|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

灰階比特幣信託 (GBTC) 宣布計劃推出一個新的比特幣迷你信託,其費用為史無前例的 0.15%,這可能會削弱當前成本最低的現貨比特幣 ETF。在此之前,GBTC 由於收取 1.5% 的費用而出現大量資金流出,投資者尋求更具成本效益的選擇。新的迷你信託提供了稅收效率,因為轉讓無需納稅,這對擁有未實現收益的投資者俱有吸引力。該信託最初將出資 63,204 BTC,並向 GBTC 股東發行 692,370,100 股股票。

Grayscale Announces Groundbreaking Bitcoin Mini-Trust with 0.15% Fee

Grayscale 宣布推出突破性的比特幣迷你信託,收費 0.15%

In a groundbreaking move that could revolutionize the Bitcoin exchange-traded fund (ETF) market, Grayscale Investments is planning to launch a new Bitcoin mini-trust with an unparalleled fee of just 0.15%, as reported by Coindesk on April 22, 2023.

根據Coindesk 2023 年4 月22 日報道,Grayscale Investments 計劃推出一項新的比特幣迷你信託,其費用僅為0.15%,這是一項可能徹底改變比特幣交易所交易基金(ETF) 市場的突破性舉措。

Undercutting Competition with Lowest Fee

以最低的費用削弱競爭

If brought to fruition, this new offering would significantly undercut the current lowest-cost spot Bitcoin ETF, the Franklin Bitcoin ETF (EZBC), which levies a fee of 0.19%, according to data from Coinglass.

Coinglass 的數據顯示,如果實現的話,這項新產品將大大低於目前成本最低的現貨比特幣 ETF,即富蘭克林比特幣 ETF (EZBC),該基金收取 0.19% 的費用。

Outflows Prompt Fee Reduction

資金流出及時減費

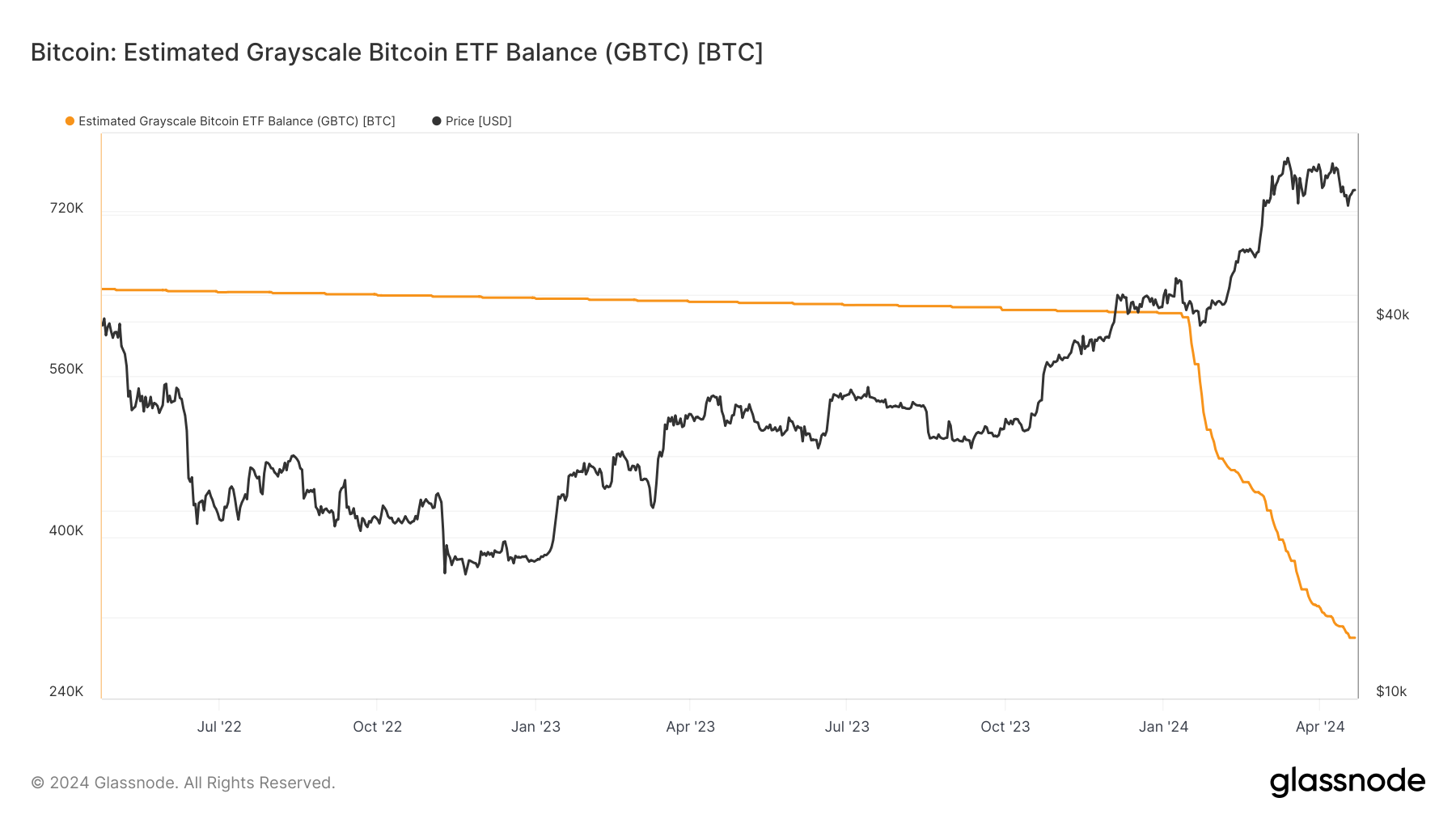

This move comes in response to significant outflows from Grayscale's flagship Bitcoin Trust (GBTC), which has seen its Bitcoin holdings dwindle from 622,000 before the launch of the spot Bitcoin ETF on January 11, 2023, to approximately 300,000 as of April 19, 2023, as reported by Glassnode.

此舉是為了回應灰階旗艦比特幣信託(GBTC)的大量資金外流,該公司的比特幣持有量從2023年1月11日推出現貨比特幣ETF前的622,000減少至截至2023年4月19日的約30萬。

GBTC's High Fees Drive Outflows

GBTC 的高額費用導致資金外流

The high 1.5% fee associated with GBTC, compared to lower fees offered by competing ETFs, has been a major factor contributing to the outflows.

與競爭 ETF 提供的較低費用相比,GBTC 的 1.5% 高額費用是導致資金流出的一個主要因素。

Mini-Trust as Tax-Efficient Alternative

迷你信託作為節稅替代方案

However, the proposed mini-trust could provide a tax-efficient solution for investors seeking to convert their holdings, as the transition would not be considered a taxable event, according to Coindesk.

然而,據 Coindesk 稱,擬議的迷你信託可以為尋求轉換其持股的投資者提供節稅的解決方案,因為這種轉換不會被視為應稅事件。

Appealing to Investors with Unrealized Gains

吸引未實現收益的投資者

This is particularly attractive for investors who have accumulated substantial unrealized gains due to GBTC's significant discount over the years, as shown by data from ycharts.

正如 ycharts 的數據所示,這對於多年來因 GBTC 大幅折價而積累了大量未實現收益的投資者來說尤其有吸引力。

SEC Filing Reveals Details

美國證券交易委員會 (SEC) 文件揭露細節

An SEC filing indicates that Grayscale will contribute 63,204 BTC to the new BTC Trust, resulting in the issuance and distribution of 692,370,100 shares of the trust to GBTC shareholders.

SEC 文件顯示,Grayscale 將向新的 BTC 信託基金捐贈 63,204 BTC,從而向 GBTC 股東發行和分配 692,370,100 股信託股票。

Analyst Perspective

分析師視角

Bloomberg's senior ETF analyst Eric Balchunas notes that these financial projections are hypothetical and do not necessarily guarantee that the actual fee will be 0.15%.

彭博社的高級 ETF 分析師 Eric Balchunas 指出,這些財務預測都是假設性的,並不一定保證實際費用為 0.15%。

Conclusion

結論

Grayscale's plan to launch a Bitcoin mini-trust with an ultra-low fee represents a significant development in the Bitcoin ETF market. If successful, this offering could attract investors seeking a more cost-effective way to gain Bitcoin exposure, potentially leading to further outflows from GBTC and a shift in market dynamics.

Grayscale 計劃推出超低費用的比特幣迷你信託,代表比特幣 ETF 市場的重大發展。如果成功,此次發行可能會吸引尋求更具成本效益的方式來獲得比特幣敞口的投資者,從而可能導致 GBTC 進一步資金流出以及市場動態的轉變。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- 幣安新平台現已推出 5 種加密貨幣

- 2024-12-24 08:55:02

- 全球交易量最大的加密貨幣交易所幣安昨天宣布,兩種新的加密貨幣將加入其 HODLer 空投門戶

-

- 分析可能在 2025 年帶來顯著收益的被低估的山寨幣

- 2024-12-24 08:55:02

- 隨著比特幣飆升至新的高度,加密貨幣市場一片興奮。主要的山寨幣正在打破記錄,吸引了人們的注意

-

-

-

- 狗狗幣會成為 2025 年值得關注的加密貨幣嗎?投資者見解和預測

- 2024-12-24 08:55:02

- 加密貨幣領域本來就充滿波動和投機環境,科技創新者馬斯克的新主張進一步動搖了加密貨幣領域。

-