|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

香港有條件批准了首個現貨比特幣(BTC)和以太幣(ETH)交易所交易基金(ETF),使其成為亞洲第一個將這些加密貨幣納入其受監管投資框架的司法管轄區。此舉標誌著加密貨幣採用的重要一步,為投資者提供了新的資產配置機會,並鞏固了香港作為全球金融中心和虛擬資產中心的地位。

Hong Kong Embraces Crypto with Landmark Approval of Bitcoin and Ether Spot ETFs

香港擁抱加密貨幣,比特幣和以太坊現貨 ETF 獲得里程碑批准

Hong Kong, April 15, 2023 - Hong Kong has taken a groundbreaking step in the adoption of cryptocurrencies, conditionally approving its first spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs). This historic decision positions Hong Kong as the first Asian jurisdiction to integrate these prominent cryptocurrencies into its regulated investment ecosystem.

香港,2023 年 4 月 15 日 - 香港在採用加密貨幣方面邁出了突破性的一步,有條件批准了首個現貨比特幣 (BTC) 和以太幣 (ETH) 交易所交易基金 (ETF)。這項歷史性決定使香港成為第一個將這些著名的加密貨幣納入其受監管的投資生態系統的亞洲司法管轄區。

The Securities and Futures Commission (SFC) of Hong Kong has granted conditional approval to ETF applications from three prominent local issuers: Hong Kong subsidiaries of Chinese asset management powerhouses Harvest Fund Management, Bosera Asset Management, and China Asset Management (ChinaAMC).

香港證券及期貨事務監察委員會(證監會)已有條件批准三個著名本地發行人的ETF 申請:中國資產管理巨頭嘉年華基金管理公司、博時資產管理公司和華夏基金管理公司(華夏基金)的香港子公司。

Industry experts applaud the move as a significant boost to Hong Kong's financial credentials. "The launch of virtual asset spot ETFs not only diversifies investment options but also cements Hong Kong's position as a global financial hub and the Asian vanguard for virtual assets," stated a Bosera Asset Management spokesperson.

業界專家稱讚此舉極大提升了香港的金融信譽。博時資產管理發言人表示:“虛擬資產現貨ETF的推出不僅多元化了投資選擇,也鞏固了香港作為全球金融中心和亞洲虛擬資產先鋒的地位。”

Bosera Asset Management, in collaboration with Hong Kong-headquartered HashKey Capital, will lead the pack with a novel "in-kind" subscription mechanism. This mechanism permits investors to contribute directly with BTC and ETH, providing a seamless entry point into the cryptocurrency market.

博時資產管理公司將與總部位於香港的HashKey Capital合作,推出新穎的「實體」認購機制。這種機制允許投資者直接使用 BTC 和 ETH 進行貢獻,從而提供了進入加密貨幣市場的無縫切入點。

ChinaAMC's Hong Kong arm has also secured approval to offer virtual asset management services and is actively developing its spot ETFs. "This conditional approval aligns with our aim to drive industry innovation and cater to evolving investor needs," said Han Tongli, CEO of Harvest Global Investments, reflecting the optimism shared by industry players.

華夏基金的香港分公司也已獲得提供虛擬資產管理服務的批准,並積極開發其現貨ETF。嘉實環球投資執行長韓同利表示:「這項有條件批准符合我們推動產業創新、滿足不斷變化的投資者需求的目標,」這反映了產業參與者的樂觀態度。

Hong Kong's ETF approval comes on the heels of the United States' first spot Bitcoin ETFs, which attracted an impressive $12 billion in net inflows, underscoring the substantial market appetite for these products.

香港 ETF 的批准緊隨美國首個現貨比特幣 ETF 的批准,該 ETF 吸引了令人印象深刻的 120 億美元淨流入,凸顯了市場對這些產品的巨大興趣。

Similarly, Hong Kong's ETFs are anticipated to generate considerable interest, particularly from institutional investors seeking new investment avenues during Asia trading hours. "This development could have a positive impact in the short term, while broader market narratives and macro factors remain key drivers," observed QCP Capital, a Singapore-based digital asset trading firm, highlighting the global ramifications of Hong Kong's move.

同樣,香港的 ETF 預計將引起相當大的興趣,特別是來自在亞洲交易時段尋求新投資途徑的機構投資者。總部位於新加坡的數位資產交易公司QCP Capital 表示:「這一事態發展可能會在短期內產生積極影響,而更廣泛的市場敘事和宏觀因素仍然是關鍵驅動因素。」他強調了香港此舉的全球影響。

The introduction of these ETFs will empower investors with innovative asset allocation opportunities, solidifying Hong Kong's position as a leading global financial hub and the Asian trailblazer in the virtual asset space. This strategic move aligns with Hong Kong's broader ambition to establish itself as a primary destination for digital asset business, in contrast to the stricter regulatory landscape for cryptocurrencies in mainland China.

這些ETF的推出將為投資者提供創新的資產配置機會,鞏固香港作為全球領先金融中心和虛擬資產領域亞洲開拓者的地位。與中國大陸對加密貨幣更嚴格的監管環境相比,這項策略性舉措符合香港將自身打造成數位資產業務主要目的地的更廣泛雄心。

As Hong Kong cements its foothold as a crypto-friendly jurisdiction, these conditional ETF approvals mark a pivotal moment in the evolution of the virtual asset ecosystem in Asia. The world will eagerly watch as Hong Kong navigates this rapidly evolving landscape, shaping the future of cryptocurrencies in the global financial arena.

隨著香港鞏固其作為加密貨幣友善司法管轄區的地位,這些有條件 ETF 的批准標誌著亞洲虛擬資產生態系統發展的關鍵時刻。全世界都將熱切地關注香港在這一快速發展的格局中的發展,塑造加密貨幣在全球金融領域的未來。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

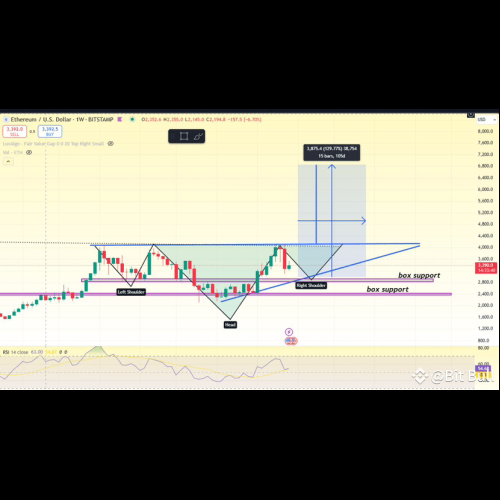

- 交易員解釋山寨幣季節如何開始

- 2024-12-29 21:10:02

- 據一位加密貨幣交易員稱,在蓬勃發展的山寨幣季節開始之前,山寨幣的總市值需要從目前的水平增加約 16%。

-

-

-

-

-

-

-