|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

摩根大通預測,在即將到來的獎勵減半事件之後,比特幣的價值可能會下跌。他們的分析表明,加密貨幣仍然處於超買狀態,與黃金相比,其當前價格超過了波動調整後的估計價值。因此,該銀行預計比特幣價格在減半後將出現調整。

JPMorgan Predicts Bitcoin Price Decline Post-Halving

摩根大通預測減半後比特幣價格下跌

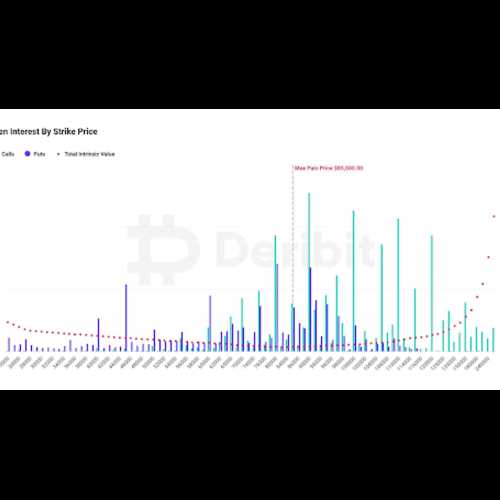

New York, April 18, 2024 - Financial behemoth JPMorgan (JPM) has released a comprehensive analysis predicting a downward trajectory for Bitcoin (BTC) following the upcoming halving event. The bank's assessment, based on an examination of open interest in Bitcoin futures, suggests that the cryptocurrency remains overbought and is poised for a correction.

紐約,2024 年 4 月 18 日 - 金融巨頭摩根大通 (JPM) 發布了一份綜合分析報告,預測比特幣 (BTC) 在即將到來的減半事件後將出現下行軌跡。該銀行的評估是基於對比特幣期貨未平倉合約的檢查,顯示該加密貨幣仍處於超買狀態,並準備進行調整。

Overbought Market Conditions

超買市場狀況

JPMorgan's analysts cited the current market conditions, which indicate that Bitcoin is still overpriced. The bank's volatility-adjusted comparison with gold values Bitcoin at $45,000, significantly lower than its current price of approximately $61,200. Similarly, the projected production cost of Bitcoin post-halving is estimated at $42,000, further substantiating the overbought status of the cryptocurrency.

摩根大通分析師引用了當前的市場狀況,這表明比特幣仍然定價過高。該銀行經波動性調整後與黃金的比較,得出比特幣的估值為 45,000 美元,遠低於目前約 61,200 美元的價格。同樣,比特幣減半後的預計生產成本估計為 42,000 美元,進一步證實了加密貨幣的超買狀態。

Miner Impact

礦工影響

The halving event, scheduled to occur between April 19th and 20th, will significantly impact Bitcoin miners. It is anticipated that unprofitable miners will exit the network, leading to a substantial decline in the hashrate. This, in turn, will result in consolidation among miners, with publicly-listed Bitcoin mining companies expected to acquire a larger share of the market.

計劃於 4 月 19 日至 20 日期間發生的減半事件將對比特幣礦工產生重大影響。預計無利可圖的礦工將退出網絡,導致算力大幅下降。反過來,這將導致礦商之間的整合,上市的比特幣礦業公司預計將獲得更大的市場份額。

Regional Diversification

區域多元化

JPMorgan also noted that some Bitcoin mining firms may seek to diversify into low energy cost regions such as Latin America or Africa to salvage value from inefficient mining rigs. This move is seen as a strategic response to the increased operating costs associated with mining Bitcoin post-halving.

摩根大通也指出,一些比特幣挖礦公司可能會尋求多元化發展,進入拉丁美洲或非洲等低能源成本地區,以從低效率的礦機中挽救價值。此舉被視為對比特幣減半後開採相關營運成本增加的策略回應。

Subdued Venture Capital Funding

創投資金疲軟

Despite the recent resurgence in the crypto market, JPMorgan observed that venture capital funding in the space remains subdued. This suggests that investors are adopting a cautious approach, likely due to the potential risks associated with Bitcoin's overbought status and the impending halving event.

儘管加密貨幣市場最近復甦,但摩根大通觀察到該領域的創投資金仍低迷。這表明投資者正在採取謹慎的態度,可能是由於比特幣超買狀態和即將發生的減半事件相關的潛在風險。

Historical Precedent

歷史先例

Historically, Bitcoin's price has experienced a notable decline following each halving event. This pattern stems from the reduced supply of newly mined Bitcoins, which can result in a temporary imbalance between supply and demand.

從歷史上看,每次減半事件後,比特幣的價格都會經歷顯著下跌。這種模式源自於新開採的比特幣供應減少,這可能導致供需之間暫時失衡。

Conclusion

結論

JPMorgan's analysis provides valuable insights into the potential impact of the upcoming Bitcoin halving. The bank's prediction of a price decline post-halving highlights the importance of market timing and risk management for investors. Investors should approach Bitcoin investments with caution and consider adjusting their portfolios accordingly in light of this analysis.

摩根大通的分析為即將到來的比特幣減半的潛在影響提供了寶貴的見解。該銀行對減半後價格下跌的預測凸顯了市場時機和風險管理對投資人的重要性。投資者應謹慎對待比特幣投資,並考慮根據此分析相應調整其投資組合。

About JPMorgan

關於摩根大通

JPMorgan is a global investment bank and financial services corporation with over 150 years of experience. The bank offers a wide range of services, including investment banking, private equity, and asset management, to clients worldwide. JPMorgan's research and analysis are widely respected in the financial industry and provide valuable insights into market trends and investment opportunities.

摩根大通是一家全球投資銀行和金融服務公司,擁有 150 多年的經驗。該銀行為全球客戶提供廣泛的服務,包括投資銀行、私募股權和資產管理。摩根大通的研究和分析在金融業廣受尊重,為市場趨勢和投資機會提供了寶貴的見解。

Disclosure

揭露

Please note that the views expressed in this article are those of JPMorgan and do not necessarily represent the views of CoinDesk. Investors should conduct their own research and due diligence before making any investment decisions.

請注意,本文所表達的觀點屬於摩根大通的觀點,不一定代表 CoinDesk 的觀點。投資者在做出任何投資決定之前應進行自己的研究和盡職調查。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- W Token (W):您的下一個加密貨幣大機會?

- 2024-12-28 08:25:02

- 加密貨幣正在改寫財富創造規則,W Token(W)正在成為 DeFi 領域的潛在明星。

-

- 在當今市場上提供最佳安全性和便利性的頂級加密錢包

- 2024-12-28 08:25:02

- 到 2024 年,加密安全漏洞將驚人地增加 21%,造成的金融動盪高達 22 億美元,很明顯,威脅情況正在改變。

-

-

-

-

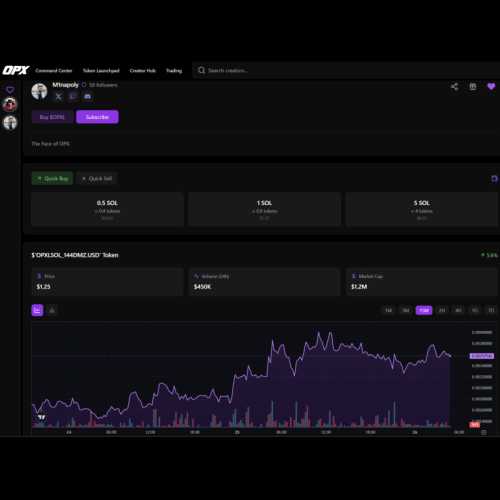

- OPX Live 本週六上線,瞄準創作者經濟 2.0

- 2024-12-28 08:25:02

- OPX Live 計劃於本週六(12 月 28 日)推出,提供整合代幣創建、交易和串流媒體的統一平台

-

-

-