|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VeChain [VET] 最近突破了多年的下降通道,引發了新的看漲樂觀情緒並引起了廣泛關注。

VeChain [VET] recently broke out of a multi-year descending channel, sparking bullish sentiment and close monitoring. At press time, VET was trading at $0.03254, showcasing a 0.82% decline over the last 24 hours.

VeChain [VET] 最近突破了多年的下降通道,引發了看漲情緒和密切關注。截至發稿時,VET 交易價格為 0.03254 美元,在過去 24 小時內下跌了 0.82%。

The token had dropped from $0.035 in recent days, and social dominance had decreased from 0.242% the previous day to 0.181%. Despite these declines, can VET sustain its breakout and move toward $0.05?

代幣從近幾天的0.035美元下跌,社交支配力從前一天的0.242%下降到0.181%。儘管這些下跌,VET 能否維持突破並走向 0.05 美元?

2 factors hint at a bullish continuationVET’s breakout positioned it close to the key $0.035 resistance level. A strong daily close above this level could pave the way for a rally to $0.05, a major target supported by the 4.236 Fibonacci extension level.

兩個因素暗示看漲持續 VET 的突破使其接近 0.035 美元的關鍵阻力位。每日強勁收盤價高於該水準可能為反彈至 0.05 美元鋪平道路,該目標受到 4.236 斐波那契擴展位的支撐。

However, the Fibonacci retracement also highlighted $0.0319 as an important support zone if prices consolidate.

然而,如果價格盤整,斐波那契回檔也強調 0.0319 美元是重要的支撐區域。

On the daily chart, the Relative Strength Index (RSI) sat at 64.8 at press time. While this meant that momentum was still bullish, it also signaled a cautious approach as VET neared overbought territory.

日線圖上,截至發稿時相對強弱指數 (RSI) 為 64.8。雖然這意味著勢頭仍然看漲,但也表明隨著 VET 接近超買區域,投資者將採取謹慎態度。

Therefore, if buying activity strengthens, the price could break above resistance levels and continue its upward movement.

因此,如果購買活動加強,價格可能會突破阻力位並繼續上漲。

Social dominance reflects mixed sentimentSocial dominance for VET had declined from 0.242% the previous day to its press time level of 0.181%. This significant drop showed reduced discussions around VET on social platforms, which could slow down speculative interest.

社會主導地位反映了複雜的情緒 VET 的社會主導地位已從前一天的 0.242% 下降至發稿時的 0.181%。這一顯著下降表明社交平台上有關職業教育與培訓的討論減少,這可能會減緩投機興趣。

Consequently, higher engagement and renewed social activity were needed to maintain the momentum and attract more traders into the market.

因此,需要更高的參與度和新的社交活動來保持動力並吸引更多交易者進入市場。

Liquidation data reveals potential volatilityLiquidation metrics showed that $41.5K worth of long positions had been liquidated, compared to just $5.96K in shorts. This imbalance suggested that bullish traders still dominate, but it also highlighted the potential for volatility.

清算數據揭示了潛在的波動性清算指標顯示,價值 4.15 萬美元的多頭部位已被清算,而空頭部位僅為 596 萬美元。這種不平衡顯示看漲交易者仍占主導地位,但也凸顯了波動的可能性。

If long liquidations increase further, this could negatively impact VET’s ability to sustain its current levels.

如果多頭清算進一步增加,可能會對 VET 維持目前水準的能力產生負面影響。

Open Interest points to increasing confidenceOpen Interest for VET had risen by 0.69%, reaching $48.94 million. This steady increase indicated growing trader confidence and market activity around VET.

未平倉合約顯示信心增強 VET 未平倉合約上升了 0.69%,達到 4,894 萬美元。這種穩定成長表明交易者對 VET 的信心和市場活動不斷增強。

While rising Open Interest often supports sustained price movements, it may also lead to heightened price volatility, especially as VET approaches critical resistance levels.

雖然未平倉量的上升通常會支撐價格的持續波動,但也可能導致價格波動加劇,特別是當 VET 接近關鍵阻力位時。

Will VET hold its breakout?VeChain’s breakout from the descending channel has positioned it for a potential rally toward $0.05.

VET 會保持突破嗎?

However, the decline from $0.035 and reduced social dominance suggested challenges in sustaining momentum.

然而,從 0.035 美元的下跌和社會主導地位的下降表明維持勢頭面臨挑戰。

If VET closes above $0.035 with renewed volume and engagement, a rally to $0.05 is likely. Failing to hold current levels, however, could lead to short-term consolidation. For now, the bias remains cautiously bullish.

如果 VET 收盤價高於 0.035 美元,且交易量和參與度有所恢復,則可能會反彈至 0.05 美元。然而,如果未能保持當前水平,可能會導致短期盤整。目前,市場仍持謹慎看漲傾向。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

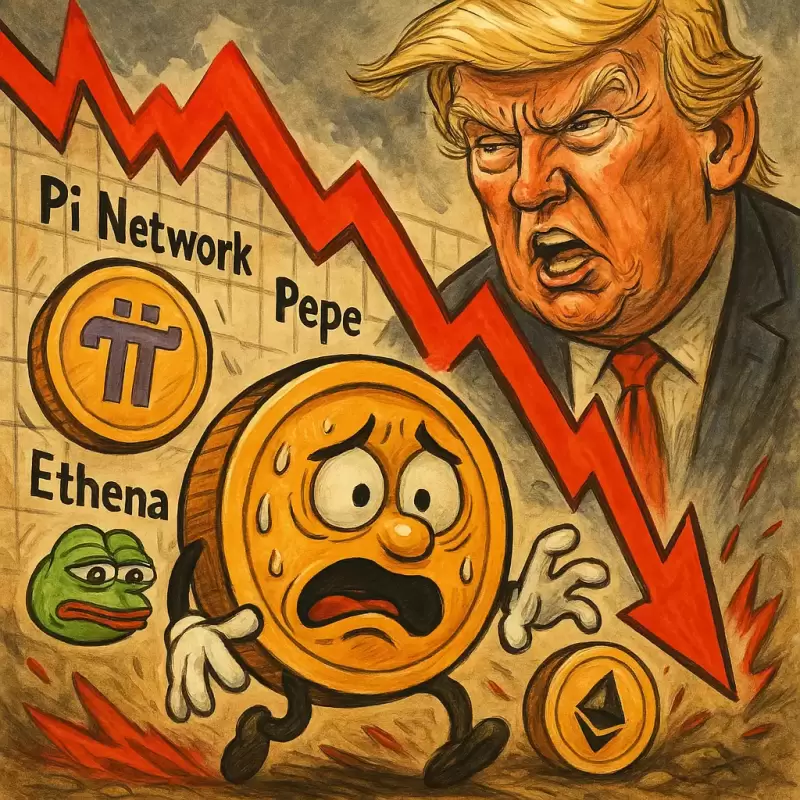

- 比特幣和許多加密硬幣在星期四急劇潛水

- 2025-04-04 13:45:12

- PI Network受到了最大的打擊之一,跌至0.56美元的新低點,標誌著2月的高峰下降了80%。

-

-

-

-

- 如果您在模因硬幣上睡覺,那麼聚會已經很晚了。

- 2025-04-04 13:35:12

- 這些古怪的加密貨幣正在從利基市場轉移到主流,現在,模因硬幣比以往任何時候都更加認真。

-

-

- 全新的加密機會已經到來

- 2025-04-04 13:30:12

- Magacoin Finance是市場上最新的加密貨幣預售 - 它已經在早期投資者中獲得了嚴重的吸引力。

-

- 以太坊和Ripple的混合信號使投資者正在尋找更多

- 2025-04-04 13:30:12

- 以太坊(ETH)和Ripple(XRP)長期以來一直被視為Crypto最值得信賴的山寨幣之一。

-