|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美國現貨比特幣(BTC)交易所交易基金(ETF)在持續的加密市場校正中發布了幾週內最大的流入。

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) are reporting their largest inflows in weeks amid a period of sustained crypto market correction. Conversely, Ethereum (ETH) funds are still seeing outflows, though at a slowing pace.

美國現貨比特幣(BTC)交易所交易基金(ETF)在一周的加密市場糾正期間報告了幾週內最大的流入。相反,以太坊(ETH)資金仍在看到流出,儘管步伐放緩。

According to SoSoValue, major Bitcoin ETFs are seeing a return to form. They reported $209.12 million in daily net inflows on March 18, marking the third day of a renewed inflow streak. This brings the week’s total to $483.71 million.

根據Sosovalue的說法,主要的比特幣ETF正在看到形式的回報。他們報告說,3月18日的每日淨流入量為2.0912億美元,這是新的流入紀錄的第三天。這使本週的總數達到4.8371億美元。

After a five-week period of exits, which saw more than $5 billion in net outflows from BTC funds, investors are showing a renewed interest in cryptocurrencies.

經過五週的退出期,從BTC資金中看到了超過50億美元的淨流出,投資者對加密貨幣表示了新的興趣。

Only two funds had significant changes in their asset holdings.

只有兩個資金的資產持有量發生了重大變化。

BlackRock’s (NYSE:BLK) iShares Bitcoin Trust (NYSE:IBIT), the leading Bitcoin ETF, noted $218.12 million in net inflows. This brings its cumulative net inflows to $39.5 billion and its net asset value to $46.79 billion.

領先的比特幣ETF貝萊德(NYSE:BLK)ISHARES比特幣信託(NYSE:IBIT),淨流入淨流入為2.1812億美元。這使其累計淨流入至395億美元,其淨資產價值為467.9億美元。

On the other hand, the ARK 21Shares Bitcoin ETF (ARKB) reported a small decline of $9 million in net inflows. This brings its cumulative net inflows to $2.67 billion and its net assets to $3.97 billion. It ranks third and fourth in these categories, respectively.

另一方面,方舟21shares比特幣ETF(ARKB)報告說,淨流入量下降了900萬美元。這使其累積淨流入到26.7億美元,淨資產為39.7億美元。在這些類別中,它分別排名第三和第四。

As major Ethereum ETFs continue to be subject to sustained outflows, they posted $52.82 million in daily net outflows, according to SoSoValue. This marks the tenth consecutive day of outflows, which now total over $693 million.

根據Sosovalue的說法,隨著主要的以太坊ETF繼續受到持續流出的影響,他們的每日淨流出了5282萬美元。這標誌著連續第十天的流出,現在總計超過6.93億美元。

Among the main changes, BlackRock’s iShares Ethereum Trust (ETHA) saw the largest outflow with a loss of $40.17 million. Despite this, it remains the top-performing Ethereum ETF with $4.11 billion in cumulative net inflows and $2.29 billion in net assets.

在主要變化中,貝萊德的iShares以太坊信託基金(ETHA)的流出最大,損失了4017萬美元。儘管如此,它仍然是表現最佳的以太坊ETF,累計淨流入和22.9億美元的淨資產。

However, this small decline allowed the Grayscale Ethereum Trust (ETHE) to surpass ETHA in terms of net assets despite accumulating $4.18 billion in cumulative net outflows.

但是,這種小小的下降使灰度以太坊信託(ETHE)在淨資產方面超過了ETHA,儘管累積了41.8億美元的累計淨流出。

The Grayscale Ethereum Mini Trust reported $9.33 million in net outflows, bringing its cumulative net inflows to $591.59 million.

灰度以太坊迷你信託公司報告說,淨流出額為933萬美元,其累積淨流入量達到5.9159億美元。

Following closely was Fidelity’s Ethereum ETF (FETH), which saw $3.32 million in net outflows. FETH remains the second-best performing ETH fund with $1.42 billion in cumulative net inflows and ranks fourth in net assets at $760.52 million.

Fidelity的Ethereum ETF(Feth)緊隨其後,淨流出了332萬美元。費斯(Feth)仍然是第二好的ETH基金,累計淨流入額14.2億美元,淨資產排名第四,為7.6052億美元。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

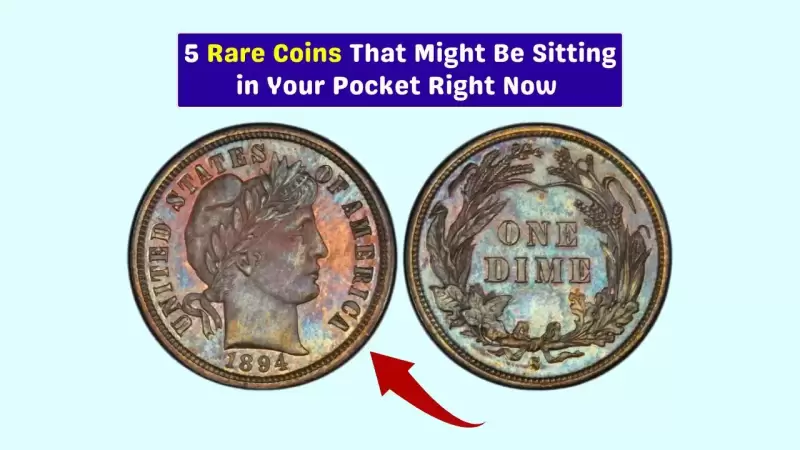

- 現在可能藏在您錢包裡的5個傳奇硬幣

- 2025-04-21 16:35:12

- 信不信由你,有幾個罕見的一角甚至是兩百年紀念季度的售價,以令人垂涎的數量,有些是9300萬美元。

-

- 特朗普官方(特朗普)代幣解鎖,儘管拋棄了恐懼,價格也會激增

- 2025-04-21 16:30:13

- 今天的聚光燈是官方特朗普(特朗普),這是一個與前美國總統相關的模因,這是一個主要的代幣解鎖震撼了社區。

-

- MicroStrategy聯合創始人Michael Saylor表示,該公司可能很快增加了大量的比特幣持有量

- 2025-04-21 16:30:13

- 這是在透露13,000多個機構現在直接接觸其股票的同時

-

- Ripple(XRP)價格集會有風險,鍊鍊活動淡出

- 2025-04-21 16:25:12

- XRP價格可能正在準備突破。圖表開始看起來看漲,尤其是在短期時間表上。

-

-

- 北極Pablo硬幣帶領一包最佳模因硬幣加入長期

- 2025-04-21 16:20:12

- 您知道模因硬幣不再只是笑話了嗎?最初從互聯網娛樂開始的是將普通投資者變成一夜傳奇。