|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

由於四月下旬的減半事件,美國過剩的比特幣礦機正在轉移到國外成本較低的地區。由於減半減少了挖礦獎勵,舊機器在美國的利潤下降,促使礦工升級到更有效率的型號。買家尋求將這些舊機器用於電力較便宜的地區,包括非洲和南美洲,在那裡他們仍然可以產生利潤。雖然一些礦工出售他們的硬件,但其他礦工選擇將其轉移到擁有第三方數據中心的低成本地點,以最大限度地減少電費並延長機器的使用壽命。

Mass Exodus of Bitcoin Mining Machines from the US: Halving Triggers Global Migration

比特幣礦機大規模撤離美國:減半引發全球遷移

May 2024

2024年5月

Approximately 6,000 obsolete Bitcoin (BTC) mining machines are poised to be decommissioned in the United States and shipped to a 35,000-square-foot facility in Colorado Springs, where they will undergo refurbishment before being resold to international buyers seeking to capitalize on lower-cost mining environments.

大約 6,000 台過時的比特幣 (BTC) 礦機準備在美國退役,並運往科羅拉多斯普林斯的一個 35,000 平方英尺的設施,在那裡進行翻新,然後轉售給尋求較低成本的國際買家採礦環境。

The Halving's Impact

減半的影響

This impending relocation signifies a broader trend driven by the upcoming Bitcoin halving, an event scheduled for late April that will witness a 50% reduction in the mining reward. This halving, occurring every four years, is designed to maintain the digital asset's supply cap at 21 million BTC.

這次即將到來的搬遷標誌著即將到來的比特幣減半所驅動的更廣泛的趨勢,比特幣減半定於 4 月底舉行,屆時挖礦獎勵將減少 50%。每四年減半一次,旨在將數位資產的供應上限維持在 2,100 萬比特幣。

In response to the halving's anticipated impact on revenue, miners are scrambling to upgrade their equipment to the most efficient and advanced models. The influx of outdated machines from the US is a testament to the economic imperatives shaping the industry.

為了應對減半對收入的預期影響,礦商們正爭先恐後地將其設備升級為最高效、最先進的型號。來自美國的過時機器的湧入證明了塑造該行業的經濟需求。

Global Migration

全球移民

According to estimates from Luxor Technology, a Seattle-based provider of crypto-mining services, approximately 600,000 S19 series machines, representing a significant portion of current mining infrastructure, are being exported from the US, predominantly to Africa and South America.

根據總部位於西雅圖的加密貨幣挖礦服務提供商 Luxor Technology 的估計,大約 60 萬台 S19 系列機器(佔目前挖礦基礎設施的很大一部分)正在從美國出口,主要出口到非洲和南美洲。

Taras Kulyk, CEO of SunnySide Digital, which operates the Colorado Springs facility, attributes this migration to the significantly lower electricity costs in these regions. "It's a natural shift for buyers to seek out areas where power is cheaper," he explains.

營運科羅拉多斯普林斯工廠的 SunnySide Digital 執行長Taras Kulyk 將此次遷移歸因於這些地區電力成本的大幅降低。 「對於買家來說,尋找電力更便宜的地區是一種自然的轉變,」他解釋道。

Seeking Profitability

尋求獲利

While S19 series machines may cease to be economically viable in the US after the halving, they "can still generate decent profits and extend their lifespan if hosted" in countries with lower electricity costs, asserts Jaran Mellerud, CEO of Dubai-based Hashlabs Mining.

總部位於杜拜的Hashlabs Mining 執行長 Jaran Mellerud 表示,雖然減半後S19 系列機器在美國可能不再具有經濟可行性,但如果託管在電力成本較低的國家,它們「仍然可以產生可觀的利潤並延長使用壽命」。

Price Decline

價格下跌

Anticipating a price drop for used mining equipment post-halving, some buyers are postponing purchases. Luxor's trading desk for used machines reports that the price of used S19 models has plunged from $7,030 in March 2022 to an estimated $356 in May 2024.

由於預計二手採礦設備價格會在減半後下降,一些買家推遲了購買。 Luxor 的二手機器交易台報告稱,二手 S19 型號的價格已從 2022 年 3 月的 7,030 美元暴跌至 2024 年 5 月的估計 356 美元。

Relocation Considerations

搬遷注意事項

Despite the lower energy costs, not all US-based miners are willing to relocate their hardware. Publicly traded companies face heightened risk aversion from shareholders, while transportation costs, breakage, and security concerns present additional obstacles.

儘管能源成本較低,但並非所有美國礦商都願意重新安置其硬體。上市公司面臨股東日益高漲的風險厭惡情緒,而運輸成本、破損和安全問題則構成了額外的障礙。

However, miners with their own facilities are actively seeking out locations with favorable electricity rates. Nuo Xu, who operates two sites in Texas, is exploring options in Ethiopia, Nigeria, and elsewhere to house approximately 6,000 older machines.

然而,擁有自己設施的礦工正在積極尋找電價優惠的地點。 Nuo Xu 在德州經營兩個工廠,正在探索在衣索比亞、奈及利亞和其他地方安置約 6,000 台舊機器的選擇。

Hosting Fees and Electricity Costs

託管費和電費

Hosting fees for miners lacking their own facilities typically include electricity, labor, and third-party operators. Estimates suggest that these fees average around 7 cents per kilowatt hour (kWh) in the US, while in Ethiopia, where crypto mining regulations have been relaxed and power generation has increased, the rate is closer to 5 cents per kWh.

缺乏自己設施的礦工的託管費通常包括電費、人工費和第三方營運商費用。據估計,在美國,這些費用平均約為每千瓦時 (kWh) 7 美分,而在衣索比亞,加密採礦法規已經放寬,發電量也有所增加,該費率接近每千瓦時 5 美分。

The substantial difference in hosting fees and the lower electricity costs in countries like Ethiopia have made them attractive destinations for miners.

埃塞俄比亞等國家託管費的巨大差異和較低的電力成本使它們成為對礦工有吸引力的目的地。

Big Investments and Funding

大投資和資金

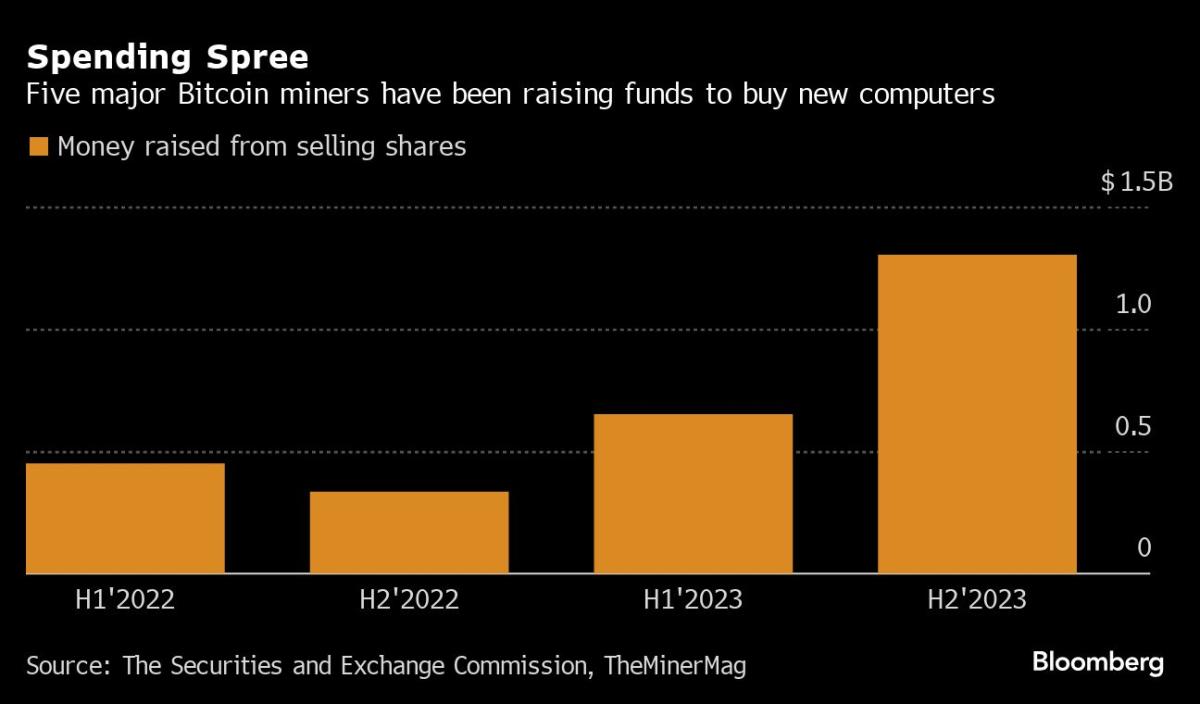

Major public Bitcoin mining companies have been investing heavily in new hardware to prepare for the halving. TheMinerMag, a crypto-mining research firm, estimates that 13 leading companies have placed orders for over $1 billion worth of machines since February 2023.

主要的公共比特幣挖礦公司一直在大力投資新硬件,為減半做準備。加密貨幣挖礦研究公司 TheMinerMag 估計,自 2023 年 2 月以來,已有 13 家領先公司下了價值超過 10 億美元的機器訂單。

Five of the largest miners have raised more than $2.7 billion through share sales in the two years leading up to December 2023, with an additional $840 million secured since the start of 2024.

截至 2023 年 12 月的兩年裡,五家最大的礦商已透過股票銷售籌集了超過 27 億美元,自 2024 年初以來又籌集了 8.4 億美元。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

-

- 巴基斯坦國家銀行發佈建議,敦促民眾不要參與加密貨幣

- 2024-11-25 00:25:19

- 巴基斯坦國家銀行(SBP)發佈公告,敦促民眾不要參與加密貨幣,並強調這些虛擬貨幣在巴基斯坦不被視為法定貨幣。

-

- 揭開萊特幣傳奇:超越隱私和環境永續性

- 2024-11-25 00:25:19

- 隨著加密貨幣穩步滲透主流金融,生態系統不斷透過滿足不同社會需求的創新而豐富。

-

-