|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARK Investment Management 最新的 2024 年第一季度 13F 文件突显了 Cathie Wood 的战略转变,包括增加 15 只新股以及特斯拉和 Roku 的持仓大幅增加。该文件还披露了 Coinbase Global 和 Twilio 的 8 项资产的剥离以及大幅减持。该投资组合目前共有 231 只股票,其中技术、医疗保健和通信服务领域的权重很大。

ARK Investment Unveils Strategic Shifts in Latest 13F Filing

ARK Investment 在最新 13F 文件中公布战略转变

ARK Investment Management, under the stewardship of renowned visionary Cathie Wood, has released its latest 13F filing, providing insights into the investment strategies employed during the first quarter of 2024. Driven by a firm belief in the transformative power of technological advancements, ARK continues to search for groundbreaking opportunities in industries such as artificial intelligence (AI), robotics, and blockchain technology.

在著名远见卓识者 Cathie Wood 的管理下,ARK 投资管理公司发布了最新的 13F 文件,提供了对 2024 年第一季度采用的投资策略的见解。在对技术进步的变革力量的坚定信念的推动下,ARK 继续寻找人工智能 (AI)、机器人和区块链技术等行业的突破性机会。

New Additions to the ARK Portfolio

ARK 产品组合新增内容

Wood's latest moves reflect a continued commitment to disruptive innovation. The firm welcomed 15 new stocks to its portfolio, including:

伍德的最新举措体现了对颠覆性创新的持续承诺。该公司的投资组合迎来了 15 只新股票,包括:

- ARK 21Shares Bitcoin ETF Beneficial Interest (ARKB), with 2,909,018 shares (1.43% of the portfolio), valued at $206.48 million.

- Standard BioTools Inc (NASDAQ: LAB), with 13,042,440 shares (0.24% of the portfolio), valued at $35.35 million.

- Natera Inc (NASDAQ: NTRA), with 322,384 shares (0.2% of the portfolio), valued at $29.49 million.

Significant Increases in Existing Holdings

ARK 21Shares 比特币 ETF 实益权益 (ARKB),拥有 2,909,018 股(占投资组合的 1.43%),价值 2.0648 亿美元。Standard BioTools Inc(纳斯达克股票代码:LAB),拥有 13,042,440 股(占投资组合的 0.24%),价值 3535 万美元.Natera Inc(纳斯达克股票代码:NTRA),拥有322,384股(占投资组合的0.2%),价值2,949万美元。现有持股大幅增加

ARK also increased its stakes in numerous existing holdings, particularly in:

ARK 还增持了众多现有股份,特别是:

- Tesla Inc (NASDAQ: TSLA), with an additional 1,375,910 shares, bringing the total to 5,178,429 shares (1.67% impact on the portfolio), valued at $910.32 million.

- Roku Inc (NASDAQ: ROKU), with an additional 3,027,775 shares, bringing the total to 12,556,647 (0.55% impact on the portfolio), valued at $818.32 million.

Divestments and Notable Decreases

Tesla Inc(纳斯达克股票代码:TSLA)增发 1,375,910 股,使总股数达到 5,178,429 股(对投资组合影响 1.67%),价值 9.1032 亿美元。 Roku Inc(纳斯达克股票代码:ROKU)增发 3,027,775 股,使总计 12,556,647(对投资组合影响 0.55%),价值 81832 万美元。 撤资和显着减少

To align with its evolving investment strategy, ARK has divested entirely from eight companies, including:

为了配合其不断发展的投资战略,ARK 已完全剥离八家公司,包括:

- SomaLogic Inc (SLGC), with all 14,241,979 shares sold (-0.21% impact on the portfolio).

- Invitae Corp (NVTAQ), with all 32,550,683 shares liquidated (-0.12% impact on the portfolio).

Significant reductions were made in the following companies:

SomaLogic Inc (SLGC),出售全部 14,241,979 股(对投资组合影响 -0.21%)。Invitae Corp (NVTAQ),清算全部 32,550,683 股(对投资组合影响 -0.12%)。以下公司大幅减持:

- Coinbase Global Inc (NASDAQ: COIN), with a reduction of 4,178,670 shares (-48.59% decrease, -4.31% impact on the portfolio).

- Twilio Inc (NYSE: TWLO), with a reduction of 6,187,545 shares (-86.78% decrease, -2.78% impact on the portfolio).

Portfolio Overview

Coinbase Global Inc(纳斯达克股票代码:COIN),减持 4,178,670 股(减持-48.59%,对投资组合影响-4.31%)。 Twilio Inc(纽约证券交易所代码:TWLO),减持 6,187,545 股(减持-86.78%,对投资组合影响-4.31%)。 -2.78% 对投资组合的影响)。投资组合概述

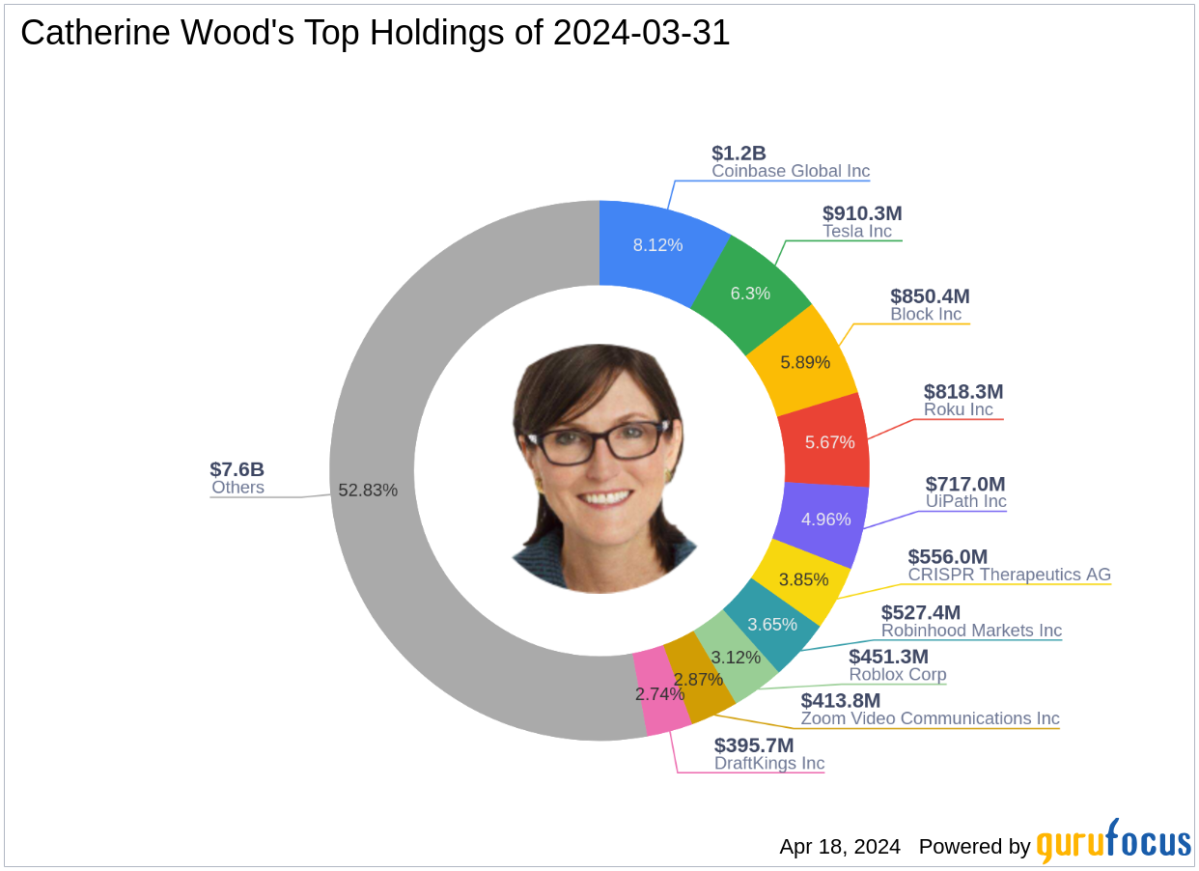

As of the first quarter of 2024, ARK's portfolio consists of 231 stocks, with top holdings including:

截至 2024 年第一季度,ARK 的投资组合由 231 只股票组成,其中重仓股包括:

- Coinbase Global Inc (8.12%)

- Tesla Inc (6.3%)

- Block Inc (5.89%)

- Roku Inc (5.67%)

- UiPath Inc (4.96%)

The investments span nine industries, including Technology, Healthcare, Communication Services, Financial Services, Consumer Cyclical, Industrials, Energy, Consumer Defensive, and Basic Materials.

Coinbase Global Inc (8.12%)Tesla Inc (6.3%)Block Inc (5.89%)Roku Inc (5.67%)UiPath Inc (4.96%)投资涉及九个行业,包括科技、医疗保健、通信服务、金融服务、周期性消费品、工业、能源、消费者防御和基础材料。

Conclusion

结论

ARK Investment Management's latest 13F filing paints a clear picture of Cathie Wood's unwavering focus on innovation. The firm's strategic shifts, including new additions, position increases, and divestments, reflect a commitment to identifying and capitalizing on businesses that can fundamentally reshape the future. ARK's track record of investing in disruptive technologies with long-term potential continues to drive its investment approach.

ARK Investment Management 最新的 13F 文件清楚地描绘了 Cathie Wood 对创新坚定不移的关注。该公司的战略转变,包括新增人员、增加职位和撤资,反映了对识别和利用能够从根本上重塑未来的业务的承诺。 ARK 在投资具有长期潜力的颠覆性技术方面的记录继续推动其投资方式。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- VERUM 和 PHALA 在市场看跌的情况下实现两位数增长

- 2024-12-29 01:25:56

- VERUM和PHALA的价格出现了两位数的涨幅,而比特币则回落至94,000美元的水平。

-

-

-

- Rollblock (RBLK):一种挑战市场趋势的新山寨币

- 2024-12-29 01:15:01

- 加密货币市场以其波动性而闻名,比特币在过去几周急剧下跌至 92,000 美元就证明了这一点。

-

-

- 随着比特币测试“最后一道防线”,比特币回调迫在眉睫

- 2024-12-29 01:10:01

- 比特币似乎即将进入关键修正阶段,9.2 万美元的水平将成为底线。

-

-

- 2024 年 12 月最值得购买的 5 种代币:揭开市场隐藏的瑰宝

- 2024-12-29 01:10:01

- 十二月即将结束,加密货币市场一片兴奋。投资者正在寻找 2024 年 12 月可购买的顶级代币