|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

市场分析师和期权交易员越来越看好比特币 (BTC),许多人预测,无论谁入主白宫,其价格都可能飙升至 80,000 美元甚至更高。

As the US presidential election draws near, its potential impact on the cryptocurrency market is a subject of keen interest. While some anticipate a Bitcoin rally to $80,000 or higher, irrespective of the election outcome, others believe the results may influence Bitcoin's price trajectory. Here's a closer look at the recent market developments and analysts' perspectives:

随着美国总统大选的临近,其对加密货币市场的潜在影响备受关注。尽管一些人预计,无论选举结果如何,比特币都会上涨至 80,000 美元或更高,但另一些人则认为,选举结果可能会影响比特币的价格轨迹。以下是对近期市场发展和分析师观点的详细了解:

Bitcoin's recent price performance has been impressive, with a 66% gain in 2024. This resilience is notable amidst scaled-back expectations for Federal Reserve rate cuts and increased scrutiny of stablecoin Tether.

比特币最近的价格表现令人印象深刻,2024 年上涨了 66%。在美联储降息预期减弱和稳定币 Tether 审查加强的情况下,这种弹性非常引人注目。

Anticipating a Potential Surge to $80,000:

预计价格可能飙升至 80,000 美元:

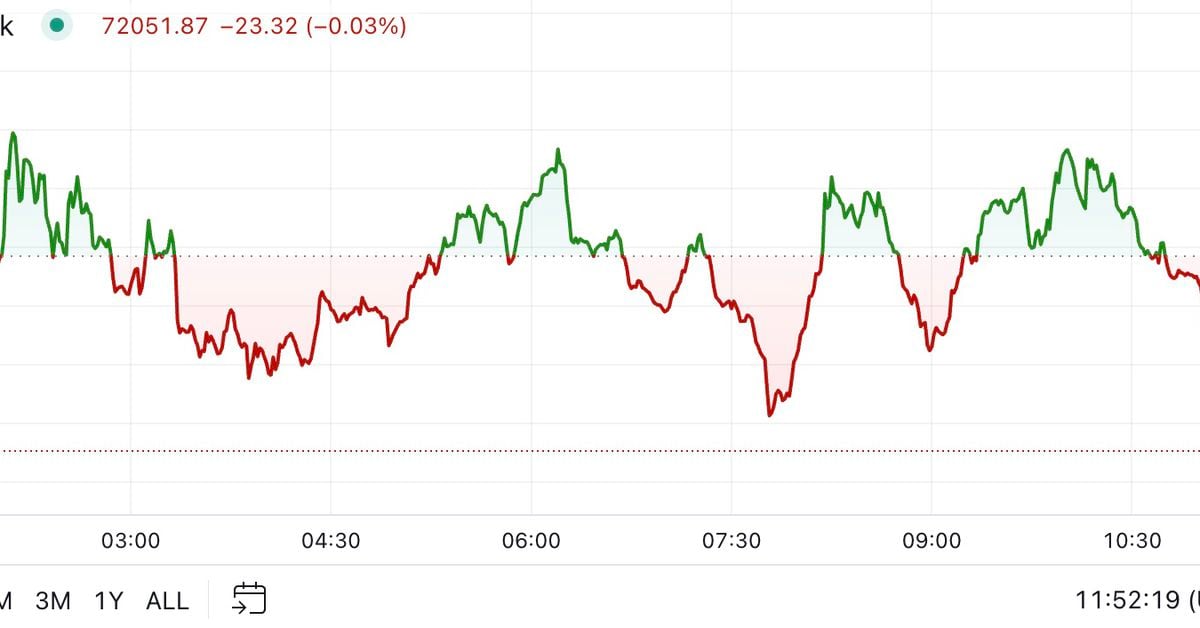

According to market analysts, Bitcoin's price movements are largely reflecting the anticipation surrounding the US election. Tony Sycamore, a market analyst at IG Australia Pty, highlights that a sustained break above $70,000 could pave the way for a new all-time high, potentially exceeding March's record of $73,798.

市场分析师表示,比特币的价格走势很大程度上反映了对美国大选的预期。 IG Australia Pty 市场分析师 Tony Sycamore 强调,持续突破 70,000 美元可能为历史新高铺平道路,有可能超过 3 月份创下的 73,798 美元纪录。

Standard Chartered's Geoffrey Kendrick also anticipates a strong correlation between the election outcome and Bitcoin's price trajectory. His analysis, based on options data and betting odds, predicts that Bitcoin will reach $73,000 by election day, with a further surge past $80,000 shortly after.

渣打银行的杰弗里·肯德里克还预计选举结果与比特币的价格轨迹之间存在很强的相关性。他根据期权数据和投注赔率进行分析,预测比特币到选举日将达到 73,000 美元,不久后将进一步飙升至 80,000 美元以上。

Options traders are also placing significant bets on a Bitcoin breakout, with a notable focus on call options at the $80,000 strike price for November and December expiry dates. This activity suggests a growing belief that Bitcoin will perform well regardless of the political outcome.

期权交易员也对比特币的突破进行了大量押注,特别关注 11 月和 12 月到期日执行价格为 80,000 美元的看涨期权。这一活动表明,人们越来越相信,无论政治结果如何,比特币都会表现良好。

David Lawant, head of research at FalconX, observes a "notable topside-heavy bias" in options activity surrounding the election. This indicates a collective belief that Bitcoin is poised to perform well irrespective of the political outcome.

FalconX 研究主管 David Lawant 观察到,围绕选举的期权活动存在“明显的上行偏重偏见”。这表明人们普遍相信,无论政治结果如何,比特币都将表现良好。

Yev Feldman, co-founder of SwapGlobal, points to the decreasing put-to-call ratio as further evidence of bullish sentiment. He adds that a post-election surge is more likely than a collapse, given the limited downside potential.

SwapGlobal 联合创始人 Yev Feldman 指出,看跌期权与看涨期权比率的下降进一步证明了看涨情绪。他补充说,鉴于下行潜力有限,大选后股市飙升的可能性比崩盘的可能性更大。

Several factors beyond the immediate impact of the election are also contributing to Bitcoin's positive momentum. These include its strong historical performance in the fourth quarter, especially in years following a halving event, and the growing institutional interest in the cryptocurrency.

除了选举的直接影响之外,还有几个因素也促进了比特币的积极势头。其中包括第四季度强劲的历史表现,尤其是在减半事件发生后的几年里,以及机构对加密货币日益增长的兴趣。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币(BTC)在创下历史新高后几乎没有变化

- 2024-10-30 22:30:12

- 本文最初发表于 CoinDesk 的每日新闻通讯 First Mover,介绍了加密货币市场的最新动态。

-

-

-

-

-

- Catzilla:Meme 硬币英雄,即将爆发式增长

- 2024-10-30 22:30:01

- 作为下个月首选的一部分,Catzilla 成为加密货币市场大幅收益的大胆竞争者。这不仅仅是另一个模因硬币

-

- EarthMeta:元宇宙房地产繁荣中的下一件大事

- 2024-10-30 22:30:01

- 虚拟房地产已迅速成为一个价值数十亿美元的产业,虚拟宇宙中的土地和房地产资产售价高达数百万美元。

-

-