

Discussing capital movements, Puckrin mentions that the U.S. Dollar Index (DXY) has been dropping due to shifts in investor sentiment. As investors become more risk-averse, capital is seen flowing out of the U.S. and into European markets.

在讨论资本运动时,Puckrin提到美元指数(DXY)由于投资者情绪的转移而下降。随着投资者的风险规避风险,资本被视为从美国流出并进入欧洲市场。

The expert notes a sharp decrease in the DXY occurred in March, indicating broader macroeconomic concerns and capital outflows from the U.S.

专家指出,DXY在3月发生了急剧下降,这表明来自美国的宏观经济问题和资本流出更广泛

Moreover, President Trump’s tariffs have contributed to market instability, leading to a strong sell-off in the crypto sector. Bitcoin (BTC) is now down 24% from its January peak of $109,000, while altcoins have sustained even steeper declines.

此外,特朗普总统的关税促成了市场不稳定,导致加密货币部门的强烈抛售。比特币(BTC)现在比其一月份的峰值下降了24%,而Altcoins的下降幅度更高。

The heightened trade war fears have seen a complete reversal in market sentiment from post-election optimism to extreme caution.

贸易战的恐惧加剧使市场情绪从选举后的乐观情绪彻底逆转到极端谨慎。

Analysts suggest the pressure on crypto markets could continue at least until April, pending any positive developments in trade negotiations.

分析师认为,至少要直到4月,在贸易谈判方面的任何积极进展之前,对加密货币市场的压力可能会持续下去。

However, some experts are detecting signs that Bitcoin could be nearing a bottom.

但是,一些专家正在发现比特币可能接近底部的迹象。

10x Research's head of digital assets, Markus Thielen, notes that a shift in Trump’s trade rhetoric could be the key factor for a potential recovery in crypto prices.

10倍研究的数字资产负责人马库斯·泰伦(Markus Thielen)指出,特朗普的贸易言论的转变可能是潜在恢复加密价格的关键因素。

If the administration shows signs of softening its stance on tariffs or indicates progress in trade negotiations with a possibility of compromises, it could trigger a reversal in Bitcoin’s trajectory from its recent sell-off.

如果政府表现出对关税的立场的软化迹象,或表明贸易谈判的进展并有可能发生折衷方案,则可能会引发比特币轨迹的逆转。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

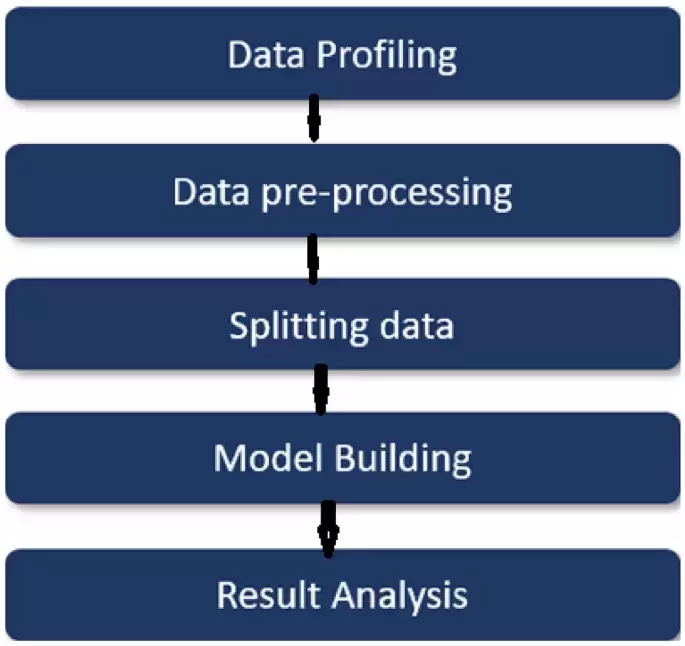

- 基于图的深度学习模型,用于检测比特币交易期间非法交易

- 2025-04-01 16:45:12

- 在比特币交易期间确定和防止非法交易是私人金融市场的挑战性问题。

-

-

-

- Solana在动荡的市场中的韧性

- 2025-04-01 16:35:12

- 在过去的24小时内,Solana(Sol)在加密货币空间中引起了极大的关注,其稳定的供应和积累显示了潜在的看涨转变的有希望的迹象。

-

-