|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

ARK Investment Shifts Gears with Latest Portfolio Moves

Apr 19, 2024 at 03:09 am

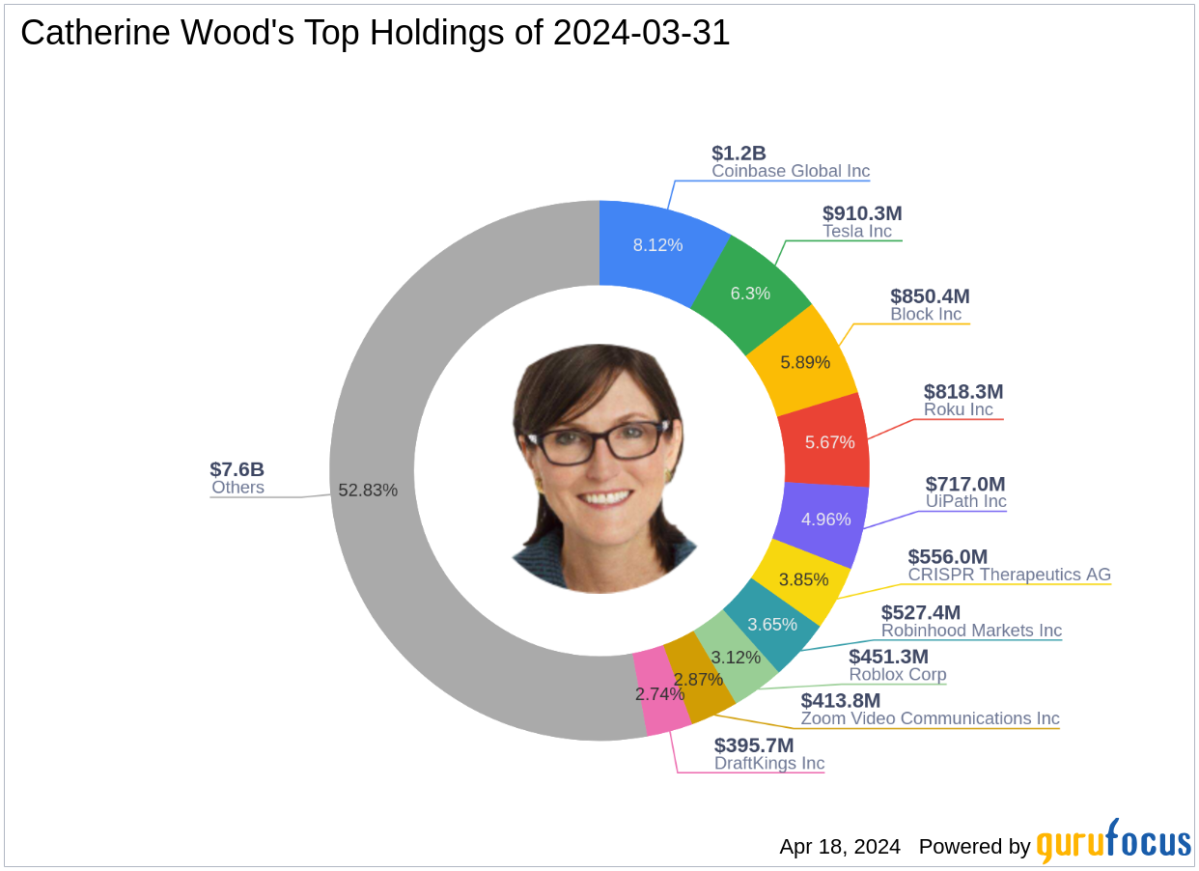

ARK Investment Management's latest 13F filing for Q1 2024 highlights Cathie Wood's strategic shifts, including the addition of 15 new stocks and significant position increases in Tesla and Roku. The filing also reveals divestitures from 8 holdings and notable reductions in Coinbase Global and Twilio. The portfolio now stands at 231 stocks, with significant weightings in technology, healthcare, and communication services.

ARK Investment Unveils Strategic Shifts in Latest 13F Filing

ARK Investment Management, under the stewardship of renowned visionary Cathie Wood, has released its latest 13F filing, providing insights into the investment strategies employed during the first quarter of 2024. Driven by a firm belief in the transformative power of technological advancements, ARK continues to search for groundbreaking opportunities in industries such as artificial intelligence (AI), robotics, and blockchain technology.

New Additions to the ARK Portfolio

Wood's latest moves reflect a continued commitment to disruptive innovation. The firm welcomed 15 new stocks to its portfolio, including:

- ARK 21Shares Bitcoin ETF Beneficial Interest (ARKB), with 2,909,018 shares (1.43% of the portfolio), valued at $206.48 million.

- Standard BioTools Inc (NASDAQ: LAB), with 13,042,440 shares (0.24% of the portfolio), valued at $35.35 million.

- Natera Inc (NASDAQ: NTRA), with 322,384 shares (0.2% of the portfolio), valued at $29.49 million.

Significant Increases in Existing Holdings

ARK also increased its stakes in numerous existing holdings, particularly in:

- Tesla Inc (NASDAQ: TSLA), with an additional 1,375,910 shares, bringing the total to 5,178,429 shares (1.67% impact on the portfolio), valued at $910.32 million.

- Roku Inc (NASDAQ: ROKU), with an additional 3,027,775 shares, bringing the total to 12,556,647 (0.55% impact on the portfolio), valued at $818.32 million.

Divestments and Notable Decreases

To align with its evolving investment strategy, ARK has divested entirely from eight companies, including:

- SomaLogic Inc (SLGC), with all 14,241,979 shares sold (-0.21% impact on the portfolio).

- Invitae Corp (NVTAQ), with all 32,550,683 shares liquidated (-0.12% impact on the portfolio).

Significant reductions were made in the following companies:

- Coinbase Global Inc (NASDAQ: COIN), with a reduction of 4,178,670 shares (-48.59% decrease, -4.31% impact on the portfolio).

- Twilio Inc (NYSE: TWLO), with a reduction of 6,187,545 shares (-86.78% decrease, -2.78% impact on the portfolio).

Portfolio Overview

As of the first quarter of 2024, ARK's portfolio consists of 231 stocks, with top holdings including:

- Coinbase Global Inc (8.12%)

- Tesla Inc (6.3%)

- Block Inc (5.89%)

- Roku Inc (5.67%)

- UiPath Inc (4.96%)

The investments span nine industries, including Technology, Healthcare, Communication Services, Financial Services, Consumer Cyclical, Industrials, Energy, Consumer Defensive, and Basic Materials.

Conclusion

ARK Investment Management's latest 13F filing paints a clear picture of Cathie Wood's unwavering focus on innovation. The firm's strategic shifts, including new additions, position increases, and divestments, reflect a commitment to identifying and capitalizing on businesses that can fundamentally reshape the future. ARK's track record of investing in disruptive technologies with long-term potential continues to drive its investment approach.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Rexas Finance (RXS) Will Outperform XRP and SUI, Eyes $17 from Current Price of $0.15

- Dec 29, 2024 at 01:10 am

- The cryptocurrency market is buzzing with bullish projections, particularly for XRP and Sui. While both tokens demonstrate impressive growth potential, Rexas Finance (RXS) is a dark horse poised to outperform them all. With a groundbreaking ecosystem and a rapidly advancing presale, RXS is set to transform real-world asset ownership through blockchain technology. Let’s explore why Rexas Finance is the one to watch and how it compares to XRP and Sui.

-

-

-

- The "Xmas Rally" Unveiled: Bitcoin Rate Predictions for 2025 and Smart Investment Strategies

- Dec 29, 2024 at 01:10 am

- As the cryptocurrency market evolves, investors are keenly analyzing projections for future growth and potential risks. By 2025, numerous analysts predict that Bitcoin could reach unprecedented heights

-