|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

尋求獲利機會的交易者可以利用幣安上新上市的代幣。儘管具有高流動性和透過空投或獎勵獲得代幣的優勢,但保持洞察力並避免成為退出流動性的工具至關重要。透過利用技術分析、監控做市商行為,並遵循順應趨勢、設定適當停損水準等原則,交易者可以有效應對新上市幣種的波動。

Unlocking Profitable Opportunities with Newly Listed Coins on Binance: A Comprehensive Guide for Traders

利用幣安新上市的代幣釋放獲利機會:交易者綜合指南

In the fast-paced world of cryptocurrency trading, the arrival of new tokens on major exchanges presents a unique opportunity for savvy traders to capitalize on price volatility and market trends. Binance, the world's foremost cryptocurrency exchange, stands out for its unparalleled liquidity, making it a prime destination for traders seeking to profit from newly listed coins. This comprehensive guide will provide an in-depth analysis of how traders can harness the power of Binance's platform to maximize their earnings.

在快節奏的加密貨幣交易世界中,主要交易所新代幣的到來為精明的交易者提供了利用價格波動和市場趨勢的獨特機會。幣安是世界上最重要的加密貨幣交易所,以其無與倫比的流動性而脫穎而出,使其成為尋求從新上市加密貨幣中獲利的交易者的主要目的地。這份綜合指南將深入分析交易者如何利用幣安平台的力量來最大化他們的收入。

Why Binance? The Liquidity Advantage

為什麼選擇幣安?流動性優勢

Binance has established itself as a global leader in cryptocurrency trading, amassing an unparalleled level of liquidity that is unmatched by its competitors. This liquidity ensures that traders can execute trades swiftly, without concerns about liquidity starvation. Moreover, the sheer volume of transactions on Binance attracts a substantial number of new tokens eager to gain access to this vast market. This influx of new listings provides traders with ample opportunities to identify promising coins and profit from their price movements.

幣安已成為加密貨幣交易的全球領導者,累積了競爭對手無法比擬的無與倫比的流動性水準。這種流動性確保交易者可以快速執行交易,而不必擔心流動性匱乏。此外,幣安上的龐大交易量吸引了大量渴望進入這個廣大市場的新代幣。新上市的貨幣的湧入為交易者提供了充足的機會來識別有前途的硬幣並從其價格變動中獲利。

Navigating New Listings: A Step-by-Step Approach

瀏覽新清單:循序漸進的方法

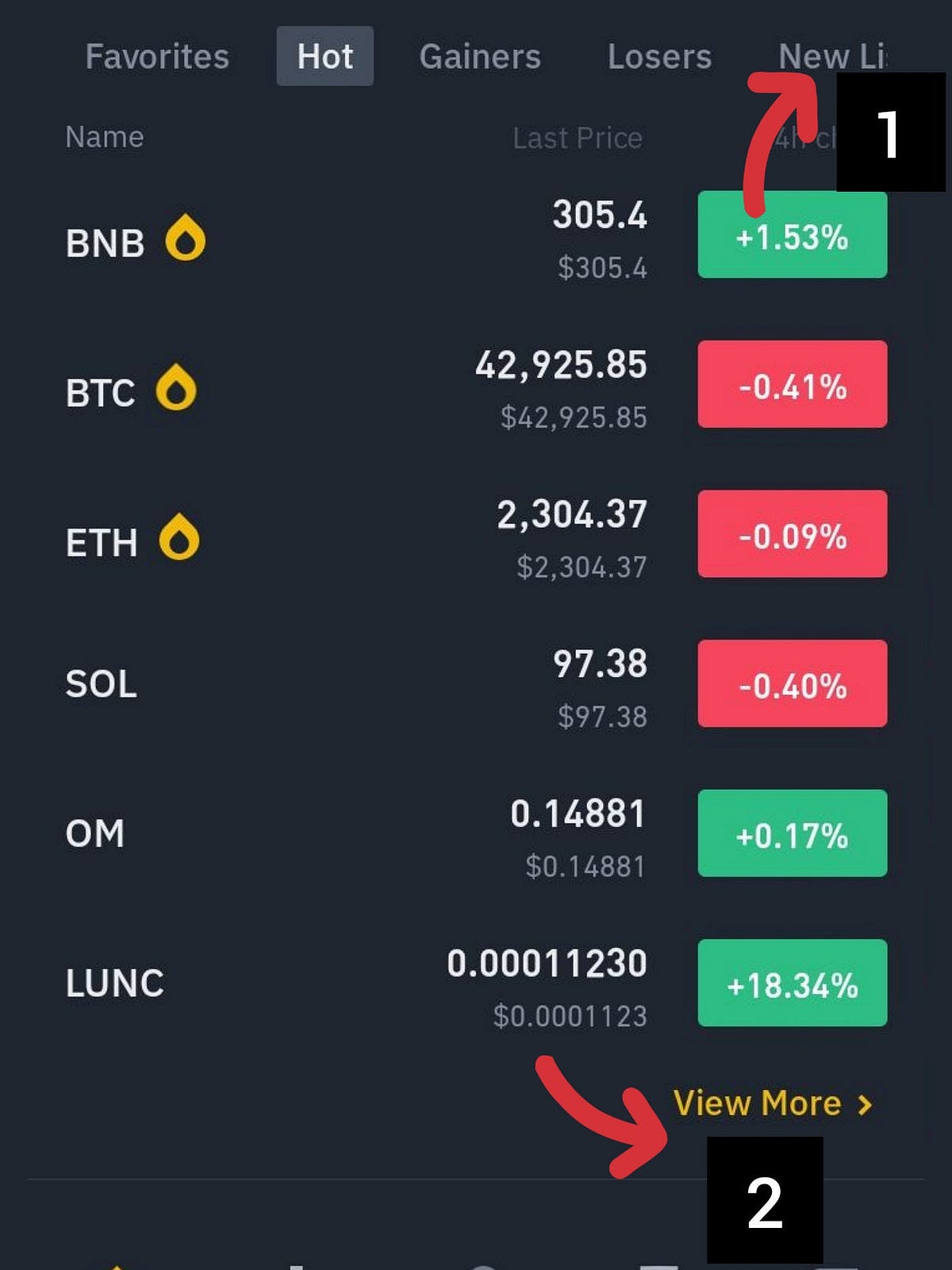

To access the New Listings section on Binance, begin by accessing your trading account and navigating to the homepage. Locate the section labeled "New Listings" and click on it. You will be presented with a comprehensive list of recently launched tokens. For illustrative purposes, let's delve into the JUP-USDT pair as an example.

要存取幣安上的新清單部分,請先造訪您的交易帳戶並導航至主頁。找到標有“新列表”的部分並單擊它。您將看到最近推出的代幣的完整清單。為了方便說明,我們以 JUP-USDT 貨幣對為例進行深入研究。

Avoid Launch Day Pitfalls: A Prudent Approach

避免發布日陷阱:謹慎的方法

As tempting as it may be to jump in on the action of a newly listed coin on its launch date, it is important to exercise caution. Market makers may seize this opportunity to unload their tokens onto unsuspecting buyers, leading to potential losses. Instead, adopt a prudent approach by adding the coin to your watchlist, closing the trading application, and revisiting it the following day to gather more data. This will allow you to make more informed decisions based on a more comprehensive understanding of market dynamics.

儘管在新上市的代幣發行之日參與其中可能很誘人,但謹慎行事很重要。做市商可能會抓住這個機會將代幣拋售給毫無戒心的買家,從而導致潛在的損失。相反,應採取謹慎的方法,將代幣添加到您的觀察列表中,關閉交易應用程序,並在第二天重新訪問它以收集更多數據。這將使您能夠根據對市場動態的更全面的了解做出更明智的決策。

Quants vs. Retail Traders: Navigating the Algorithmic Advantage

量化交易員與散戶交易員:發揮演算法優勢

When new projects debut on major centralized exchanges, traders utilizing algorithmic trading software often have an advantage, executing orders in mere seconds or minutes. As a retail trader, it can be challenging to compete directly with these trading bots. Instead, adopt a strategy of patience and observation, watching how market makers operate over several hours or days.

當新項目在主要中心化交易所首次亮相時,使用演算法交易軟體的交易者通常具有優勢,只需幾秒鐘或幾分鐘即可執行訂單。作為零售交易者,直接與這些交易機器人競爭可能具有挑戰性。相反,採取耐心和觀察的策略,觀察做市商在幾個小時或幾天內如何運作。

Employing Technical Analysis: Identifying Market Trends

採用技術分析:識別市場趨勢

After allowing some time for market forces to stabilize, it's time to incorporate technical analysis into your trading strategy. Adjust the chart timeframe to 1-hour and add the Exponential Moving Average (EMA) with a period of 20. This will provide insights into the asset's interaction with this key technical indicator.

在讓市場力量穩定一段時間後,是時候將技術分析納入您的交易策略了。將圖表時間範圍調整為 1 小時,並添加週期為 20 的指數移動平均線 (EMA)。這將提供有關資產與此關鍵技術指標相互作用的見解。

Bullish Momentum: Identifying Buy Opportunities

看漲勢頭:識別買進機會

If the asset breaks above the 20 EMA on the 1-hour timeframe and conclusively closes a green candle, this signals bullish momentum and presents a potential opportunity to initiate a buy position. Consider taking a small position and await confirmation on the 4-hour timeframe.

如果資產在 1 小時時間範圍內突破 20 EMA 並最終收盤為綠色蠟燭,則表明看漲勢頭,並提供了啟動買入頭寸的潛在機會。考慮持有少量頭寸並等待 4 小時時間框架的確認。

Bearish Trend: Exercising Caution

看跌趨勢:謹慎行事

Conversely, if the pair is trading below the 20 EMA on the 1-hour timeframe, maintain a cautious stance and refrain from entering the market. Avoid succumbing to panic or FOMO (Fear of Missing Out). Monitor the pair closely for any changes in market sentiment.

相反,如果該貨幣對在 1 小時時間範圍內交投於 20 EMA 下方,則保持謹慎立場,避免入市。避免陷入恐慌或 FOMO(害怕錯過)。密切注意該貨幣對市場情緒的任何變化。

Higher Timeframe Analysis: Assessing Long-Term Trends

較高的時間範圍分析:評估長期趨勢

For a more comprehensive assessment of market dynamics, adjust the chart timeframe to 4-hours. Incorporate the EMA 100 and EMA 20 to identify longer-term trends. Stick to the principle of trading with the trend to maximize profitability.

為了更全面地評估市場動態,請將圖表時間範圍調整為 4 小時。結合 EMA 100 和 EMA 20 來確定長期趨勢。堅持順勢交易原則,獲利最大化。

Identifying Entry and Exit Points: A Disciplined Approach

確定進入點和退出點:嚴格的方法

Wait for the asset to breach and conclusively close above the 20-EMA on the 4-hour timeframe before considering "Buy" positions. Upon entering a position, set your stop loss below the preceding 4-hour candle to mitigate risk. Employ Fibonacci levels and EMAs to identify potential support and resistance zones.

等待資產在 4 小時時間範圍內突破並最終收於 20 均線上方,然後再考慮「買入」頭寸。建倉後,將停損設置在前 4 小時蠟燭下方以降低風險。利用斐波那契水平和 EMA 來確定潛在的支撐和阻力區域。

Leverage: A Double-Edged Sword

槓桿:一把雙面刃

This strategy is best implemented without leverage due to the high volatility of newly listed coins. While leverage can amplify potential profits, it also magnifies losses. Prudent risk management is paramount.

由於新上市代幣的高波動性,該策略最好在沒有槓桿的情況下實施。槓桿雖然可以放大潛在利潤,但也會放大損失。審慎的風險管理至關重要。

Take-Profit Targets: Securing Gains

止盈目標:確保收益

When using the 4-hour timeframe, consider capturing partial profits when the pair breaches and conclusively closes below the 20 EMA for the first time. Adjust your stop loss above the entry point to safeguard some profits while allowing 60% of your position to remain active.

使用 4 小時時間框架時,請考慮在貨幣對首次突破並最終收於 20 EMA 以下時獲取部分利潤。將停損調整至入場點上方,以保障部分利潤,同時允許 60% 的部位保持活躍。

Bearish Scenario: Damage Control

看跌情景:損害控制

Incorporate the 200 EMA into your 1-hour timeframe analysis for additional insights. The 200 EMA typically acts as a support level, but a break below it can signal a bearish trend. Monitor price movements closely and manage risk accordingly.

將 200 EMA 納入您的 1 小時時間範圍分析中以獲得更多見解。 200 EMA 通常充當支撐位,但跌破該水準可能預示看跌趨勢。密切監控價格變動並相應地管理風險。

Conclusion: A Path to Profitability

結論:獲利之路

Mastering the art of trading newly listed coins on Binance requires patience, discipline, and a keen eye for market trends. By employing the strategies outlined in this comprehensive guide, you can harness the power of Binance's liquidity to identify profitable opportunities, minimize risk, and maximize your earnings in the ever-evolving world of cryptocurrency trading.

掌握在幣安上交易新上市代幣的藝術需要耐心、紀律和對市場趨勢的敏銳洞察力。透過採用本綜合指南中概述的策略,您可以利用幣安流動性的力量,在不斷發展的加密貨幣交易世界中識別獲利機會、最小化風險並最大化您的收益。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 亞洲股市波動,美元維持上漲,比特幣創下新紀錄

- 2024-11-07 15:35:02

- 週三,所謂的川普交易進入超速狀態,因為這位大亨將在擊敗民主黨人卡馬拉·哈里斯後重返白宮

-

- ADA 價格預測:未來的嚴峻情勢

- 2024-11-07 15:35:02

- 山寨幣是“除比特幣之外的任何東西”,但卡爾達諾已經存在了很長時間,它基本上是“建立”的,並且是原始加密貨幣集的一部分

-

- 川普獲勝,比特幣蓬勃發展:下一步何去何從?

- 2024-11-07 15:35:02

- 比特幣的復興幾乎與唐納德·川普一樣令人印象深刻,並讓加密貨幣愛好者歡呼雀躍。

-

- 隨著加密貨幣情緒走強,比特幣維持在 74,838 美元,以太幣和 Chainlink 飆升

- 2024-11-07 15:35:02

- 隨著唐納德·川普最近在美國總統大選中獲勝,加密貨幣市場的熱情高漲,活動活躍。

-

-

-

- XRP Ledger (XRPL) 上的活躍帳戶數量創七個月新高

- 2024-11-07 15:00:01

- XRP 生態系最近特別活躍; XRP Ledger (XRPL) 的活躍帳戶數量創下七個月以來的新高。

-

-

- 選舉炒作引發的狗狗幣價格展望

- 2024-11-07 14:35:02

- 選舉季正在推動加密貨幣市場的活動,而 DOGE 也是其中的一部分。其交易價格為 0.1723 美元,上週上漲超過 3%。