|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

目前主要的加密貨幣贏家:MAPLE (MPL)、Pendle (PENDLE)、Mega Cube (DICE)、Synthetix (SNX) 和 Sprint (DASH)

2024/07/20 08:45

當我們踏上尋找當今主要贏家的旅程時,讓我們簡要了解一下世界加密貨幣市場的最新特徵。

Bitcoin whales went on a shopping for spree in the course of the latest market downturn, accumulating 71,000 BTC on the quickest fee since April 2023, when a number of U.S. banks collapsed. This surge in whale exercise coincides with Bitcoin’s dip to $54,200 on July 5, as highlighted by CryptoQuant.

在最近的市場低迷期間,比特幣鯨魚繼續瘋狂購買,以自 2023 年 4 月多家美國銀行倒閉以來最快的速度累積了 71,000 BTC。正如 CryptoQuant 所強調的那樣,鯨魚活動的激增恰逢 7 月 5 日比特幣跌至 54,200 美元。

Whereas smaller merchants offloaded their holdings, a internet improve of 261 wallets holding at the very least 10 BTC was noticed in early July, indicating long-term bullish sentiment. However not all whales adopted this pattern; a dormant whale transferred 1,000 BTC price almost $60 million after a 12-year hiatus. Presently, BTC is buying and selling at $62,500, rebounding from latest lows amid market challenges.

儘管小型商家紛紛拋售比特幣,但 7 月初,網路上有 261 個錢包持有至少 10 比特幣,數量有所增加,這表明長期看漲情緒。然而,並非所有鯨魚都採用這種模式。一隻休眠鯨魚在中斷 12 年後以近 6000 萬美元的價格轉移了 1,000 個 BTC。目前,BTC 的交易價格為 62,500 美元,在市場挑戰中從最新低點反彈。

At this time’s choose of prime crypto gainers highlights a spectrum of resilience and volatility. Maple and Pendle have demonstrated exceptional progress and innovation, with Maple excelling in decentralized company credit score markets and Pendle pioneering the tokenization of future yields. Synthetix and Sprint, then again, current a distinction with their distinctive worth propositions. Synthetix focuses on artificial asset buying and selling, whereas Sprint emphasizes quick, personal funds.

此時對主要加密貨幣上漲者的選擇凸顯了一系列的彈性和波動性。 Maple 和 Pendle 展現了非凡的進步和創新,其中 Maple 在去中心化公司信用評分市場中表現出色,而 Pendle 則開創了未來收益率的代幣化。 Synthetix 和 Sprint 再次以其獨特的價值主張脫穎而出。 Synthetix 專注於人工資產買賣,而 Sprint 則強調快速的個人資金。

Whereas Maple and Pendle boast spectacular year-over-year efficiency and strong buying and selling above their 200-day easy shifting averages, Synthetix and Sprint each exhibit challenges of their long-term market outlook. They commerce beneath their 200-day SMA and present declines over the previous 12 months. Let’s delve into every of those to evaluate their potential for inclusion in a portfolio.

雖然 Maple 和 Pendle 擁有驚人的同比效率以及高於 200 天輕鬆移動平均線的強勁買賣,但 Synthetix 和 Sprint 各自的長期市場前景都面臨挑戰。它們的交易價格低於 200 日移動平均線,並且在過去 12 個月中呈現下降趨勢。讓我們深入研究其中的每一個,以評估它們納入投資組合的潛力。

1. MAPLE (MPL)

1. 楓樹 (MPL)

楓 (MPL) is a governance token for the Maple platform, a decentralized company credit score market that gives clear, on-chain financing for debtors and sustainable yield for liquidity suppliers. Managed by Pool Delegates, Maple’s lending swimming pools carry out due diligence and set mortgage phrases.

楓 (MPL) 是 Maple 平台的治理代幣,Maple 平台是一個去中心化的公司信用評分市場,為債務人提供清晰的鏈上融資,並為流動性供應商提供可持續的收益。 Maple 的貸款池由池代表管理,進行盡職調查並設定抵押貸款期限。

MPL holders can take part in governance, share in payment revenues, and stake insurance coverage. In essence, Maple connects institutional lenders with debtors, merging compliance with good contract effectivity. Institutional debtors safe under-collateralized loans with out concern of liquidation, whereas liquidity suppliers earn yields from diversified publicity to top-tier crypto establishments.

MPL 持有者可以參與治理、分享支付收入和權益保險。從本質上講,Maple 將機構貸方與債務人聯繫起來,將合規性與良好的合約有效性結合起來。機構債務人可以保護抵押不足的貸款,而不必擔心清算,而流動性提供者則透過對頂級加密貨幣機構的多元化宣傳來賺取收益。

On July 9, 2024, Maple introduced a partnership with Zodia Custody, a digital asset custodian backed by Normal Chartered and others. Zodia Custody will maintain collateral pledged to Maple, enhancing safety and compliance for institutional shoppers. The partnership additionally permits Zodia Custody wallets to help the Maple token, maximizing returns for establishments in high-interest environments.

2024 年 7 月 9 日,Maple 與 Zodia Custody 建立了合作夥伴關係,Zodia Custody 是一家由 Normal Chartered 等公司支持的數位資產託管機構。 Zodia Custody 將保留向 Maple 承諾的抵押品,以增強機構購物者的安全性和合規性。該合作夥伴關係還允許 Zodia Custody 錢包支援 Maple 代幣,從而最大限度地提高高利率環境中企業的回報。

“We’re excited to announce a strategic partnership with @ZodiaCustody, a number one institution-first digital asset custodian to additional progress Maple’s purpose to be the house of digital asset lending and borrowing within the house.”

“我們很高興宣布與@ZodiaCustody 建立戰略合作夥伴關係,@ZodiaCustody 是一家機構優先的數位資產託管機構,以進一步推進 Maple 成為數位資產借貸之家的目標。”

Learn extra right here: https://t.co/ov2KpyMwEX

在這裡了解更多:https://t.co/ov2KpyMwEX

— Maple (@ETHCC) (@maplefinance) July 9, 2024

- Maple (@ETHCC) (@maplefinance) 2024 年 7 月 9 日

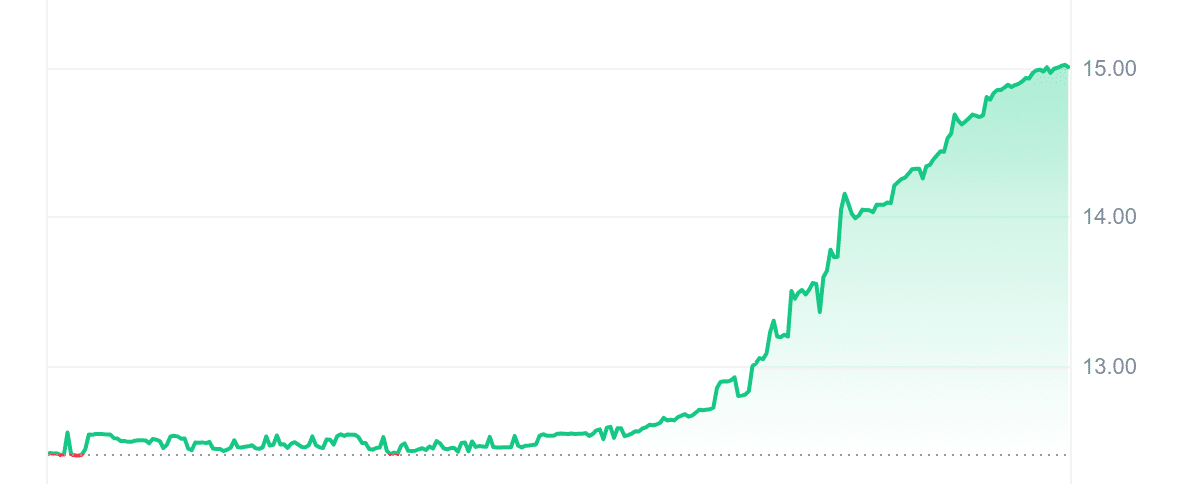

At present, MPL is valued at $14.89, up 20.06% in 24 hours. Its liquidity is strong, with a volume-to-market cap ratio of 0.0324. The 14-day RSI of 43.41 suggests it’s in a impartial zone, prone to commerce sideways. Over the previous 30 days, MPL has had 14 inexperienced days (47%), and its volatility is comfortably low at 5%. Remarkably, MPL is buying and selling 61.52% above its 200-day SMA of $9.22, exhibiting important energy in comparison with Sprint, which is struggling beneath its 200-day SMA. MPL’s worth has risen by 122% within the final 12 months, outperforming 67% of the highest 100 crypto property, a stark distinction to Synthetix’s efficiency.

目前MPL估值為14.89美元,24小時上漲20.06%。其流動性強勁,成交量與市值比率為0.0324。 14 天 RSI 為 43.41,表示它處於中立區域,容易出現橫盤整理。在過去的 30 天裡,MPL 有 14 天沒有交易(47%),其波動性低至 5%。值得注意的是,MPL 的買賣價格高於 9.22 美元的 200 日移動平均線 61.52%,與在 200 日移動平均線下方苦苦掙扎的 Sprint 相比,表現出重要的能量。 MPL 的價值在過去 12 個月內上漲了 122%,超過了前 100 名的加密資產的 67%,這與 Synthetix 的效率形成了鮮明對比。

2. Pendle (PENDLE)

2. 彭德爾(PENDLE)

Pendle is a DeFi protocol that focuses on tokenizing and buying and selling future yields. By permitting customers to separate the possession of the underlying asset from its future yield, Pendle permits the creation of recent monetary devices that may be traded on its platform.

Pendle 是一種 DeFi 協議,專注於代幣化以及買賣未來收益率。透過允許客戶將標的資產的所有權與其未來收益分開,Pendle 允許創建可在其平台上交易的最新貨幣工具。

The core of Pendle’s providing is its automated market maker (AMM), designed to help property that have time decay, addressing the problem of valuing future yields, which may fluctuate based mostly on quite a few components. This design is pivotal in offering customers extra management over future yield, providing them optionality and alternatives for its utilization.

Pendle 服務的核心是其自動做市商 (AMM),旨在幫助具有時間衰減的資產,解決對未來收益率進行估值的問題,該收益率可能主要根據多種因素而波動。這種設計對於為客戶提供對未來產量的額外管理、為其利用提供選擇性和替代方案至關重要。

Pendle’s major makes use of embrace staking to safe the community, yield farming to optimize earnings, governance participation, and liquidity provision. Its safety framework additionally contains complete audits, rigorous code opinions, and steady monitoring

Pendle 的專業利用擁抱質押來保障社區安全,利用流動性挖礦來優化收益、治理參與和流動性供應。其安全框架還包含完整的審計、嚴格的程式碼意見和穩定的監控

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣 Coinbase 溢價缺口剛剛大幅下降

- 2024-11-22 06:20:02

- 數據顯示,在 BTC 最新高點突破 98,000 美元之後,比特幣 Coinbase 溢價缺口已陷入負值區域。

-

-

- 破產加密貨幣交易所FTX宣布重整計畫將於2025年1月生效

- 2024-11-22 06:20:02

- 在最近的新聞稿中,FTX 聲稱已準備好繼續實施法院批准的重組計劃

-

- 比特幣 (BTC) 觸及 97,900 美元的歷史新高,引發投資者興奮

- 2024-11-22 06:20:02

- 由於市場情緒仍然極度樂觀,比特幣在幾個小時前創下了歷史新高,達到 97,900 美元。

-

-

- RCO Finance、Floki、Tron:揭開加密貨幣世界的隱藏瑰寶

- 2024-11-22 06:20:02

- 隱藏在廣闊的加密貨幣世界中,幾種新興貨幣以其高回報的承諾引起了投資者的興趣。

-

- Propichain:將房地產投資者變成百萬富翁

- 2024-11-22 06:20:02

- Propichain (PCHAIN) 是一個加密項目,旨在改變房地產投資,同時為用戶提供一系列有益的方法。

-

-