|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

随着 2024 年 12 月比特币大幅跌破 96,000 美元的尘埃落定,金融专家和投资者正在重新调整未来几年的策略。

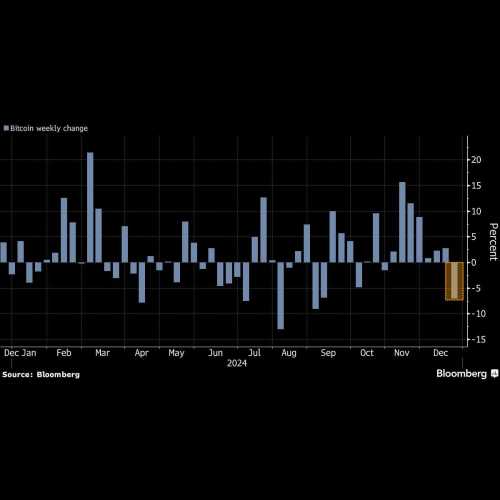

Bitcoin's value experienced a startling decline on Sunday, December 22, 2024, dropping below the $96,000 mark. This dramatic decrease, from a recent high of over $100,000, left many investors and traders feeling uneasy as the world's leading cryptocurrency experienced a concerning downturn.

2024 年 12 月 22 日星期日,比特币的价值出现惊人下跌,跌破 96,000 美元大关。由于全球领先的加密货币经历了令人担忧的低迷,从最近超过 100,000 美元的高点大幅下跌,让许多投资者和交易者感到不安。

The recent price plunge left many in the financial community scrambling to understand the factors driving this sudden decrease. As the cryptocurrency market fluctuates, investors are continually reminded of the unpredictable nature of digital assets.

最近的价格暴跌让金融界的许多人争先恐后地了解导致价格突然下跌的因素。随着加密货币市场的波动,投资者不断被提醒数字资产的不可预测性。

Despite this recent decline, some market analysts remain optimistic about bitcoin's future performance. They point out that bitcoin has experienced similar downturns in the past, only to recover and reach new heights. However, this plunge serves as a stark reminder of the potential risks involved in cryptocurrency trading.

尽管最近出现下跌,但一些市场分析师仍然对比特币的未来表现持乐观态度。他们指出,比特币过去也经历过类似的低迷,但后来又恢复并达到新的高度。然而,这次暴跌清楚地提醒人们,加密货币交易存在潜在风险。

The sharp decrease also sparked discussions about the potential influence of external economic factors and market dynamics. Speculation abounds over whether foreseeable regulatory decisions or other financial indicators might have played a role in this price drop.

大幅下跌也引发了有关外部经济因素和市场动态潜在影响的讨论。关于可预见的监管决策或其他财务指标是否在此次价格下跌中发挥了作用的猜测比比皆是。

As the digital asset community keenly observes the market's response, analysts urge traders to remain vigilant and informed. While the recent price slump may cause uncertainty in the short term, the long-term trajectory of bitcoin continues to capture the interest of investors around the globe.

在数字资产社区敏锐观察市场反应之际,分析师敦促交易者保持警惕并了解情况。尽管最近的价格暴跌可能会在短期内造成不确定性,但比特币的长期轨迹继续吸引全球投资者的兴趣。

Bitcoin Rollercoaster: What Investors Need to Know for 2025As the dust settles from Bitcoin’s dramatic drop below $96,000 in December 2024, financial experts and investors are recalibrating their strategies for the coming years. With volatility intrinsic to the cryptocurrency market, understanding future trends and risks remains crucial for all stakeholders involved.

比特币过山车:2025 年投资者需要了解什么随着 2024 年 12 月比特币大幅跌破 96,000 美元的尘埃落定,金融专家和投资者正在重新调整未来几年的策略。由于加密货币市场固有的波动性,了解未来趋势和风险对于所有相关利益相关者仍然至关重要。

Cryptocurrency Rate Predictions for 2025Looking ahead, industry analysts offer a mixed yet optimistic outlook for Bitcoin by 2025. Many predict that the leading cryptocurrency could rebound significantly, potentially achieving new record highs. This optimism is backed by increasing mainstream adoption, technological advancements like the Lightning Network, and growing investor interest in digital assets as a hedge against inflation. However, these bullish outlooks are tempered by potential regulatory changes and market dynamics that could influence Bitcoin’s trajectory.

2025 年加密货币汇率预测 展望未来,行业分析师对 2025 年比特币的前景喜忧参半但乐观。许多人预测,这种领先的加密货币可能会大幅反弹,有可能创下新的历史新高。这种乐观情绪得到了越来越多的主流采用、闪电网络等技术进步以及投资者对数字资产作为对冲通胀工具的兴趣的增长的支持。然而,这些看涨前景受到潜在监管变化和可能影响比特币走势的市场动态的影响。

Investment RisksAs with any volatile asset, investing in Bitcoin carries inherent risks. The recent plunge underscores the unpredictable nature of the cryptocurrency market. Price fluctuations can be driven by a range of factors, including regulatory announcements, macroeconomic trends, and shifts in investor sentiment. Additionally, the potential for hacking and security breaches poses risks to crypto holdings, necessitating robust security measures for investors.

投资风险与任何波动性资产一样,投资比特币也存在固有风险。最近的暴跌凸显了加密货币市场的不可预测性。价格波动可能由一系列因素驱动,包括监管公告、宏观经济趋势和投资者情绪的变化。此外,黑客攻击和安全漏洞的可能性会给加密货币持有带来风险,因此投资者需要采取强有力的安全措施。

Pros and Cons of Investing in BitcoinInvestors weigh several benefits and drawbacks when considering Bitcoin.

投资比特币的利弊投资者在考虑比特币时权衡了几个优点和缺点。

Pros:

优点:

– Decentralization and Transparency: Bitcoin operates on a decentralized network, offering transparency and reducing the control of centralized financial institutions.

– 去中心化和透明度:比特币在去中心化网络上运行,提供透明度并减少中心化金融机构的控制。

– Potential High Returns: Historically, Bitcoin has demonstrated the potential for substantial returns, appealing to speculative investors.

– 潜在的高回报:从历史上看,比特币已经证明了可观回报的潜力,对投机投资者有吸引力。

– Inflation Hedge: Many see Bitcoin as a digital gold, providing a hedge against inflation and currency devaluation.

– 通货膨胀对冲:许多人将比特币视为数字黄金,可以对冲通货膨胀和货币贬值。

Cons:

缺点:

– Volatility: The price of Bitcoin can be highly volatile, resulting in significant financial loss for unprepared investors.

– 波动性:比特币的价格可能会大幅波动,从而给没有准备的投资者带来重大的财务损失。

– Regulatory Uncertainty: The evolving regulatory landscape could impact Bitcoin’s accessibility and utility, affecting overall market sentiment.

– 监管不确定性:不断变化的监管环境可能会影响比特币的可及性和实用性,从而影响整体市场情绪。

– Security Concerns: The risk of hacking and fraud remains a significant concern, necessitating comprehensive security practices.

– 安全问题:黑客和欺诈的风险仍然是一个重大问题,因此需要采取全面的安全措施。

Controversies and External InfluencesThe cryptocurrency space is not without its controversies. Regulatory decisions worldwide could shape the future of Bitcoin, with potential crackdowns on crypto exchanges and ICOs influencing market stability. Furthermore, the ecological impact of Bitcoin mining continues to attract criticism from environmental groups, prompting discussions about sustainable alternatives.

争议和外部影响加密货币领域并非没有争议。全球范围内的监管决策可能会塑造比特币的未来,对加密货币交易所和 ICO 的潜在打击会影响市场稳定。此外,比特币挖矿的生态影响继续引起环保组织的批评,引发了关于可持续替代方案的讨论。

Investors considering Bitcoin should remain informed and cautious, recognizing both the opportunities and risks associated with this digital asset. As the cryptocurrency market navigates the complexities of a rapidly changing financial ecosystem, staying updated on market news, regulatory developments, and technological advancements is essential.

考虑比特币的投资者应保持知情和谨慎,认识到与这种数字资产相关的机会和风险。随着加密货币市场应对快速变化的金融生态系统的复杂性,及时了解市场新闻、监管发展和技术进步至关重要。

For more insights into the cryptocurrency market, visit Coindesk and Cointelegraph.

有关加密货币市场的更多见解,请访问 Coindesk 和 Cointelegraph。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.