|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

現在,從505938獨特的錢包持有人的Solana網絡上存放了價值超過539億美元的SOL,他們將獲得8.31%的年薪

Solana briefly surpassed Ethereum in total staked value of their respective native tokens, sparking debate over whether it is actually bullish or bearish for Solana.

索拉納(Solana)短暫地超過了以太坊的全部代幣價值,引發了關於索拉納(Solana)是看漲還是看跌的辯論。

More than $53.9 billion worth of SOL is now staked on the Solana network from 505,938 unique wallet holders, who are making an 8.31% annualized return, blockchain data shows.

區塊鏈數據顯示,現在有505,938個獨特的錢包持有人的Solana網絡上,價值超過539億美元的SOL被存放在索拉納網絡上,他們的年度返回8.31%。

The figure briefly overtook the staked ETH market cap on April 20, which now has $53.93 billion worth of value secured from 34.7 million staked tokens, Beaconcha.in data shows.

Beaconcha.in顯示,該數字在4月20日短暫地超過了固定的ETH市值,該數據的價值從3,470萬個固定令牌中獲得了539.3億美元的價值。

A contributing factor behind the flippening has been SOL’s strong price performance relative to ETH over the last two years, which has seen the SOL/ETH price ratio rise nearly tenfold from 0.0088 to 0.0866 since June 12, 2023, CoinGecko data shows.

Coingecko數據顯示,在過去的兩年中,SOL相對於ETH的價格表現強勁的原因是,自2023年6月12日以來,SOL/ETH價格比從0.0088的0.0088上漲了近十倍。

However, the “risk-free” 8.31% return for SOL stakers at the network level — significantly higher than ETH’s 2.98% — may be attracting Solana users away from DeFi activities, such as providing liquidity to automated market makers and lending protocols in exchange for token rewards.

但是,網絡級別的SOL Stakers的“無風險”回報率為8.31%(明顯高於ETH的2.98%)可能會吸引Solana用戶脫離DEFI活動,例如向自動化的做市商提供流動性和貸款協議,以換取令牌Rewards。

“Solana having 65% of its marketcap staked means there's no other use of it’s token, it’s actually bearish,” Builda Protocol developer and X user “JC” said.

Builda協議開發商和X用戶“ JC”說:“固定在其市場上的65%的索拉納沒有其他用途,實際上是看跌的。”

DefiLlama data shows that there are $21.5 billion worth of liquid staked ETH tokens on Ethereum compared to just $7.22 billion of liquid staked SOL on Solana.

Defillama的數據顯示,以太坊上有價值215億美元的液體固定ETH代幣,而Solana上的液體固定溶膠僅為72.2億美元。

Multicoin Capital managing partner Tushar Jain previously said that Solana DeFi has been stifled because it’s not rational to make an investment in something that produces a lower return than the “risk-free” investment.

Multicoin Capital管理合夥人Tushar Jain此前曾表示,Solana Defi被扼殺了,因為對產生比“無風險”投資的回報的投資是不合理的。

Ethereum also dominates in terms of DeFi total value locked at $50.4 million compared to Solana’s $8.85 billion.

以太坊還以鎖定的總價值為5040萬美元,而索拉納(Solana)的88.5億美元則占主導地位。

Industry pundits also pointed out that there are still far more validators securing the Ethereum network at 1.06 million compared to Solana’s 1,243.

行業專家還指出,與Solana的1,243相比,仍然有更多的驗證者將以太坊網絡確保為106萬。

One Ethereum researcher said Solana staking isn’t really securing the Solana network because there isn’t a mechanism to penalize bad actors for malicious behavior.

一位以太坊研究人員說,索拉納的股權並不是真正確保Solana網絡的確保,因為沒有機制來懲罰惡意行為的壞演員。

“It's very ironic to call it ‘staking’ when there is no slashing. What's at stake?” Dankrad Feist said in an April 20 X post.

“當沒有削減時,稱其為'Stage'是非常具有諷刺意味的。 Dankrad Feist在4月20日的帖子中說。

Solana Labs said slashing is already possible, but it’s not automatic, and the attacker’s assets can only be slashed by restarting the entire network.

Solana Labs說,已經進行了削減,但不是自動的,並且只能通過重新啟動整個網絡來削減攻擊者的資產。

Solana is looking to roll out a more comprehensive slashing solution later this year, according to Multicoin Capital Managing Partner Kyle Samani.

據Multicoin Capital Capital Capital Contrand合作夥伴Kyle Samani稱,Solana希望在今年晚些時候推出更全面的削減解決方案。

Solana Labs CEO Anatoly Yakovenko said he’s pushing for a “correlated slashing” mechanism, where the penalty would be equal to the square of the difference between a validator’s faulty stake in an epoch and the median network staked validator.

Solana Labs首席執行官Anatoly Yakovenko說,他正在推動“相關的削減”機制,在該機構中,罰款將等於驗證者在時期股權和中間網絡固定驗證器中差異之間差異的平方。

Meanwhile, Ethereum developers and researchers have been exploring ways to decentralize Ethereum staking. Many Ethereum stakers have resorted to liquid staking protocols over the last few years due to the high 32 ETH minimum needed to run an independent validator. However, this shift has led to the Lido protocol capturing an 88% share in Ethereum’s liquid staking market, adding another layer to Ethereum’s staking centralization concerns.

同時,以太坊開發人員和研究人員一直在探索分散以太坊積分的方法。在過去的幾年中,由於運行獨立驗證器所需的最低32個ETH,許多以太坊staker在過去的幾年中訴諸液體均值方案。但是,這種轉變導致了利多(Lido)協議,在以太坊的液體蒸發市場中佔據了88%的份額,這為以太坊的積分集中化問題增加了另一層。

output: Solana briefly surpassed Ethereum in total staked value of their respective native tokens, sparking debate over whether it is actually bullish or bearish for Solana.

輸出:Solana在其各自的本地令牌的總固定價值中短暫超過了以太坊,引發了關於Solana是看漲還是看跌的爭論。

More than $53.9 billion worth of SOL is now staked on the Solana network from 505,938 unique wallet holders, who are making an 8.31% annualized return, blockchain data shows.

區塊鏈數據顯示,現在有505,938個獨特的錢包持有人的Solana網絡上,價值超過539億美元的SOL被存放在索拉納網絡上,他們的年度返回8.31%。

The figure briefly overtook the staked ETH market cap on April 20, which now has $53.93 billion worth of value secured from 34.7 million staked tokens, Beaconcha.in data shows.

Beaconcha.in顯示,該數字在4月20日短暫地超過了固定的ETH市值,該數據的價值從3,470萬個固定令牌中獲得了539.3億美元的價值。

A contributing factor behind the flippening has been SOL’s strong price performance relative to ETH over the last two years, which has seen the SOL/ETH price ratio rise nearly tenfold from 0.0088 to 0.0866 since June 12, 2023, CoinGecko data shows.

Coingecko數據顯示,在過去的兩年中,SOL相對於ETH的價格表現強勁的原因是,自2023年6月12日以來,SOL/ETH價格比從0.0088的0.0088上漲了近十倍。

However, the “risk-free” 8.31% return for SOL stakers at the network level — significantly higher than ETH’s 2.98% — may be attracting Solana users away from DeFi activities, such as providing liquidity to automated market makers and lending protocols in exchange for token rewards.

但是,網絡級別的SOL Stakers的“無風險”回報率為8.31%(明顯高於ETH的2.98%)可能會吸引Solana用戶脫離DEFI活動,例如向自動化的做市商提供流動性和貸款協議,以換取令牌Rewards。

“Solana having 65% of its marketcap staked means there's no other use of it’s token, it’s actually bearish,” Builda

“擁有65%的MarketCap儲存的Solana意味著它沒有其他用用的代幣,實際上是看跌的,” Builda

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

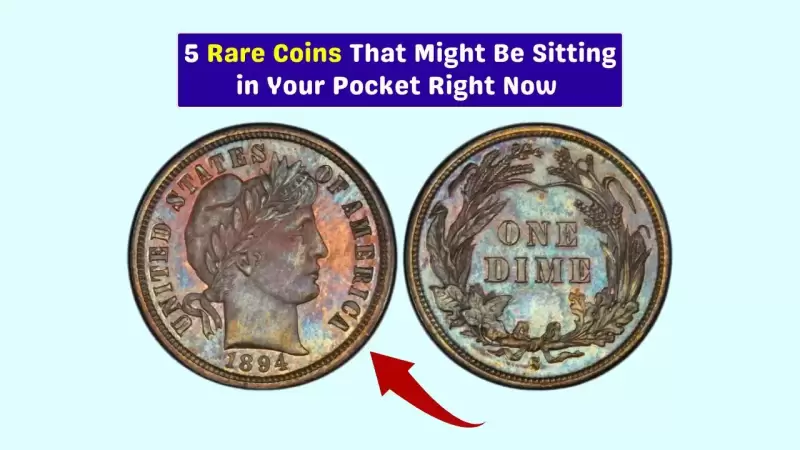

- 現在可能藏在您錢包裡的5個傳奇硬幣

- 2025-04-21 16:35:12

- 信不信由你,有幾個罕見的一角甚至是兩百年紀念季度的售價,以令人垂涎的數量,有些是9300萬美元。

-

- 特朗普官方(特朗普)代幣解鎖,儘管拋棄了恐懼,價格也會激增

- 2025-04-21 16:30:13

- 今天的聚光燈是官方特朗普(特朗普),這是一個與前美國總統相關的模因,這是一個主要的代幣解鎖震撼了社區。

-

- MicroStrategy聯合創始人Michael Saylor表示,該公司可能很快增加了大量的比特幣持有量

- 2025-04-21 16:30:13

- 這是在透露13,000多個機構現在直接接觸其股票的同時

-

- Ripple(XRP)價格集會有風險,鍊鍊活動淡出

- 2025-04-21 16:25:12

- XRP價格可能正在準備突破。圖表開始看起來看漲,尤其是在短期時間表上。

-

-

- 北極Pablo硬幣帶領一包最佳模因硬幣加入長期

- 2025-04-21 16:20:12

- 您知道模因硬幣不再只是笑話了嗎?最初從互聯網娛樂開始的是將普通投資者變成一夜傳奇。