|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

邁克爾·塞勒 (Michael Saylor) 將在向微軟董事會進行的三分鐘演講中分享他對比特幣投資策略的見解

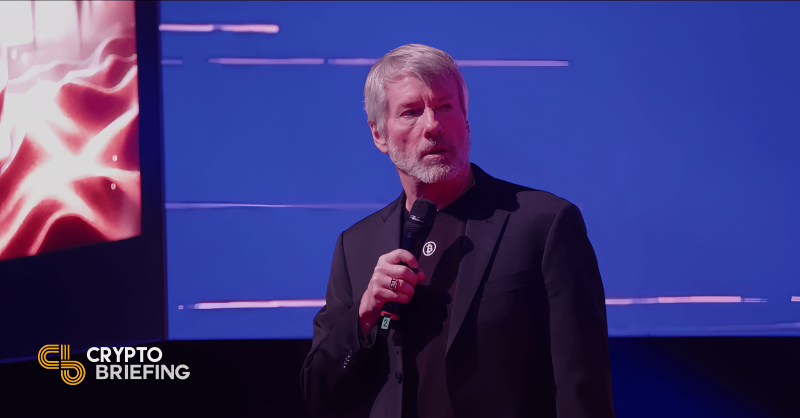

Michael Saylor, the MicroStrategy co-founder and Executive Chairman, will present his insights on Bitcoin investment strategies to Microsoft’s board of directors, following a proposal from the National Center for Public Policy Research (NCPPR).

根據國家公共政策研究中心 (NCPPR) 的提議,MicroStrategy 聯合創始人兼執行主席 Michael Saylor 將向微軟董事會介紹他對比特幣投資策略的見解。

The activist that put that proposal together contacted me to present to the board, and I agreed to provide a three-minute presentation. I’m going to present it to the board of directors.

提出該提案的積極分子聯繫我向董事會進行演示,我同意提供三分鐘的演示。我將把它提交給董事會。

Saylor has publicly encouraged Microsoft to consider adding Bitcoin to its treasury, which he believes can make “the next trillion dollars” for Microsoft shareholders.

塞勒公開鼓勵微軟考慮將比特幣納入其金庫,他認為這可以為微軟股東賺取「下一個兆美元」。

Companies like Berkshire Hathaway, Apple, Google, and Meta (formerly Facebook) should discuss and evaluate Bitcoin as a potential investment, Saylor suggested, “because they all have huge hordes of cash, and they’re all burning shareholder value.”

塞勒建議,伯克希爾·哈撒韋公司、蘋果公司、谷歌和Meta(前身為Facebook)等公司應該將比特幣作為一項潛在投資進行討論和評估,「因為他們都擁有大量現金,而且都在燃燒股東價值。

Shareholders are scheduled to vote on a proposal to consider adding Bitcoin to the balance sheet on December 10. Top shareholders include major financial institutions like Vanguard Group, BlackRock, State Street, and Fidelity Management & Research.

股東定於 12 月 10 日就考慮將比特幣添加到資產負債表中的提案進行投票。

Vanguard, a known crypto skeptic, has also invested in MicroStrategy’s stock (MSTR), as well as shares of other crypto firms like Coinbase and MARA Holdings. As of September 30, the asset management giant reported holding approximately 16 million MSTR shares.

Vanguard 是一位著名的加密貨幣懷疑論者,它也投資了 MicroStrategy 的股票 (MSTR),以及 Coinbase 和 MARA Holdings 等其他加密貨幣公司的股票。截至 9 月 30 日,這家資產管理巨頭持有約 1,600 萬股 MSTR 股票。

MicroStrategy’s Bitcoin strategy has led to huge stock price appreciation, outperforming Microsoft’s stock (MSFT) performance.

MicroStrategy 的比特幣策略導致股價大幅升值,跑贏了微軟股票 (MSFT) 的表現。

According to data from Yahoo Finance, MicroStrategy’s stock jumped to a fresh record high at market close on Tuesday. It has skyrocketed 581% so far this year, while Microsoft’s stock has seen around 12% gains over the same timeframe.

根據雅虎財經的數據,MicroStrategy 的股價在周二收盤時躍升至歷史新高。今年迄今為止,該公司股價已飆升 581%,而同期微軟股價上漲了 12% 左右。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 查理王 5 便士硬幣:您口袋裡的同花大順?

- 2025-10-23 08:07:25

- 2320 萬枚查爾斯國王 5 便士硬幣正在流通,標誌著一個歷史性時刻。收藏家們,準備好尋找一段歷史吧!

-

-

-

- 嘉手納的路的盡頭? KDA 代幣因項目放棄而暴跌

- 2025-10-23 07:59:26

- Kadena 關閉運營,導致 KDA 代幣螺旋式上升。這是結束了,還是社區可以讓這條鏈繼續存在?

-

- 查爾斯國王 5 便士硬幣開始流通:硬幣收藏家的同花大順!

- 2025-10-23 07:07:25

- 查爾斯國王 5 便士硬幣現已在英國流通!了解熱門話題、橡樹葉設計,以及為什麼收藏家對這款皇家發佈如此興奮。

-

- 查爾斯國王 5 便士硬幣進入流通:收藏家指南

- 2025-10-23 07:07:25

- 查理三世國王的 5 便士硬幣現已流通!了解新設計、其意義以及收藏家為何如此興奮。準備好尋找這些歷史硬幣!

-