|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

隨著加密貨幣遊戲產業的上漲,沙盒 [SAND] 在過去 7 天內上漲了 75%。

Cryptocurrency gaming token The Sandbox [SAND] has seen gains of 75% in the last seven days, as gains were recorded across the sector. At press time, SAND was trading at $0.602 after a drop of 4% in 24 hours. Meanwhile, trading volumes had dropped by 51% per CoinMarketCap.

加密貨幣遊戲代幣 The Sandbox [SAND] 在過去 7 天內上漲了 75%,整個產業都錄得漲幅。截至發稿時,SAND 交易價格為 0.602 美元,24 小時內下跌 4%。同時,根據 CoinMarketCap 的數據,交易量下降了 51%。

SAND’s recent gains came amid increasing volatility. This was highlighted by the widening Bollinger bands on the altcoin’s four-hour chart.

SAND 最近的上漲是在波動性加劇的情況下出現的。山寨幣四小時圖表上不斷擴大的布林通道凸顯了這一點。

The strong bullish momentum witnessed earlier this week saw SAND move past the upper Bollinger band. However, at press time, the price had retreated to the middle band, suggesting that buying pressure was easing.

本週早些時候出現的強勁看漲勢頭使 SAND 突破了布林線上限。然而,截至發稿時,價格已回落至中間區間,顯示購買壓力正在緩解。

The Relative Strength Index (RSI) had a similar outlook after dropping from overbought regions to 53. The RSI line is also trending below the signal line, an indication that selling activity is driving the price action.

相對強弱指數 (RSI) 從超買區域跌至 53 後也出現了類似的前景。

Buyers appear to be defending the immediate support level at $0.58. If this support fails to hold as selling activity continues, SAND could drop to the lower Bollinger band at ($0.501).

買家似乎正在捍衛 0.58 美元的即時支撐位。如果隨著拋售活動的持續,該支撐位未能保持,SAND 可能會跌至布林通道下限(0.501 美元)。

Liquidations could spur more volatility

清算可能會引發更大的波動

Data from Coinglass showed that in just four days, traders with leveraged short and long positions on The Sandbox have recorded more than $44M in liquidations. The forced closure of these positions, either by selling or buying, contributed to the rising volatility.

Coinglass 的數據顯示,在短短四天內,在 The Sandbox 上擁有槓桿空頭和多頭頭寸的交易者已記錄了超過 4400 萬美元的清算。透過出售或購買強制平倉這些部位導致了波動性的上升。

These liquidations have also had an impact on the open interest, which stood at $168M at press time after a 6% drop in 24 hours. This suggests that traders are not opening new positions on SAND.

這些清算也對未平倉合約產生了影響,截至發稿時,未平倉合約在 24 小時內下降了 6%,達到 1.68 億美元。這表示交易者沒有在 SAND 上建立新的部位。

While reduced activity in the derivatives market could lead to low volatility, it could also push SAND into consolidation.

雖然衍生性商品市場活動的減少可能導致波動性降低,但也可能推動 SAND 進入整合。

Active addresses fall from peak

活躍地址從峰值下降

The lack of fresh buying activity around SAND can be attributed to a notable decline in the number of active addresses. Data from CryptoQuant shows that in the last three days, the number of active addresses around the token has dropped from 3,809 to 1,821.

SAND 周圍缺乏新的購買活動可歸因於活躍地址數量的顯著下降。 CryptoQuant 的數據顯示,在過去三天裡,該代幣的活躍地址數量從 3,809 個下降至 1,821 個。

This decline could also show weakened market sentiment caused by a lack of fresh gains. If this lack of demand persists, SAND could extend the downturn.

這種下跌也可能表明由於缺乏新的漲幅而導致市場情緒疲軟。如果這種需求不足的情況持續存在,SAND 可能會延長經濟低迷時期。

What’s next for SAND?

沙子的下一步是什麼?

The lack of buyers to absorb the sell-side pressure on SAND could result in further dips for the token. After the RSI crossed below the signal line and formed a sell signal, the uptrend weakened, with a trend reversal set to happen if buyers re-enter the market.

由於缺乏買家來消化 SAND 的賣方壓力,可能會導致該代幣進一步下跌。 RSI 跌破訊號線並形成賣出訊號後,上升趨勢減弱,如果買家重新入市,趨勢將會逆轉。

Traders should also watch out for a drop below the lower Bollinger band as that could weaken market sentiment and drive prices lower.

交易者也應警惕跌破布林線下軌的情況,因為這可能會削弱市場情緒並壓低價格。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

- 10月美國核心PCE物價指數年增2.8%,BTC價格突破97,000美元

- 2024-11-28 18:25:02

- 週三,美國10月核心PCE物價指數年增2.8%,符合預期,但仍高於聯準會2%的目標。

-

- Kraken NFT 市場將於 11 月 27 日關閉,理由是策略轉變

- 2024-11-28 18:25:02

- Kraken 在給客戶的電子郵件中確認,該平台將於 11 月 27 日進入僅限提款階段。

-

-

![LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力? LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?](/uploads/2024/11/28/cryptocurrencies-news/articles/lcx-lcx-regains-bullish-market-structure-beat-resistance/image-1.jpg)

- LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?

- 2024-11-28 18:25:02

- LCX [LCX]近兩個月來首次在一日時間框架內恢復看漲市場結構。

-

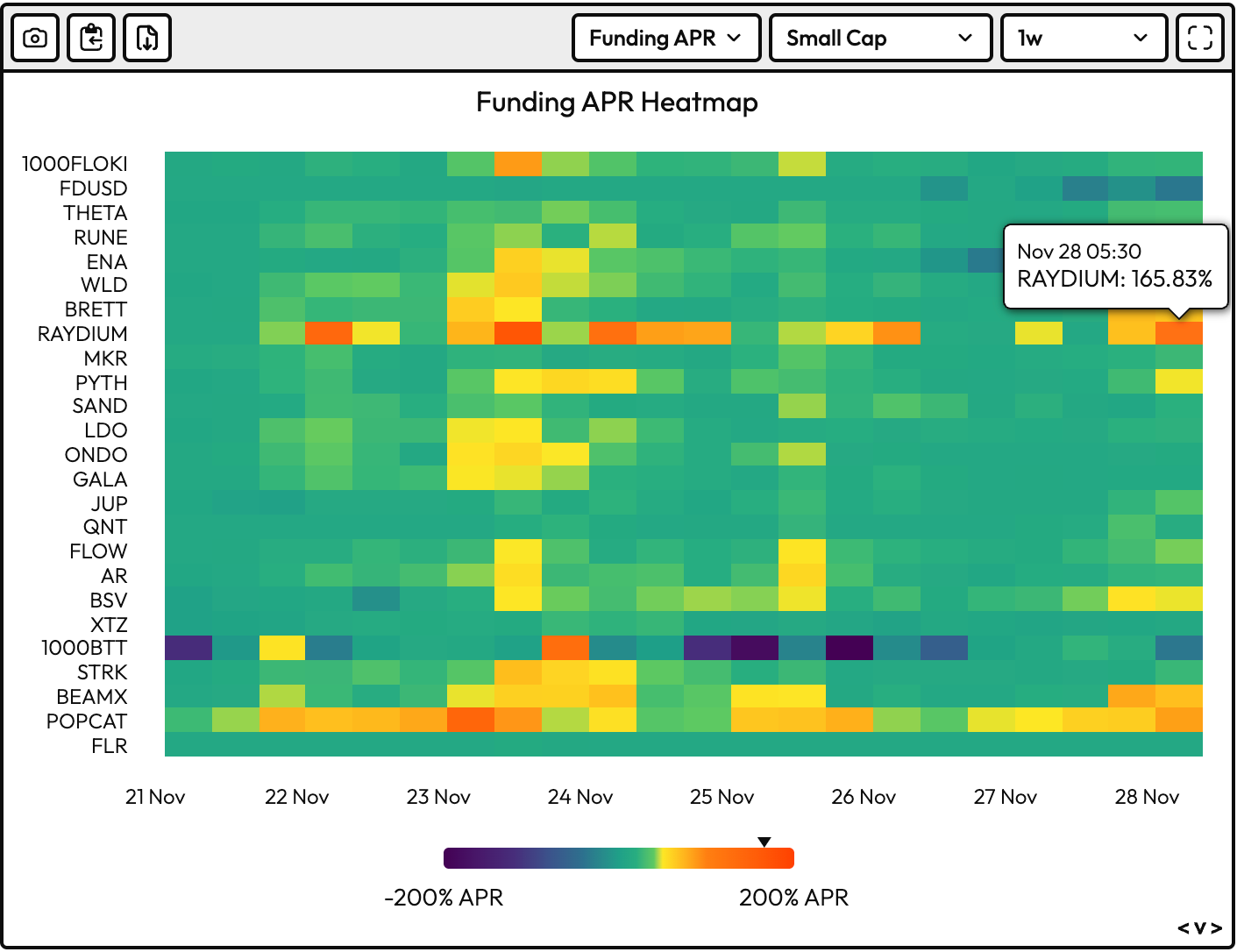

- 數據顯示,Raydium 的 RAY 代幣是最過熱的加密貨幣

- 2024-11-28 18:20:01

- 比特幣(BTC)最近的看漲停頓後,小盤代幣的年化永久融資利率已經冷卻了更廣泛的市場

-